EUR/USD

Higher Timeframes

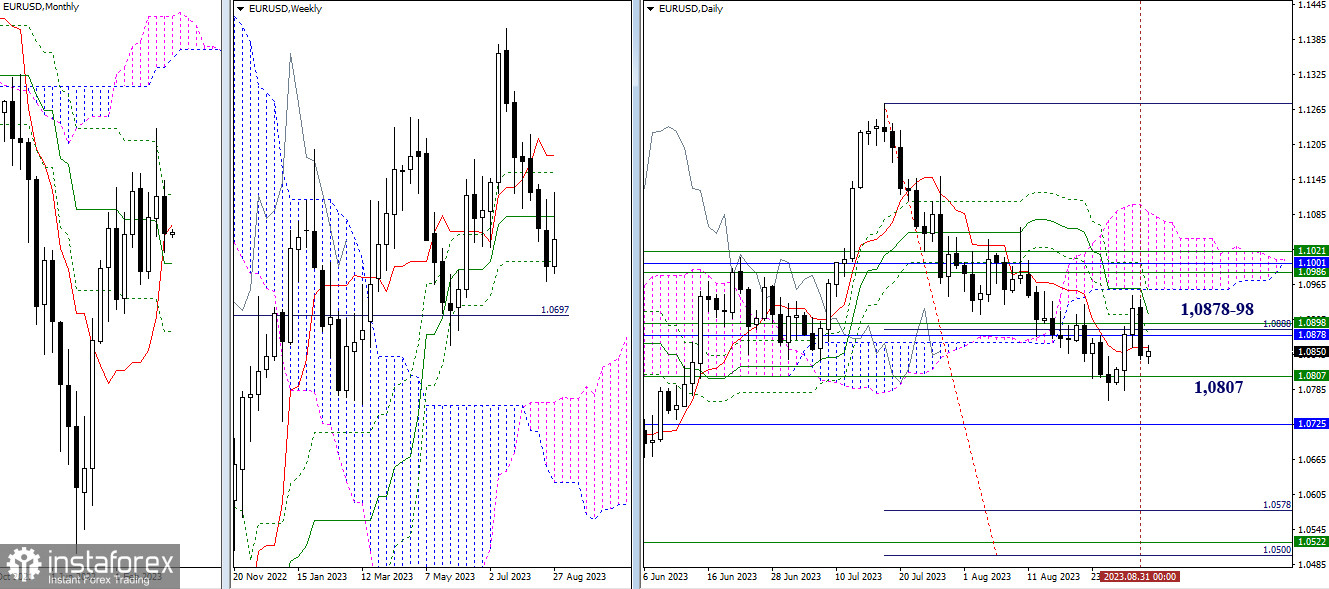

August has closed. The lower shadow of the monthly candle couldn't change the overall bearish sentiment, and the opening of a new month took place below the monthly short-term trend. Breaking through the final level of the weekly Ichimoku cross (1.0807) and updating the low (1.0766) will allow the downward trend to continue. Targets for further decline in this segment are currently the support of the monthly medium-term trend (now at 1.0725) and the upper boundary of the weekly cloud (1.0522), which has joined forces with the aim to break the daily Ichimoku cloud (1.0500 – 1.0578). At the moment, attraction is exerted by the daily short-term trend (1.0856), and the concentration of resistances can be noted around 1.0878-98 (monthly short-term trend + weekly medium-term trend).

H4 – H1

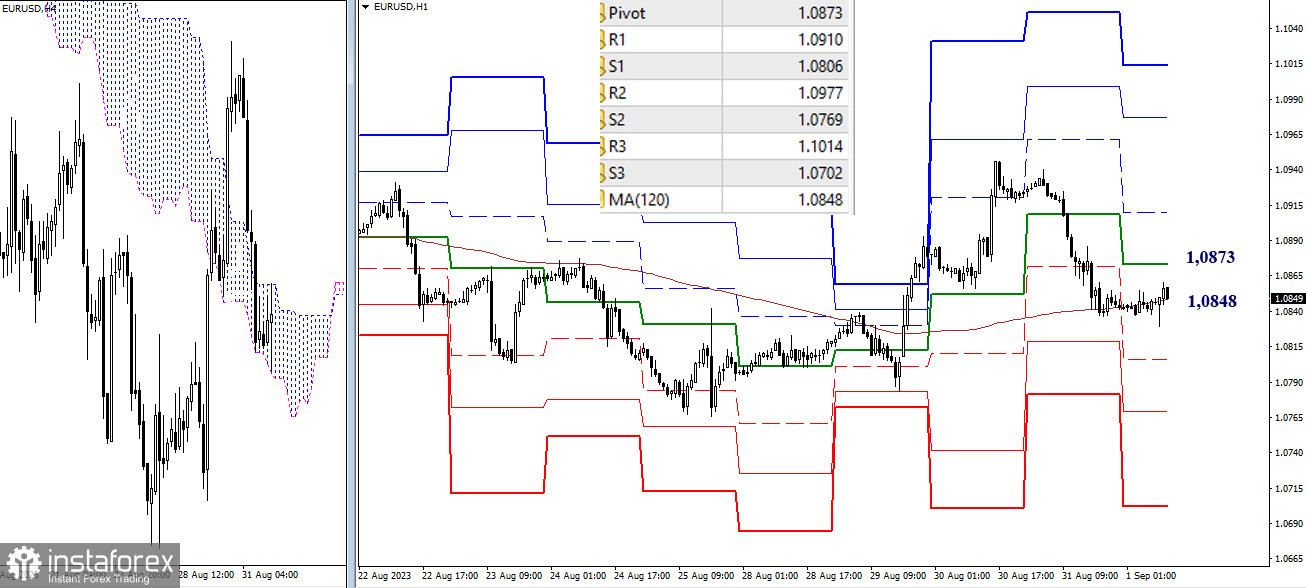

Bulls couldn't continue their rally yesterday and had to return to the support of the weekly long-term trend (1.0848). Currently, the situation on the lower timeframes is almost stagnant, with the pair in the key level's attraction zone. Trading above the weekly long-term trend will aid the bulls in regaining their position, with intraday targets at 1.0873 – 1.0910 – 1.0977 – 1.1014 (classic pivot points). Trading below these key levels will point towards intensifying bearish sentiments. For this, it will be necessary to overcome the supports of the classic pivot points (1.0806 – 1.0769 – 1.0702).

***

GBP/USD

Higher Timeframes

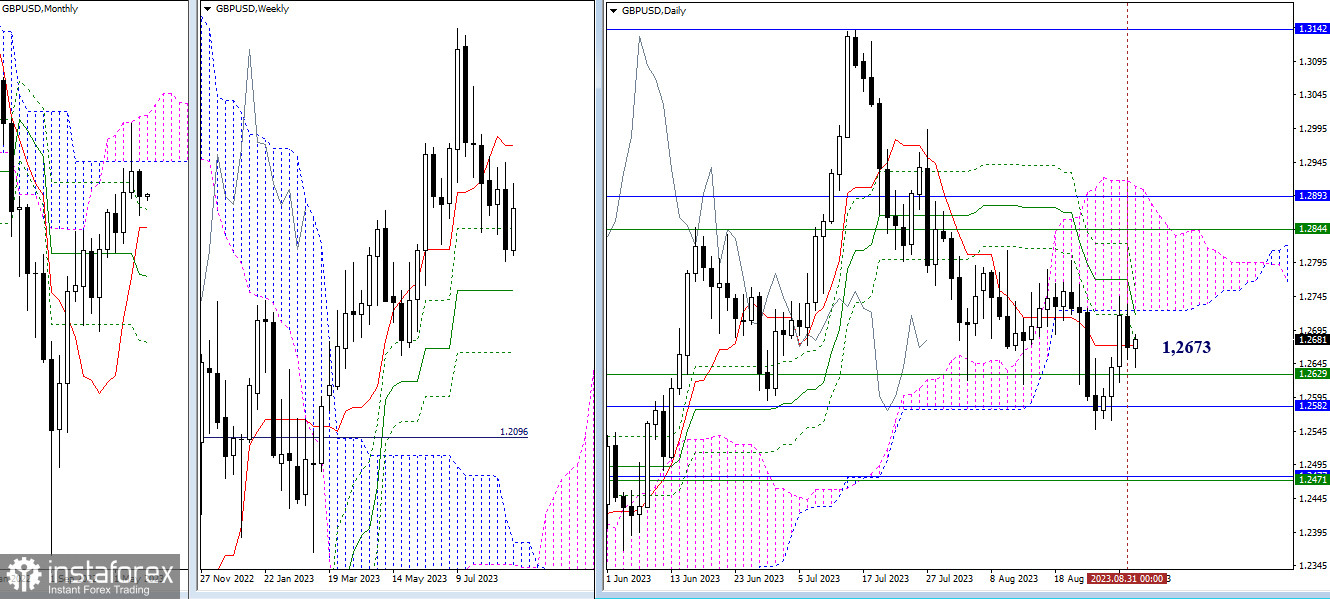

August ended without a decisive advantage for either side. Today, we close the week and will evaluate the result. New benchmarks and opportunities may arise for the bulls after passing through the daily cloud (1.2724 – 1.2909) and returning to the monthly cloud (1.2893). Along this path, the bulls will eliminate the daily death cross and reclaim the weekly short-term trend (1.2844). For the bears, in the short term, the task boils down to overcoming supports 1.2629 – 1.2582, updating the low (1.2547), and testing the 1.2471 level, where the monthly short-term trend and weekly medium-term trend are now merged.

H4 – H1

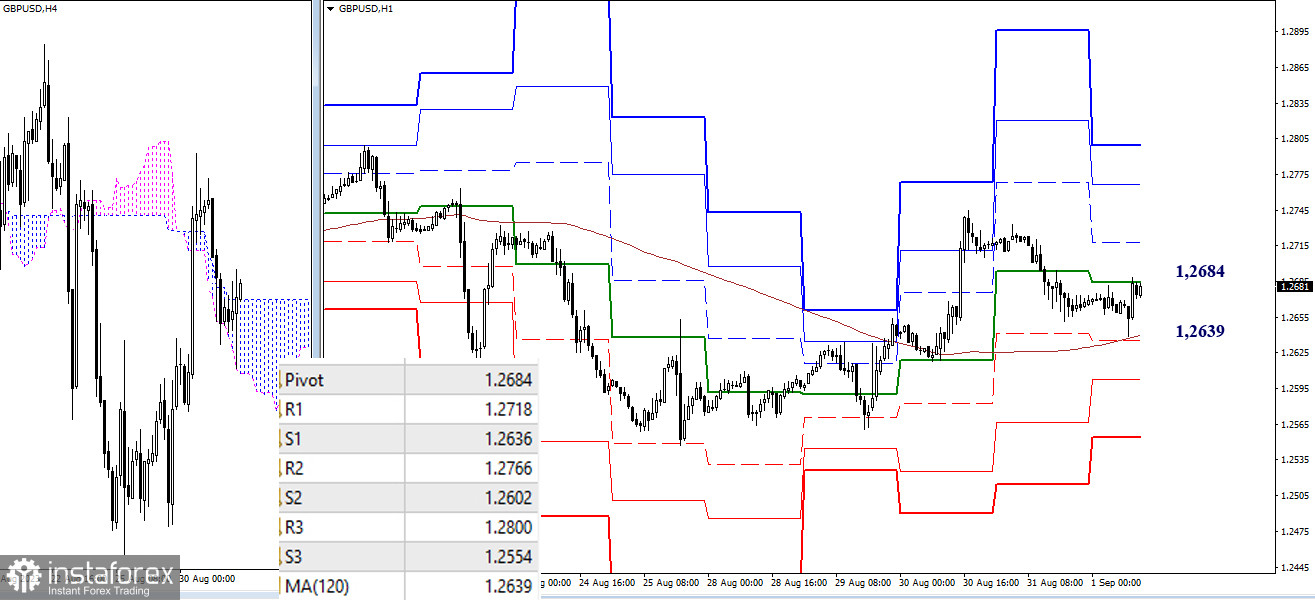

Throughout yesterday, bulls lost their positions. As a result, their opponents managed to bring the situation back to the key level of the lower timeframes—the weekly long-term trend (1.2639). This level determines the distribution of power. For the bulls to have a primary advantage, they must maintain their position above the weekly long-term trend. The targets for continuing the upward movement today are set at 1.2718 – 1.2766 – 1.2800 (resistances of classic pivot points). A change in the current balance of power might occur after consolidation below 1.2639 and a reversal of the moving average. Then, the supports of the classic pivot points, currently located at 1.2636 – 1.2602 – 1.2554, will become relevant.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română