EUR/USD

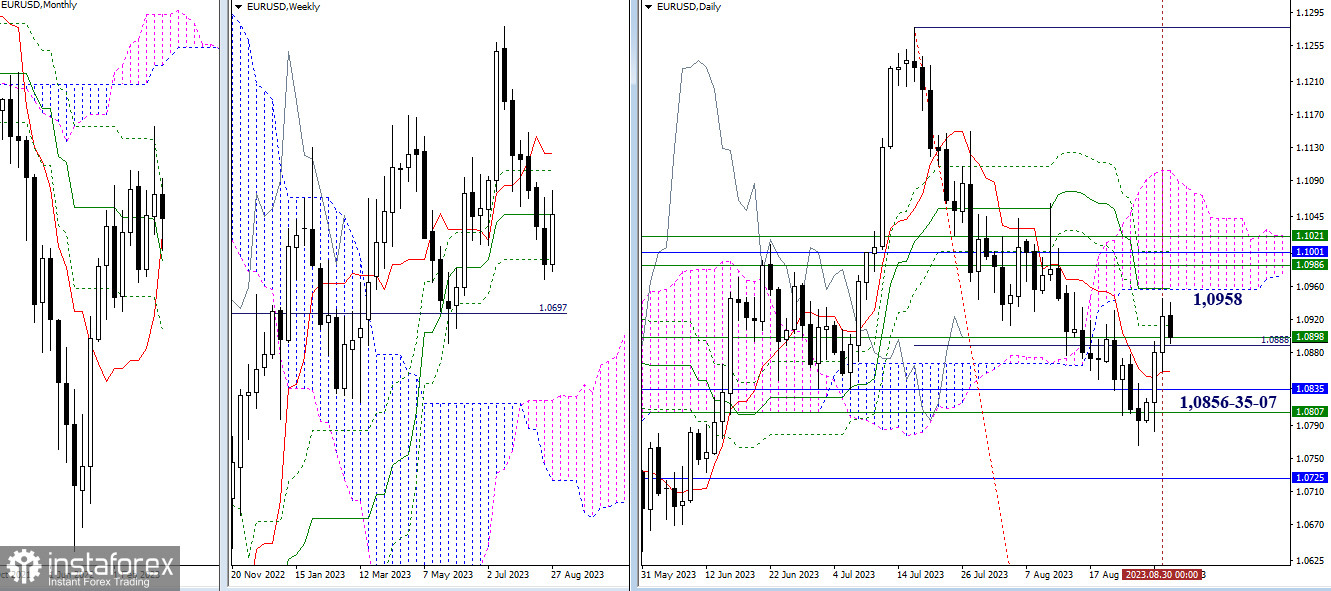

Higher Timeframes

Yesterday, bullish players overcame the resistance of 1.0898 and continued their ascent into the zone influenced by the next resistance levels of 1.0956–58 (daily medium-term trend + lower border of the daily cloud). Up ahead, the bulls face a challenge formed by strong resistance levels across several timeframes (1.0986 – 1.1001 – 1.1021). In the event of bearish sentiments returning, the nearest supports remain at 1.0856 – 1.0835 – 1.0807 (daily short-term trend + monthly short-term trend + final level of the weekly Ichimoku cross). Today, we end August, and the size of the monthly candle's lower shadow is of interest.

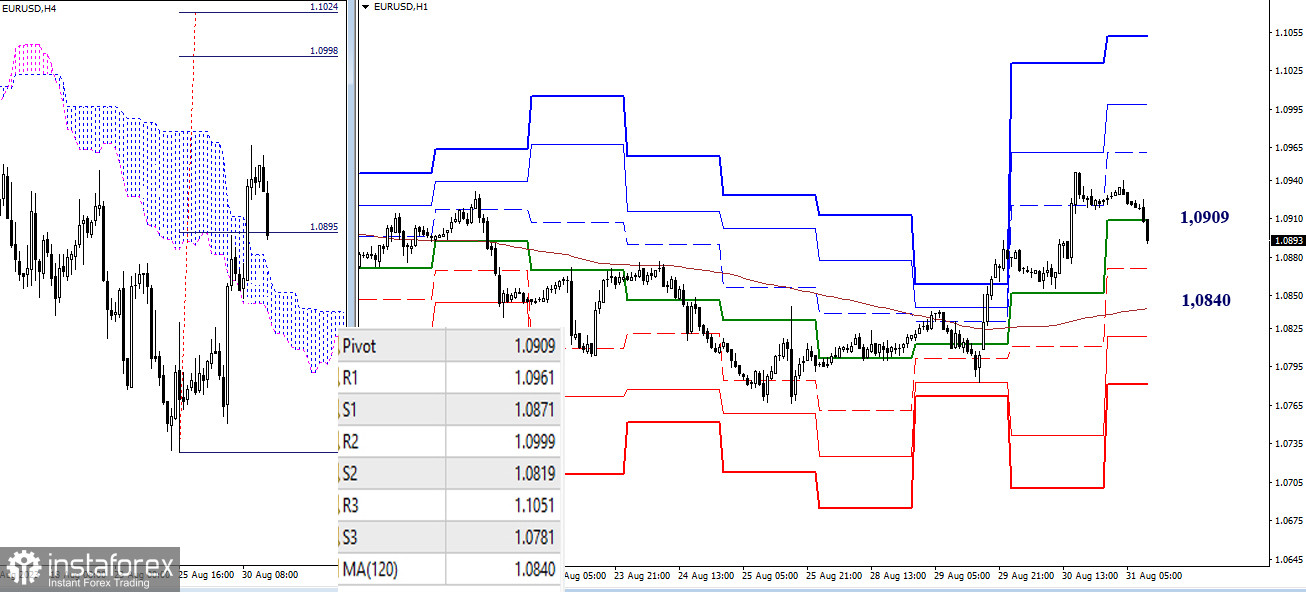

H4 – H1

On the lower timeframes, the main advantage belongs to the bullish players, with intraday targets at the resistance levels of the classic pivot points (1.0961 – 1.0999 – 1.1051) and the target for breaking through the H4 cloud (1.0998 – 1.1024). However, note that the pair is currently undergoing a corrective decline, with the central pivot point of the day (1.0909) already passed. The interaction result with the weekly long-term trend (1.0840) will be of utmost importance, with 1.0871 (S1) potentially offering intermediate support. Consolidation below the weekly long-term trend and reversal of the moving average can change the current balance of power in the lower timeframes.

***

GBP/USD

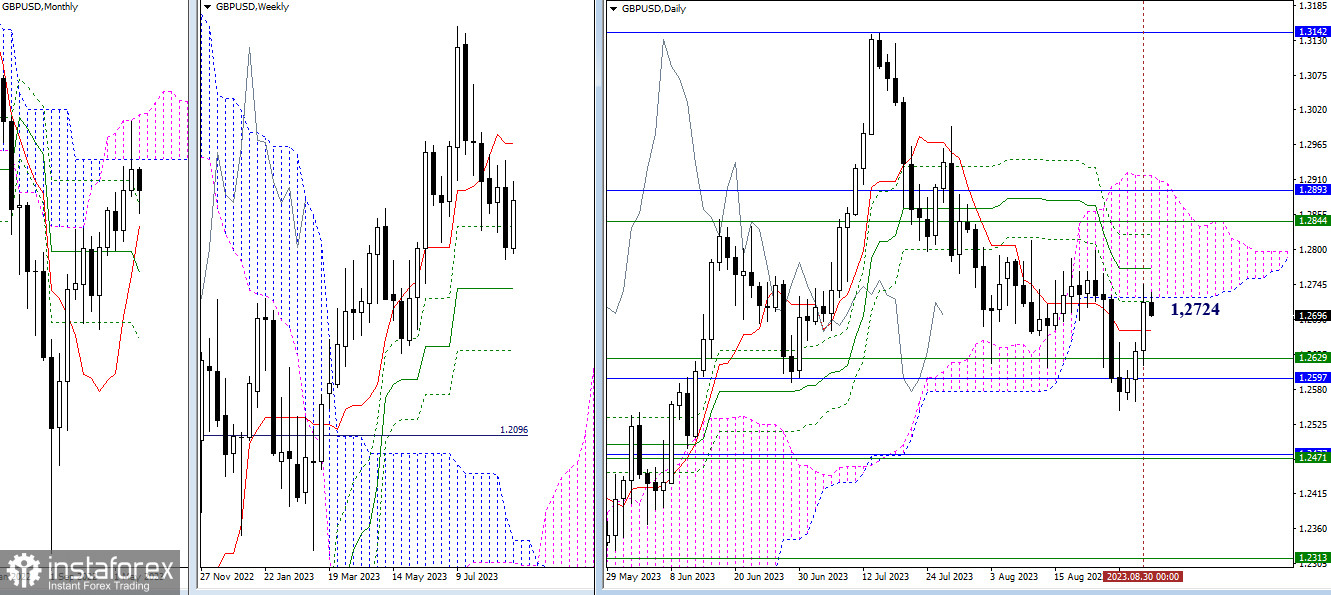

Higher Timeframes

Yesterday, bullish players managed to rise and test the strength of the lower border of the daily cloud (1.2724). Currently, the cloud contains numerous resistances. Thus, breaking through and surpassing the daily cloud will allow bullish players to achieve several objectives at once—eliminate the daily death cross (1.2771 – 1.2823), take over the weekly short-term trend (1.2844), and enter the monthly Ichimoku cloud (1.2893). However, if the bullish scenario fails and the market sentiment leader changes, the rival, as before, needs to move beyond the supports of 1.2629 – 1.2597 and test the strength of the 1.2471 boundary (final border of the weekly Ichimoku cross + monthly short-term trend).

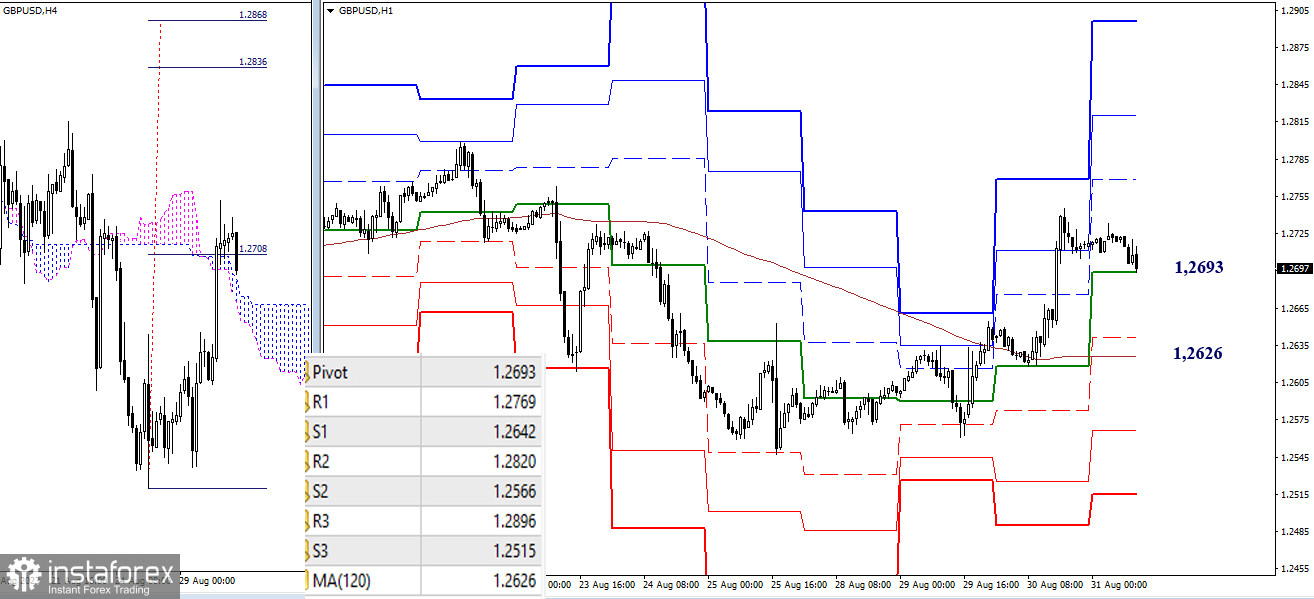

H4 – H1

Currently, on the lower timeframes, the main advantage belongs to bullish players. They have entered the bullish zone concerning the H4 cloud and have set a bullish target. Thus, if the rise continues within the day, the H4 target (1.2836 – 1.2868) will join bullish indicators in the form of resistance from classic pivot points (1.2769 – 1.2820 – 1.2896). However, if the market falls below the key levels of lower timeframes, which today are at 1.2693 (central pivot point) – 1.2626 (weekly long-term trend), we can expected the balance of power to shift towards strengthening bearish sentiments.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română