The second estimate of the US GDP for Q2 2023 unexpectedly decreased from 2.4% to 2.1%. Capital expenditures, trade balance, GDP deflator (the revised 2.0% versus the 2.2% in the first estimate), and the core Personal Consumption Expenditures Price Index (PCE) (the revised 3.7% versus the 3.8% in the first estimate) were also downgraded.

US Treasury yields went down, but expectations for the Fed rate remain broadly unchanged, with the probability of a 0.25% rate hike in November standing just above 50%.

Ahead of the publication of the nonfarm payrolls on Friday, ADP employment data provided further evidence of cooling labor market conditions in the US. Private sector employment growth reached 177,000 jobs, falling short of the forecasted 195,000. This represents the weakest growth in the past 5 months. While ADP isn't a reliable predictor of non-farm payrolls, in light of recent US labor market publications (such as the JOLTs data released earlier this week), the ADP report added confidence that the overall employment growth has been losing momentum.

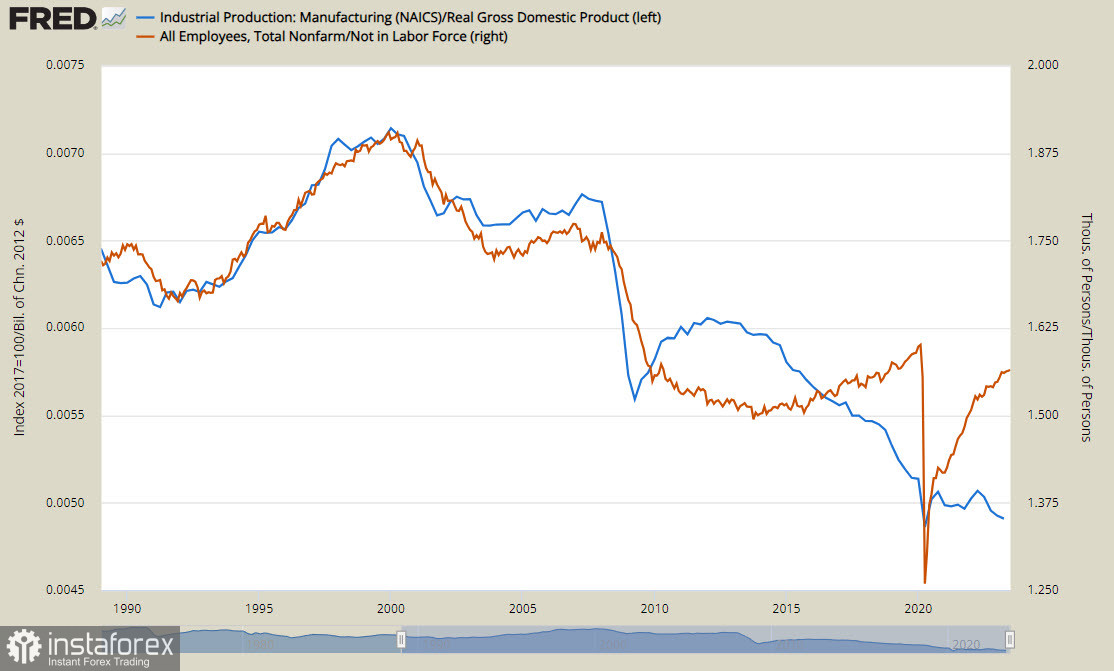

Structural changes in the US economy are becoming more concerning: the ratio of new jobs to those leaving the workforce has returned to pre-pandemic levels, yet it remains significantly below pre-2008 crisis levels. The share of industrial production in the overall economic structure continues to decline, with no signs of recovery.

The US dollar is going through a downward correction across the board for the third consecutive day. European currencies are primarily rebounding from their recent lows. However, we anticipate that this current weakening will be short-lived, and the greenback will resume its growth in the short term.

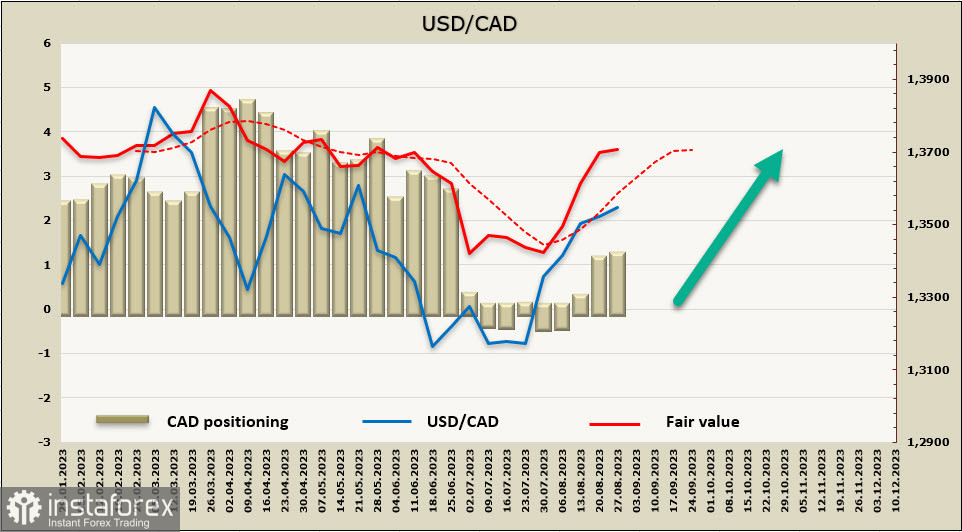

USD/CAD

The Bank of Canada's meeting is scheduled for September 6th. Tomorrow the second estimate of Canada's GDP for Q2 2023 will be unveiled. GDP is expected to decline sharply from 3.1% to 1.2% sequentially, and the main question on the agenda is whether this slowdown is sustainable and what implications it holds for financial markets. More and more market participants are confident that the Bank of Canada should terminate its rate hike cycle amid worsening economic conditions. Currently, the Bank of Canada remains silent, so data releases, especially if they deviate from forecasts, may trigger high volatility.

Speculative positioning on CAD remains moderately bearish, with the net position changing only slightly over the reporting week to around -$900 million.

Current market quotes are notably above the long-term average, the bullish momentum has weakened, but the trend is still going on.

Despite the broad retreat of USD from its highs, the Canadian dollar is unlikely to assert its strength. The trend, from both technical and fundamental viewpoints, remains bullish. Thus, we anticipate another attempt to test the resistance zone at 1.3640/70 with a move towards the upper border of the 1.3700/30 channel. Following this, there is a possibility of either returning to the channel or attempting an upward breakout. If a bullish momentum develops, the next target would be the local high at 1.3857.

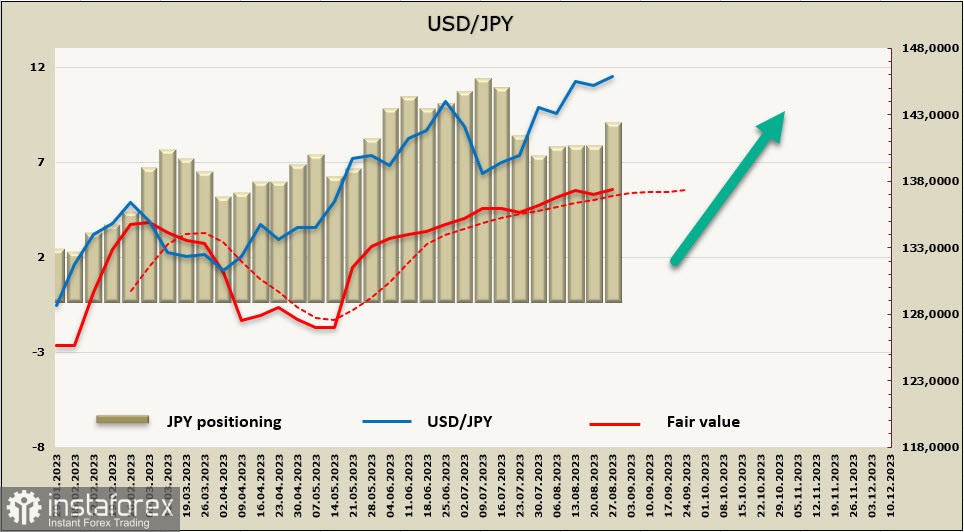

USD/JPY

Industrial production volume in Japan contracted by 2% in July, which exceeded forecasts. The assessment shifted from "industrial production demonstrates signs of moderate growth" to "production is fluctuating." Shipments of capital goods (excluding transport equipment), which are indicators for capital investments, fell by 4.5% MoM in July, marking the second consecutive month of decline. Consumer durable goods (including cars) dropped by 7.0%, the first decline in six months.

Meanwhile, retail sales volume increased from 5.6% to 6.8% YoY, significantly surpassing expectations. Consumer demand remains high, implying the persistence of inflationary pressure. The likelihood of the Bank of Japan considering an exit from its negative interest rate policy under current conditions has slightly increased. This could provide short-term support for the yen, but there is no basis for a full trend reversal until the Bank of Japan provides clear signals.

The Japanese yen was sold off more actively, as indicated by the latest CFTC report. Over the reporting week, the net short position increased by $1.2 billion, reaching -$8.2 billion. The calculated price is growing at a slower pace but remains above the long-term average, showing a trend for further growth.

USD/JPY set a new local high at 147.40, and there are strong reasons to believe that the upward movement will continue. The multi-year high of 151.96 is not far off. This level will be the main target in the short term. Internal political situations in Japan and looming forex interventions by the Bank of Japan could hinder further growth. Support is provided by the level of 145.10 or, in the case of active BoJ actions, the mid-channel at 143.20/40. Expecting a full trend reversal in the current situation is clearly premature.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română