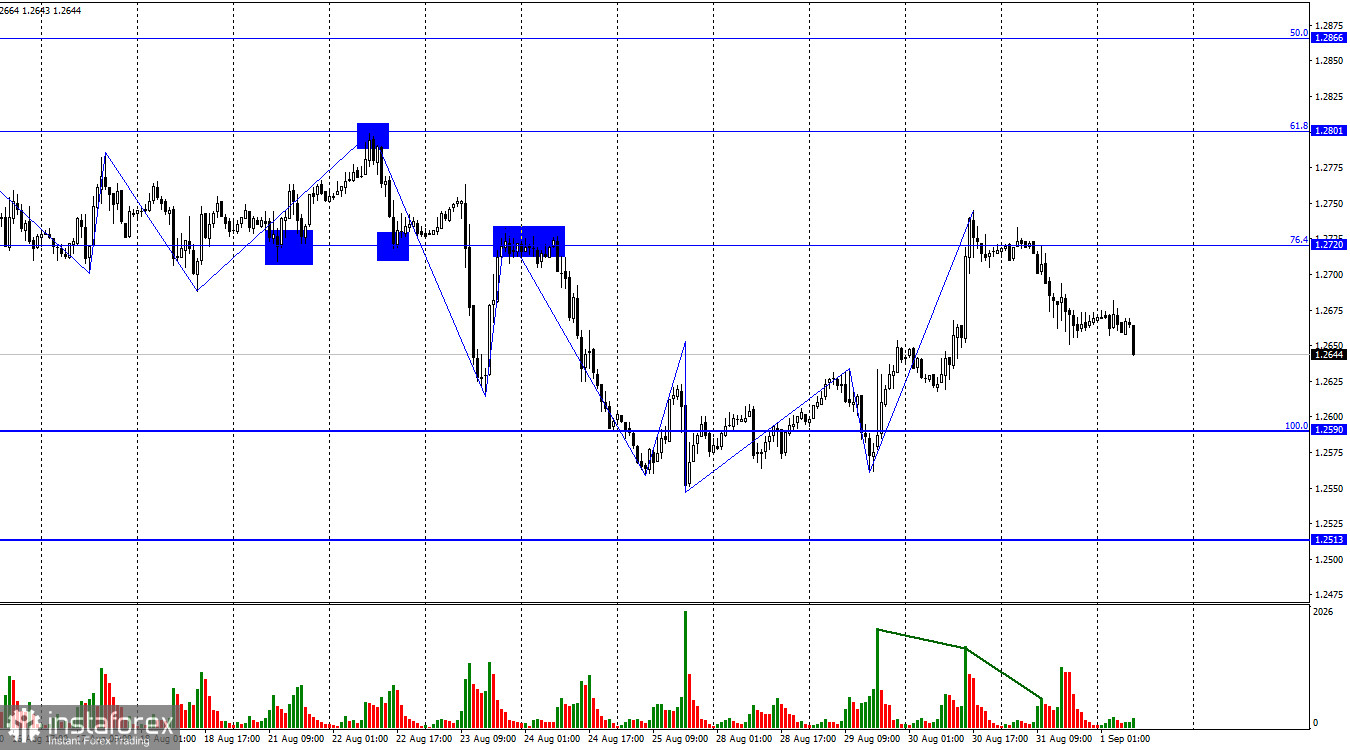

Hi, dear traders! On the 1-hour chart, the GBP/USD pair had a reversal near the 76.4% correction level at 1.2720 in favor of the US dollar on Thursday and started a decline towards the 100.0% Fibonacci level at 1.2590. In the coming hours, I do not expect the formation of new signals, as there are no nearby proper levels around the price. However, a rebound from 1.2590 will not only work in favor of the pound but also maintain the questionable bullish trend.

The waves over the past few days have altered the technical pattern. Now the last three waves confirm that a bullish trend has been going on. The ascending move has to be broken to anticipate a new bearish sequence. This scenario still seems more realistic to me. However, it won't be easy to fulfil. The new downward wave must break Tuesday's low, which is located at the level of 1.2562. By the time it's broken, most of the decline will already be behind us. It won't be beneficial to capitalize on it. There's also a simpler scenario: the next upward wave should not break yesterday's high. Yet, even this scenario requires some time.

Today is a very important day for the American currency and for the forex community as well. The current technical picture is not entirely clear, but GBP/USD could develop any movement today. High-impact US nonfarm payrolls, an unemployment rate, business activity, and wages can determine any trajectory. Thus, with an equal probability, GBP/USD may decline and resume the overall bearish trend or it could have a new rally that maintains the bullish trend. In the UK, only the manufacturing business activity index is scheduled for today, which is unlikely to attract much attention. Traders shifted their focus to American statistics yesterday.

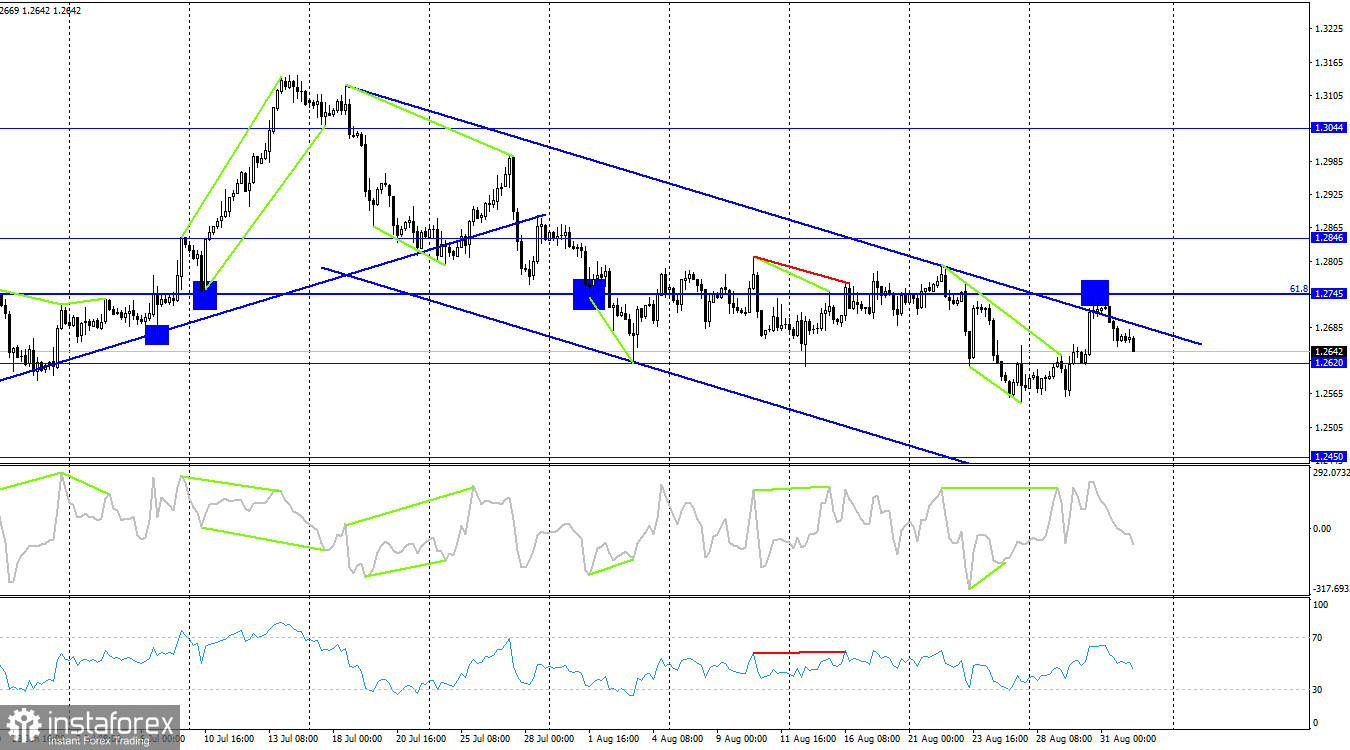

On the 4-hour chart, GBP/USD has settled above the descending trend corridor. However, the rebound from this level worked in favor of the US dollar and enabled the fall towards the 1.2620 level. At the moment, the odds for a new bearish sequence are higher than that of growth. If the price remains below the 1.2620 level, it will confirm the continuation of the bearish trend and increase the likelihood of a further decline in GBP/USD towards the next correction level at 1.2450.

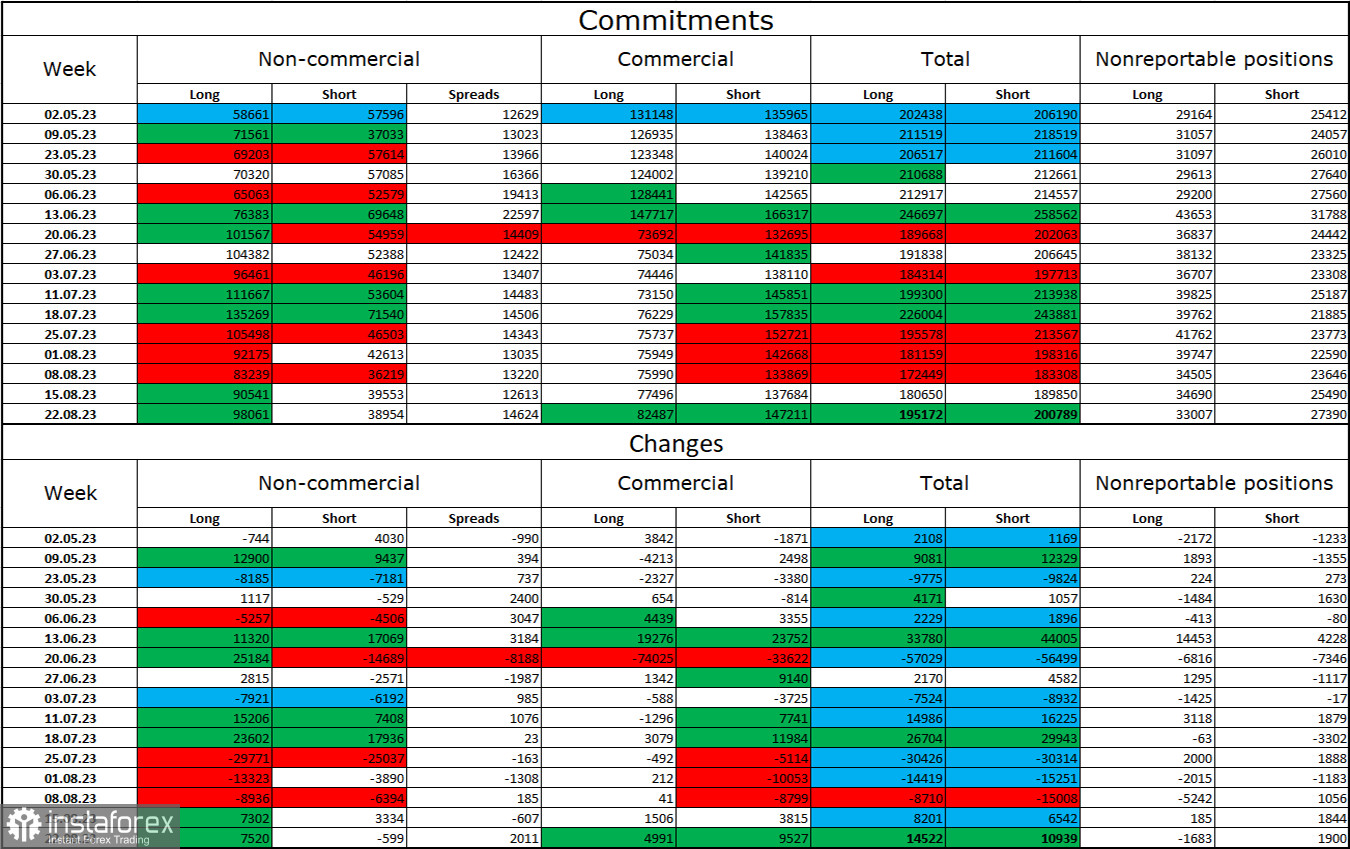

Commitments of Traders (COT)

The sentiment of the Non-commercial trader category has become more bullish over the last reporting week. The number of long contracts held by speculators increased by 75,20, while the number of short contracts decreased by 599. The overall sentiment of major players remains "bullish," with Long and Short contract numbers having a more than twofold gap: 98,000 versus 39,000. In my opinion, the pound had good growth prospects a few weeks ago, but now many factors have shifted in favor of the US dollar. Counting on a significant rise in the British pound is quite difficult. Nonetheless, bulls are not in a rush to get rid of their Buy positions, clearly counting on the pound's potential for further growth.

Economic calendar for US and UK

UK: manufacturing PMI due at 08-30 UTC

US: average hourly earnings due at 12-30 UTC

US: nonfarm employment change due at 12-30 UTC

US: unemployment rate due at 12-30 UTC

US: manufacturing PMI by ISM due at 14-00 UTC

The economic calendar on Friday contains 5 macroeconomic reports, 3 of them are highly important. The information background matters a lot for market sentiment for the rest of the day.

Outlook for GBP/USD and trading tips

We could open short positions on GBP/USD during a bounce from 1.2745 on the 4-hour chart with the target at 1.2620. As for buy positions, I think the only opportunity for long positions will be a dip from 1.2620, the target is seen at 1.2745.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română