Analyzing Friday's trades:

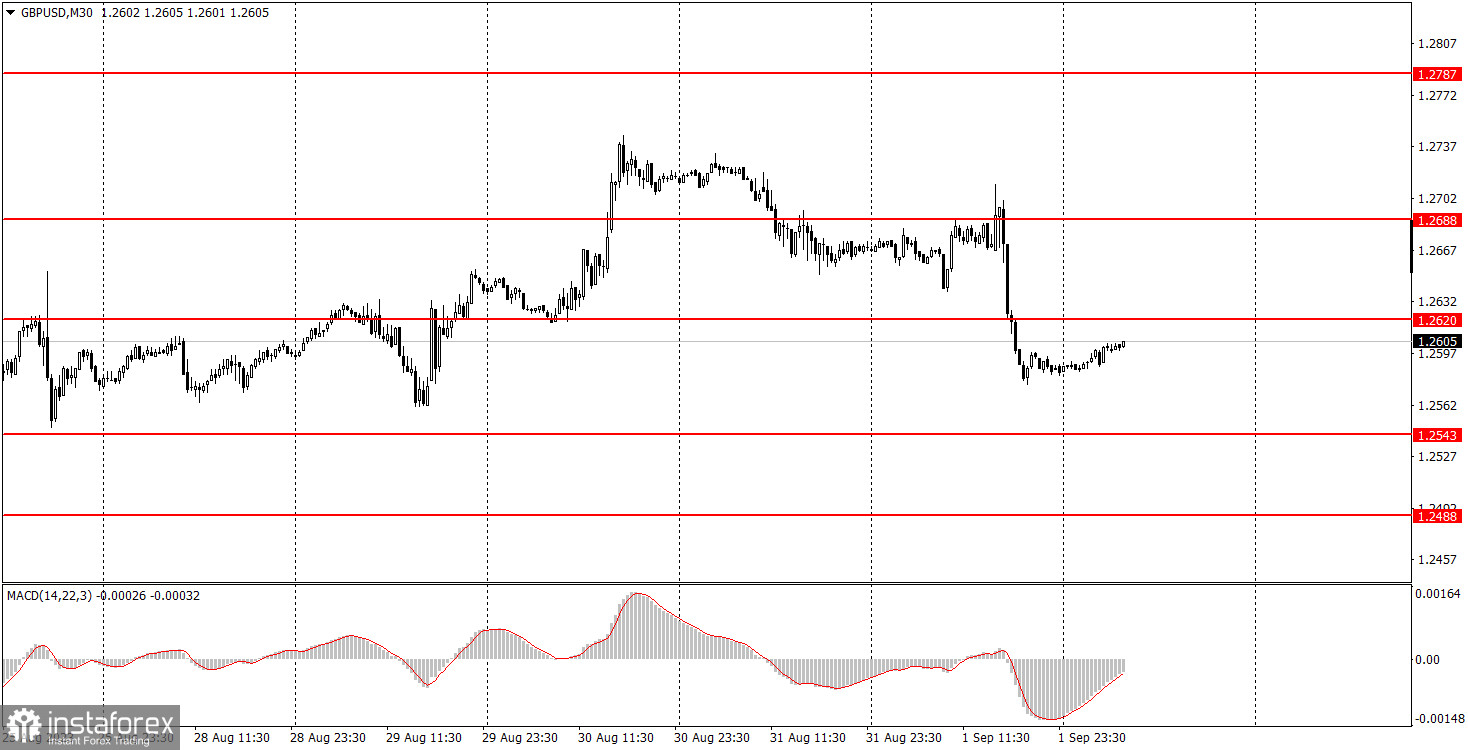

GBP/USD on 30M chart

GBP/USD also traded lower on Friday. It was quite strange for the pair to fall. To recap, the US released three influential reports, and each one did not imply a strong rally for the greenback. To be more precise, these reports should have rather provoked the dollar's fall instead. However, the market reacted the way it did. We have already mentioned that we don't always see a logical and justified market reaction.

Therefore, the pair has been falling for the past two days, but in general, last month's movements were quite confusing. Logically, the pair should continue to show downward movement, but if we look at the higher time frames, it's clear that the pair's not in a hurry to head south. The pair is moving sideways instead of showing a clear trend, which is always challenging for traders. Therefore, there's a possibility that the pair could start an upward movement this week, even if it doesn't have a solid reason to do so.

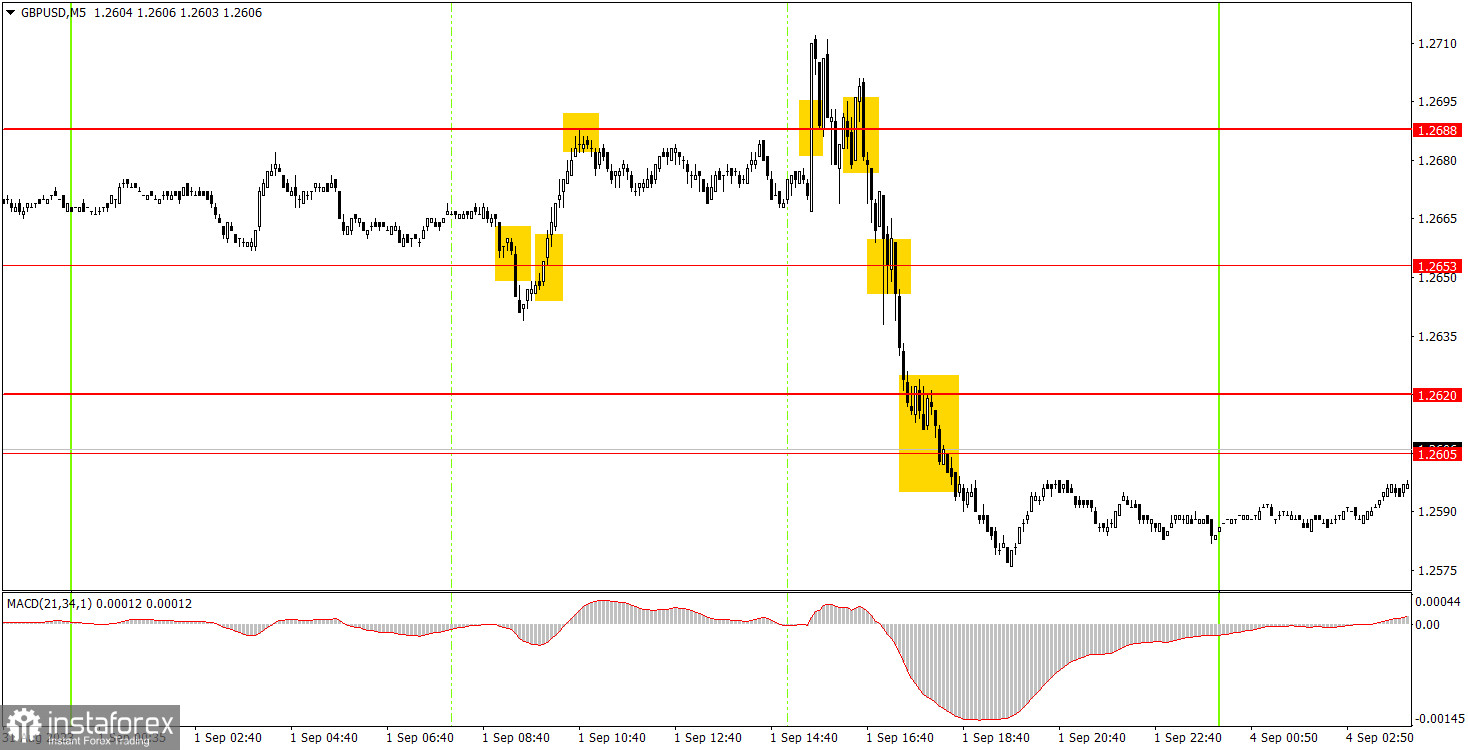

GBP/USD on 5M chart

The pair changed direction several times on the 5-minute chart. It even managed to reverse its course during the European session. As a result, we didn't get any good trading signals. For example, two signals were formed around the 1.2653 level, the first one was clearly false and resulted in losses, while the second was profitable. At the start of the US session, the pair formed several signals around the 1.2688 level, but they should not have been executed, as the US reports were published at this time. Then the pair started to fall, but it was illogical for it to do so. Therefore, although the last two signals were strong and profitable, it should have been executed at your own discretion.

Trading tips on Monday:

On the 30-minute chart, the GBP/USD pair ended a round of bullish correction, but it may start another one this week. The movements are currently confusing, and it's challenging to form a trendline or channel on the charts to understand the current trend. Therefore, you should be cautious when entering a position. The key levels on the 5M chart are 1.2457, 1.2488, 1.2543, 1.2605-1.2620, 1.2653, 1.2688, 1.2748, 1.2787-1.2791, 1.2848-1.2860. Once the price moves 20 pips in the right direction after opening a trade, you can set the stop-loss at breakeven. No significant reports or events lined up in the UK and the US. The pair could show weak movements. Although, there's a possibility that the pair could rise to rectify the illogical movement on Friday.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română