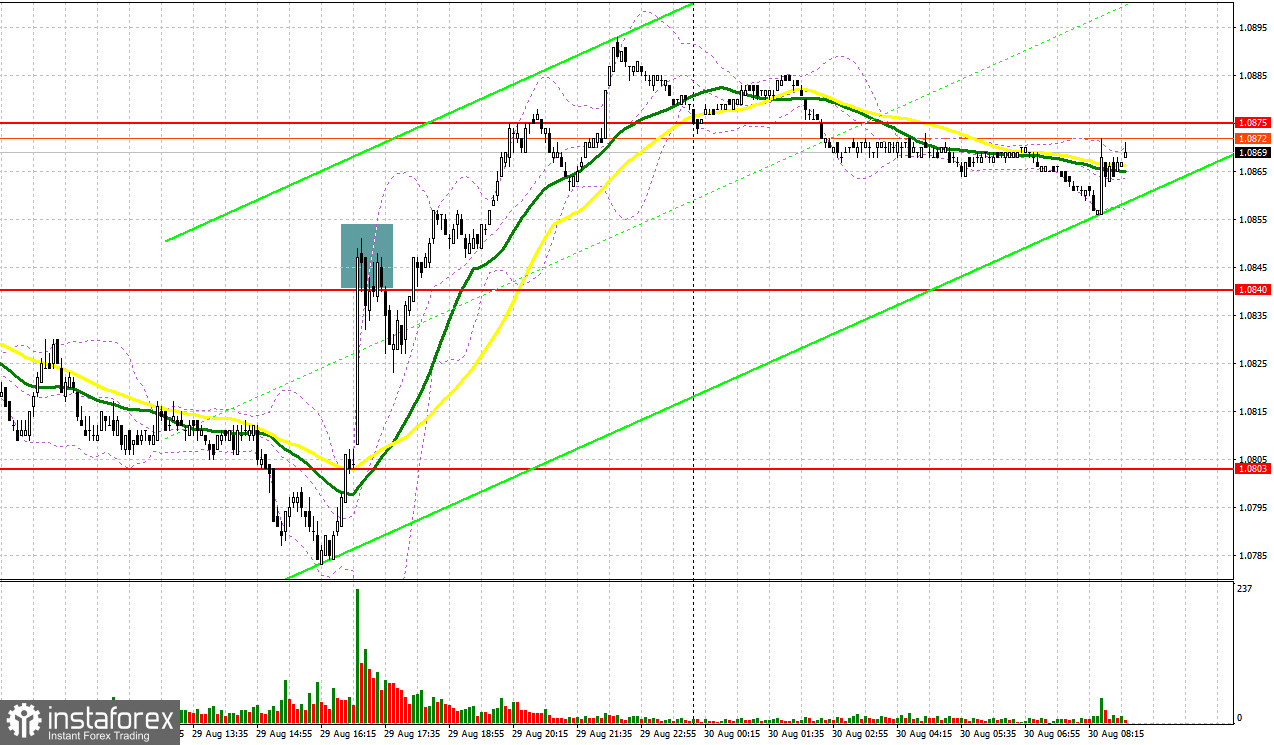

Yesterday, the pair formed several good signals to enter the market. Let's analyze what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0803 as a possible entry point. The pair fell but a false breakout was not formed. In the afternoon, growth and a false breakout at 1.0840 created a sell signal, but after falling by 15 pips, risky assets were in demand again.

For long positions on EUR/USD:

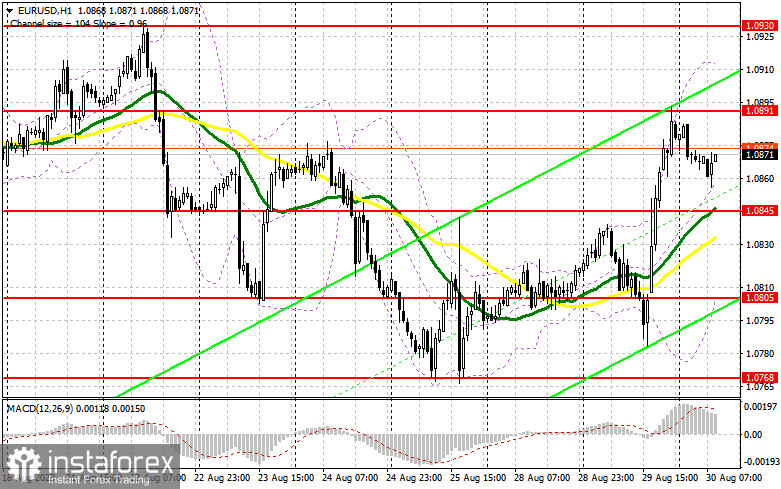

The dollar fell and the euro strengthened after a slide in US consumer confidence, against an expected growth. It is hard to say how the market will react to today's reports on German inflation and euro area consumer confidence, but it is unlikely to significantly impact market direction if the latest figures do not deviate from estimates. A slowdown in the price growth in Germany may have a negative impact on the EUR/USD. For this reason, you should be cautious with long positions. It is best to act on the decline after a false breakout near the new support level at 1.0845, formed at the end of yesterday. This would provide a good entry point for long positions and if so, we can expect the resumption of the upside correction, in hopes that it would develop into a new trend. The target will be the resistance level at 1.0891. A breakout and downward test of this range would strengthen demand for the euro, potentially pushing it toward 1.0930. The ultimate target remains around 1.0959. I will take profits there. If EUR/USD declines and bulls fail to hold at 1.0845, bears will try to regain control of the market and recoup all of yesterday's losses. Therefore, a false breakout around the next support at 1.0805 would be a buy signal for the euro. I plan to initiate long positions on a rebound from 1.0768, keeping in mind an intraday upward correction of 30-35 pips.

For short positions on EUR/USD:

Sellers are in shock after yesterday's reports and the market's reaction to it, but not all is lost yet. Today, traders will be focusing on the upcoming labor market data. For this reason, it is important for the bears to protect the nearest resistance level at 1.0891. Easing inflation in Germany and declining consumer confidence along with a false breakout at 1.0891 will create a sell signal, anticipating a decline to the support at 1.0845, which is in line with the bullish moving averages. A breakout and consolidation below this range, as well as an upward test, will provide an entry point for selling to reach 1.0805, where I expect large buyers to emerge. A more distant target would be the area around 1.0768, where traders may lock in profits. If the pair rises and bears show weak activity at 1.0891, bulls will maintain control. In this case, only a false breakout near the next resistance at 1.0930 may give an entry point for short positions. Selling at this point is possible only after a failed consolidation. I will initiate short positions immediately on a rebound from the high of 1.0959, considering a downward correction of 30-35 pips within the day.

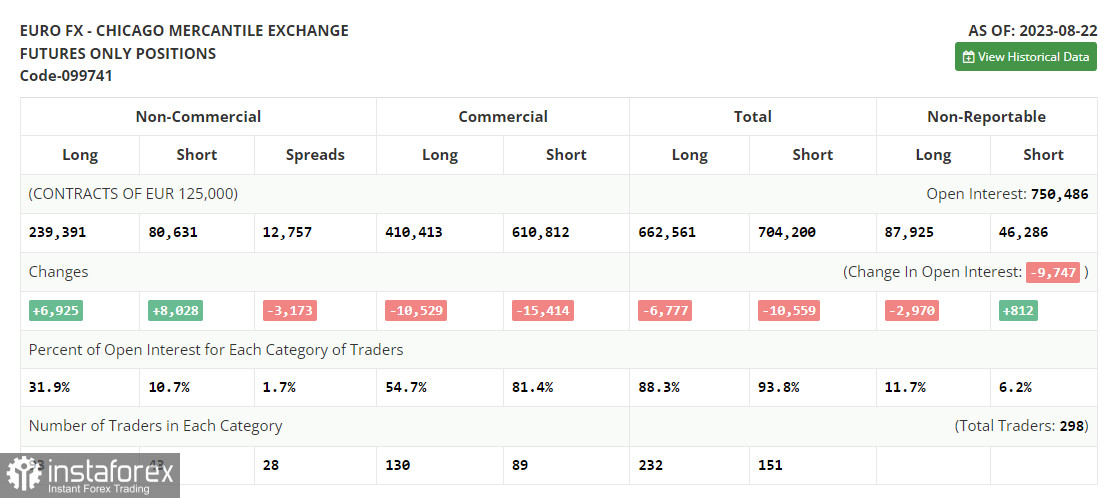

COT report:

The COT report for August 22 recorded a rise in both long and short positions. Considering the release of rather weak PMI data in the US, indicating economic contraction, as well as hawkish comments from Federal Reserve Chairman Jerome Powell during the Jackson Hole Symposium, it is not surprising that there were slightly more short positions than the long ones. However, the decline in the euro presents an attractive opportunity for traders, and the optimal medium-term strategy in the current conditions remains to buy risk assets on dips. According to the COT report, non-commercial long positions increased by 6,925 to reach 239,391, while non-commercial short positions jumped by 8,028 to 80,028. As a result, the spread between long and short positions decreased by 3,173. The closing price dropped to 1.0866 from 1.0922, indicating a bearish market sentiment.

Indicator signals:

Moving averages:

Trading above the 30- and 50-day moving averages indicates that the bulls have an advantage.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0805 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română