Indicators show the clear overbuying of dollar, so market players rectified the situation on the eve of the release of the US Department of Labor report. Demand noticeably weakened after job vacancies increased by only 177,000.

As the overheated market issue can be considered resolved for the most part, there may not be much reaction to today's jobless claims data in the US, especially since the changes will likely be very little.

The important thing to note now could be the preliminary assessment of inflation in the eurozone, because the rate of consumer price growth may slow from 5.3% to 5.0%. Further deceleration will surely prompt the ECB to be more restrained in terms of interest rate increases, which will not be in favor of euro and lead to a rise in dollar.

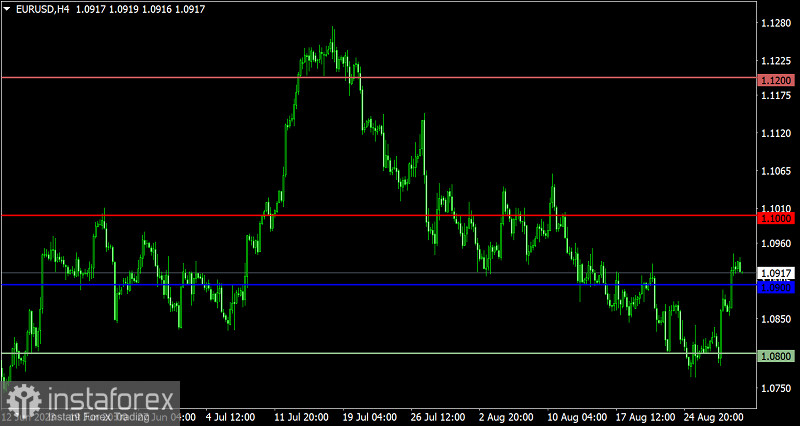

EUR/USD jumped by over 150 pips in the short-term, partially offsetting the recent decline. Staying above the level of 1.0900 will likely increase the volume of long positions, while a drop below the level will result in the surge of short positions.

GBP/USD, on the other hand, rose above 1.2700, indicating a possible price reversal. Staying above this level will surely fuel long positions, while a decline will lead to a return towards the range of 1.2650/1.2700.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română