Analyzing Thursday's trades:

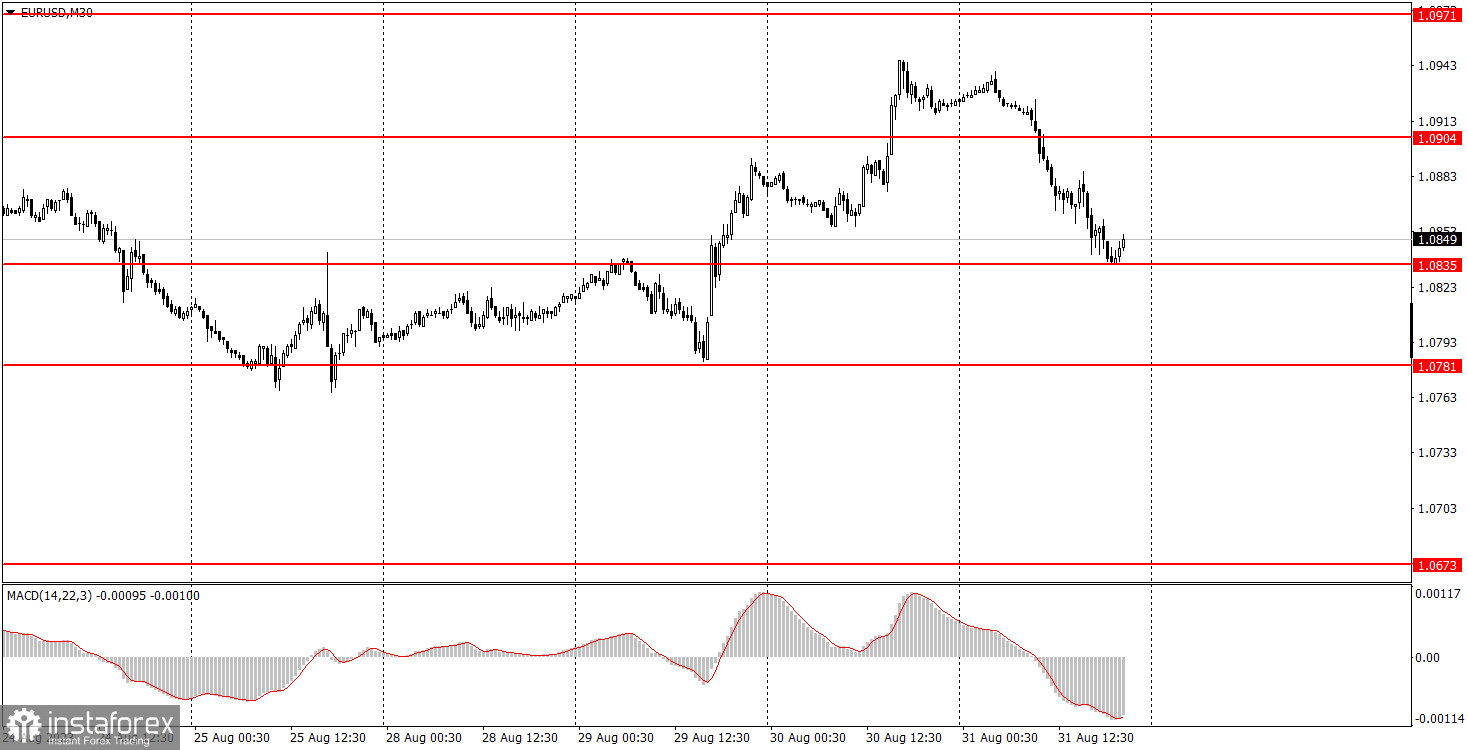

EUR/USD on 30M chart

EUR/USD unexpectedly broke down on Thursday. Unexpectedly – at first glance. However, if you delve deeply into the macroeconomic background, it becomes clear that it wasn't surprising that the dollar appreciated. Take note that Germany published two reports in the morning that turned out to be weaker than expected. This refers to unemployment claims and retail sales.

Afterwards, the Consumer Price Index for the euro area was released, which didn't fall in August, but the core inflation did decrease, as the market expected. On one hand, it might seem that this was an opportunity for the euro to rise, but on the other hand, the European Central Bank increasingly indicates its readiness to pause tightening and soon end the rate hike cycle. Hence, this report triggered the opposite reaction. Now, all that remains is to wait for data on the US labor market and unemployment. These are also unpredictable, so the dollar might drop again on Friday.

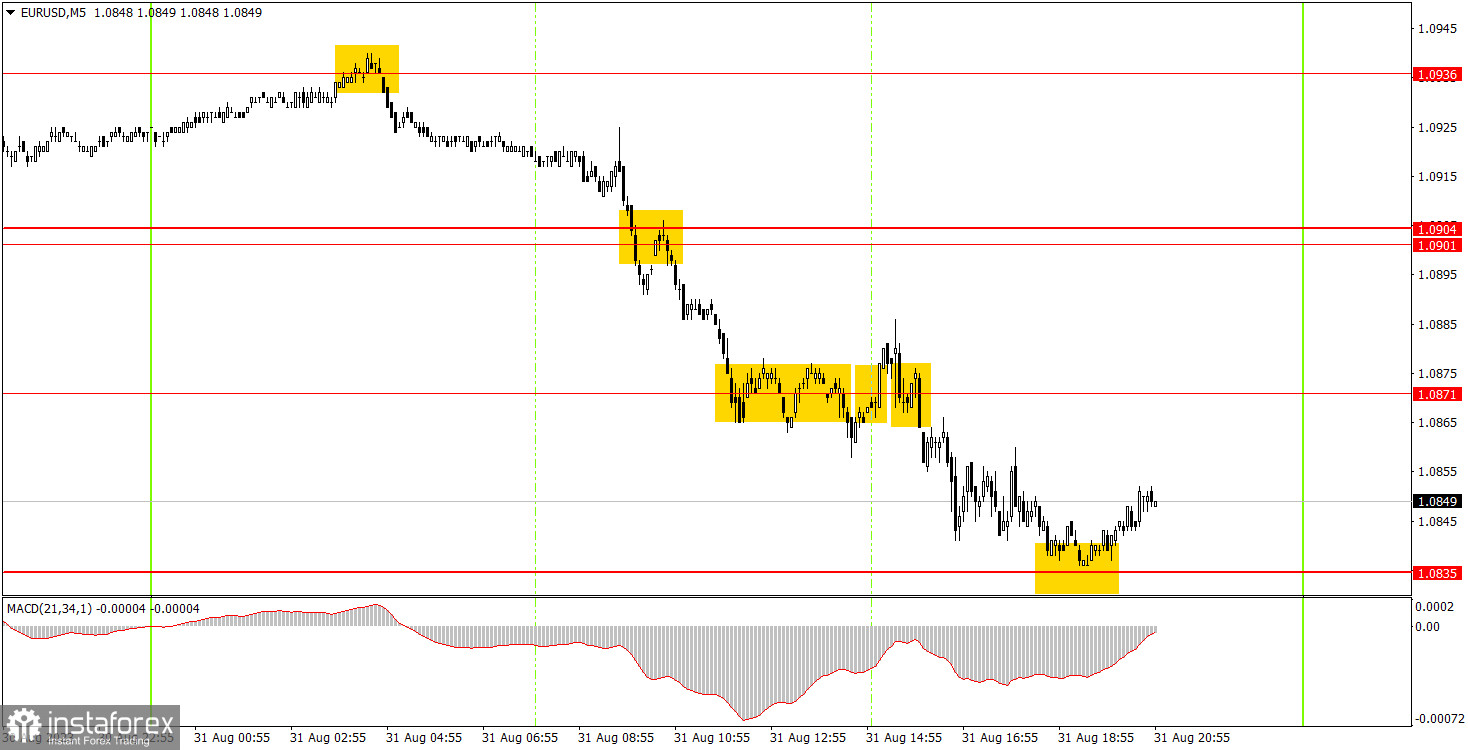

EUR/USD on 5M chart

The pair mostly fell on the 5-minute chart. The first sell signal formed overnight, and by the opening of the European session, the pair had moved 8 pips from the formation point. You could decide whether you want to open short positions. If not, another sell signal was formed within a couple of hours around 1.0901-1.0904. The price then fell to the 1.0871 level, hovering around it for several hours, frequently moving past it in both directions. It was around this time that the European inflation report and US reports were published. Since they clearly didn't support the euro, it was wise to be patient with trading decisions and wait a bit. Subsequently, the pair fell to the next level at 1.0835, where shorts should have been closed. The profit was about 70 pips.

Trading tips on Friday:

On the 30M chart, the pair started an upward correction. From our perspective, the decline of the euro remains the most justified and logical course of action in the medium-term perspective, irrespective of the macroeconomic backdrop. Therefore, once the correction ends, we expect the euro to start another downward movement. The key levels on the 5M chart are 1.0673, 1.0733, 1.0767-1.0781, 1.0835, 1.0871, 1.0901-1.0904, 1.0936, 1.0971-1.0981, 1.1011, 1.1043. A stop loss can be set at a breakeven point as soon as the price moves 15 pips in the right direction. On Friday, the US will release four major reports: on wages, unemployment, NonFarm Payrolls, and the ISM index for the manufacturing sector. Movements in the second half of the day could be very strong.

Basic trading rules:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginners should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română