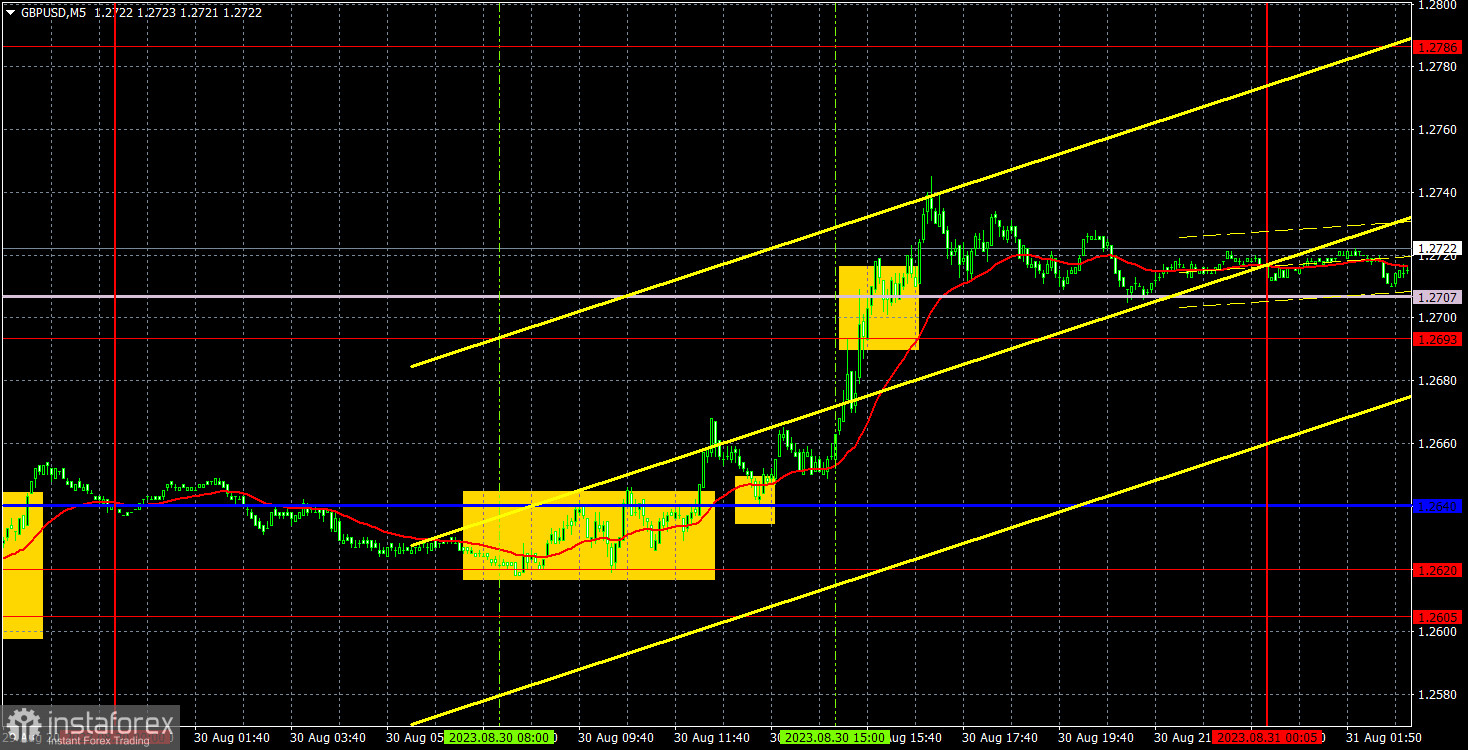

Analysis of GBP/USD 5M

The GBP/USD pair remains elevated on Wednesday after weak US GDP and ADP reports. Several crucial reports fell short, but this week traders are looking forward to even more influential reports like ISM, NonFarm Payrolls, and unemployment. Thus, in theory, the dollar could drop even lower, but it might also rise since there's no guarantee that these reports will also be weak. For instance, there is no correlation between the ADP and NonFarm reports. Therefore, we cannot confirm the revival of a global uptrend. A correction – yes, but we had already warned you about it when the pair was stagnant at the beginning of the week.

At present, the British pound quotes have settled above the Senkou Span B line, indicating a strong correction, at the very least. If the market finds reasons to buy the pound today, the pair might soar even higher.

Speaking of trading signals, there were two buy signals during the European session. Initially, the pair consolidated above the 1.2620-Kijun-sen area, and then bounced off the critical line from above. Thus, long positions should have been opened. Subsequently, the price surpassed the 1.2693 level and the Senkou Span B line, and there were no sell signals. Therefore, longs should have been manually closed above the Senkou Span B line. The profit from the single transaction amounted to no less than 65 pips.

COT report:

According to the latest report, the non-commercial group of traders opened 7,500 long positions and closed 600 short ones. Thus, the net position of non-commercial traders increased by 8,100 positions in a week. The net position has been steadily growing over the past 11 months as well as the pound sterling. Now, the net position has advanced markedly. This is why the pair will hardly maintain its bullish momentum. I believe that a long and protracted downward movement should begin. COT reports signal a slight growth of the British currency but it will not be able to rise in the long term. There are no drivers for opening new long positions. Slowly, sell signals are emerging on the 4-hour and 24-hour charts.

The British currency has already grown by a total of 2,800 pips, from its absolute lows reached last year, which is a significant increase. Without a downward correction, the continuation of the uptrend will be illogical. We are not against the uptrend; we just believe a solid correction is needed first. The market perceives the fundamental background one-sidedly, ignoring any data in favor of the dollar. The Non-commercial group of traders has a total of 98,000 long positions and 38,900 short ones. I remain skeptical about the long-term growth of the pound sterling, and the market has recently begun to pay attention to short positions.

Analysis of GBP/USD 1H

On the 1H chart, the pound/dollar pair has left the sideways channel through the lower band, but is currently going through a bullish correction. The macroeconomic and fundamental background is not that crucial for the mid-term movement, as the market has long since processed all the bullish factors for the pound. However, several influential reports will be released this week, so we can still expect the pound to rise further.

On August 31, traders should pay attention to the following key levels: 1.2429-1.2445, 1.2520, 1.2605-1.2620, 1.2693, 1.2786, 1.2863, 1.2981-1.2987. The Senkou Span B (1.2707) and Kijun-sen (1.2641) lines can also be sources of signals, e.g. rebounds and breakout of these levels and lines. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 20 pips. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits.

On Thursday, there's nothing particularly noteworthy slated in the UK, while the US will release several secondary reports, including personal income and consumer spending, as well as unemployment benefit claims. If the latter report disappoints, this may trigger the dollar's decline.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română