On Friday, the GBP/USD currency pair also plummeted like a rock and returned to the Murray level of "6/8"-1.2573, which it had failed to surpass earlier. It couldn't break through on Friday, but that's not a big concern. The key point is that the market once again signaled its preference for buying the dollar rather than the pound despite having little macroeconomic justification for doing so last week. Nearly all reports from the United States had a red hue. GDP turned out weaker, unemployment rose, Non-Farm Payrolls exceeded expectations by a small margin, and the previous figure was revised downward. In addition, the number of job openings significantly decreased, and the ADP report disappointed. Therefore, there were more reasons to get rid of the American currency this week than to buy it. That's how it played out in the first three days, but then the US currency regained all it had lost.

The British pound should continue to decline regardless of reports or statements from representatives of the Fed and the Bank of England, similar to the euro. Therefore, we expect further movement to the south, regardless of reports or statements from representatives of the Fed and the Bank of England. However, it should be noted that the Bank of England could disrupt the entire picture for the US currency. Even now, it is evident that the pound is falling less sharply and as rapidly as the euro. The market still allows for the possibility of a strong tightening of monetary policy in the next six months, which is why it is cautious about selling the British currency. However, in the next three months, we still expect a decline in the pound.

In the 24-hour timeframe, the pair could not settle below the Ichimoku cloud. We only saw another downward correction, which cannot even be called strong. Accordingly, the global upward trend may resume, but we still don't believe in it. The British pound has risen for too long, with no substantial grounds, and too strongly recently.

The dollar will strive to rise without the help of macroeconomics.

There are virtually no significant events or publications in the UK next week. On Tuesday, final assessments of business activity indices in the services and manufacturing sectors for August will be released, and on Wednesday, in the construction sector, and that's about it. The second assessment of business activity indicators is unlikely to differ significantly from the initial ones and carry much less weight in the eyes of traders. Therefore, there will be no significant events in Britain at all.

The situation in the United States is the same. All the most interesting and important data came out this week and did not derail the dollar from its winning path. Therefore, the pair's decline looks preferable for the coming week. On Wednesday, the business activity indexes for August will be released in their final form, along with the ISM index for the service sector, which can be considered the most important report of the week. If the deviation from the forecast (52.5) is insignificant, we may not see any significant market reaction. On Thursday, the standard report on unemployment claims, which also rarely surprises traders with resonant figures, and on Friday, nothing. At the moment, we are in for a very dull week. Only Christine Lagarde's speeches and the ISM index hold significant status. Lagarde's speeches have no relation to the British pound, so we may observe reduced volatility in the next five trading days.

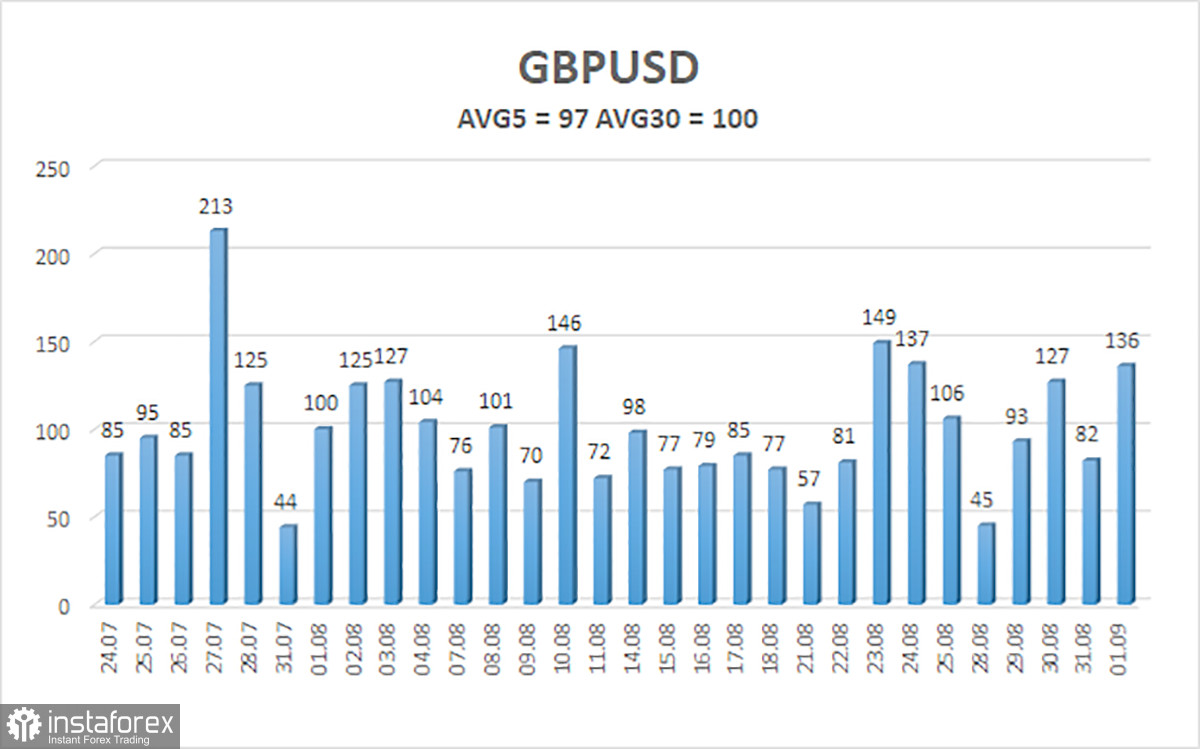

The average volatility of the GBP/USD pair over the last five trading days is 97 pips. For the pound/dollar pair, this value is considered "medium." Therefore, on Monday, September 4th, we expect movement within the range bounded by the levels of 1.2487 and 1.2681. An upward reversal of the Heiken Ashi indicator will signal a new phase of corrective movement.

Nearest support levels:

S1 – 1.2573

S2 – 1.2512

S3 – 1.2451

Nearest resistance levels:

R1 – 1.2634

R2 – 1.2695

R3 – 1.2756

Trading recommendations:

In the 4-hour timeframe, the GBP/USD pair has again settled below the moving average. Therefore, it is advisable to maintain short positions with targets at 1.2512 and 1.2487 until a Heiken Ashi reversal occurs. Long positions can be considered if the price consolidates above the moving average line with targets at 1.2695 and 1.2756.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both channels point in the same direction, it indicates a strong trend.

The moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the likely price channel in which the pair will move in the next 24 hours, based on current volatility indicators.

CCI indicator - its entry into the overbought area (above +250) or oversold area (below -250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română