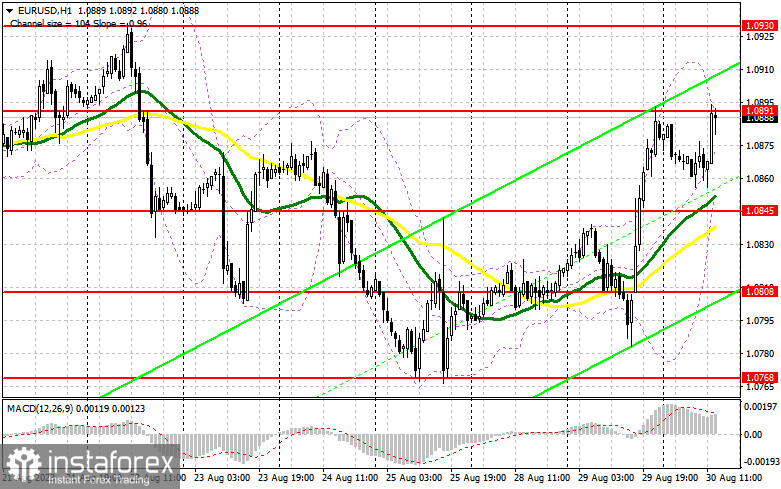

In my morning forecast, I highlighted the level of 1.0891 and advised making decisions about entering the market from there. Examining the 5-minute chart, the rise and formation of a false breakout at 1.0891 led to a sell signal. However, as we can see on the chart, there hasn't been a significant drop, and it's unlikely to happen now. The technical outlook for the second half of the day remains unchanged.

For opening long positions on EURUSD, it requires:

Considering there's hardly any activity from sellers at 1.0891, it's best to exit short positions and wait for new signals in the form of fundamental US statistics that could further weaken the dollar's stance. Weak figures are expected for the ADP employment change for August of this year. If the data disappoints even further, as was the case yesterday with consumer confidence, we can expect the bullish scenario for EUR/USD to continue. Figures related to the change in the volume of pending home sales transactions and the balance of trade in goods in the US will also carry weight, but the market will most likely react more to labor market data.

Of course, to increase long positions, it would be ideal to see a drop and formation of a false breakout around the support area of 1.0845, which we didn't reach in the first half of the day and where the moving averages in favor of the bulls are located. Only there can you find a good entry point for continuing the upward trend, which aims to develop into a new trend. Another key target for the bulls remains the resistance at 1.0891, which has yet to be breached. A breakout and a top-down test of this range will strengthen the demand for the euro, giving a chance for a leap to 1.0930. The most distant target will be the area of 1.0959, where I will be taking profits. In the event of a EUR/USD decline and lack of activity at 1.0845 in the second half of the day, the bears will try to regain market control and recoup all of yesterday's growth. In such a case, only the formation of a false breakout around 1.0808 will signal buying the euro. I will open long positions immediately on a rebound from 1.0768 with a target of an upward correction of 30-35 points within the day.

To open short positions on EURUSD, it requires:

For sellers, the primary function remains the defense of the 1.0891 resistance. Only another false breakout at this level after the release of US labor market data will provide a sell signal, leading to a decline towards the support area of 1.0845, where the moving averages that favor buyers are situated. Only after a breakthrough and stabilization below this range and a subsequent bottom-up retest do I expect to receive another signal pointing directly to 1.0805, where I anticipate the emergence of larger buyers. The most distant target will be the 1.0768 level, where I'll be taking profits. If the EUR/USD moves upward during the American session and there are no bears at 1.0891, which is most likely what will happen, the bulls will maintain control over the market. If this unfolds, I will delay short positions until the new resistance at 1.0930. I might also sell there, but only after unsuccessful consolidation. I'll open short positions directly on a rebound from the high of 1.0959, targeting a downward correction of 30-35 points.

Indicator signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating a bullish market character.

Note: The author considers the period and prices of the moving averages on the hourly H1 chart and differs from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands:

In case of growth, the upper boundary of the indicator around 1.0891 will serve as resistance.

Description of indicators:

• Moving average (defines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (defines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

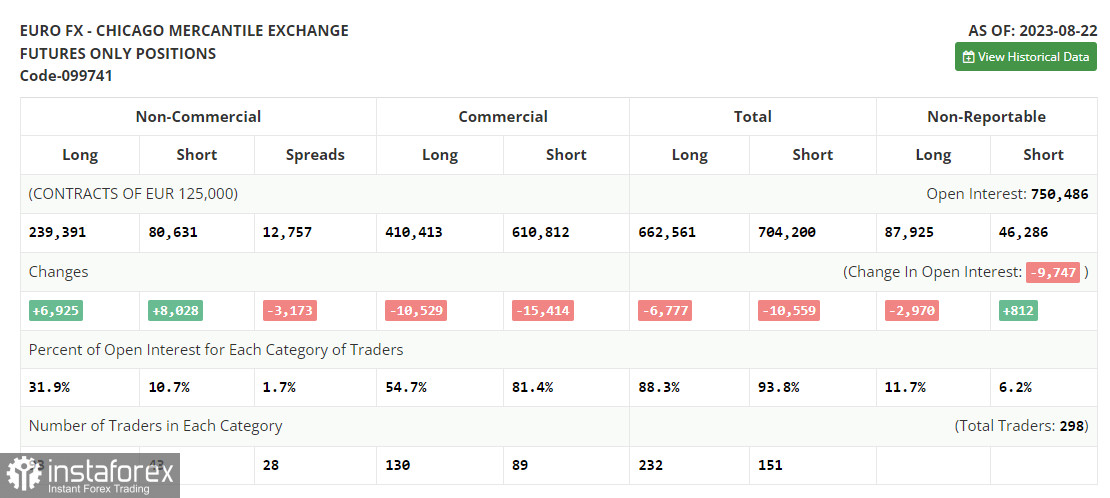

• Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet specific requirements.

• Long non-commercial positions represent the total long open positions of non-commercial traders.

• Short non-commercial positions represent the total short open positions of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română