Analysis of EUR/USD 5M

EUR/USD tried to resume its downward movement. Take note that the dollar did not even need any macroeconomic or fundamental reasons to resume growth, as the euro is currently overbought and unjustifiably pricey. Therefore, it wasn't surprising if the dollar appreciated throughout the day. Everything initially seemed to follow this pattern. However, in the US, the JOLTS report on the number of open job vacancies in July was published. Its value turned out to be significantly lower than estimates. The figure for June was also revised downward. As a result, two consecutive months proved much weaker than forecasts. It's no wonder the US dollar fell after this report. And this is just the first significant report for the week...

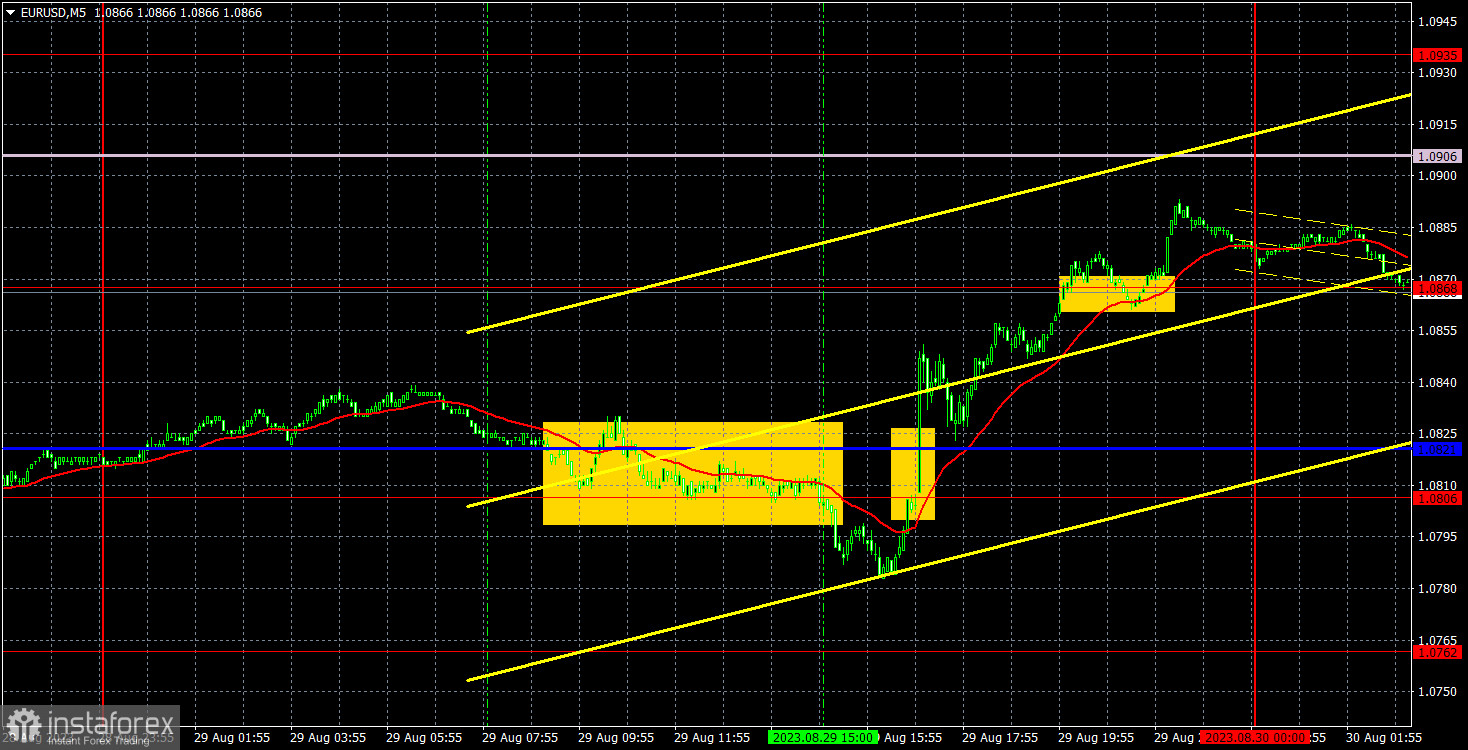

Tuesday's trading signals and the pair's movements were far from ideal. The first sell signal appeared, and when the price finally settled below the 1.0806 level, the JOLTS report was released, and the price turned upwards. Traders might have opened a short position, but after the US report, it would have been wise to close it quickly. Subsequently, a buy signal was formed in the 1.0806-1.0821 region, which was also far from ideal. Nonetheless, one could have made a couple of dozen points in profit as the price eventually reached the nearest target level of 1.0868 by the end of the day.

COT report:

On Friday, a new COT report for August 22 was released. Over the last 11 months, COT reports fully corresponded to what is happening in the market. The chart above clearly shows that the net position of major traders (the second indicator) began to grow in September 2022 and at about the same time the euro started rising too. In the last 6-7 months, the net position has not risen but the euro remains at very high levels. At the moment, the net position of non-commercial traders is bullish and remains strong. The euro keeps climbing against the US dollar (in the long term).

I have already mentioned the fact that a fairly high value of the net position signals the end of an uptrend. This is also confirmed by the first indicator where the red and green lines are very far from each other. Usually, it precedes the end of the trend. During the last reporting week, the number of long positions of the non-commercial group of traders increased by 6,900 and the number of short ones rose by 8,000. The net position decreased by 1,100 contracts, which is not significant. The number of long positions is higher than the number of short ones of non-commercial traders by 160,000. This is a very large gap as the difference is almost threefold. Even without COT reports, it is obvious that the euro should decline but speculators are still in no hurry to sell.

Analysis of EUR/USD 1H

On the 1H chart, the pair is trying to correct higher, but it has no basis for a strong upward movement in the medium-term. This week, we are looking forward to several influential reports, so the pair's movement will largely depend on their nature. The first report was already released yesterday and, as we can see, it did not support the dollar. If the other US reports turn out to be the same, the dollar may fall further. But after that, we still expect the pair to resume its decline.

On August 30, traders should pay attention to the following key levels: 1.0658-1.0669, 1.0762, 1.0806, 1.0868, 1.0935, 1.1043, 1.1092, 1.1137, as well as the Senkou Span B (1.0882) and Kijun-sen (1.0829) lines. The lines of the Ichimoku indicator can move during the day, which should be taken into account when determining trading signals. There are support and resistance levels that can be used to lock in profits. Traders look for signals at rebounds and breakouts. It is recommended to set the Stop Loss orders at the breakeven level when the price moves in the right direction by 15 pips. This will protect against possible losses if the signal turns out to be false.

Today's noteworthy economic reports include the Consumer Price Index for August in Germany and the GDP and ADP reports in the US. We believe that the German inflation and the US ADP reports are the most influential, and their values can deviate significantly from forecasts. If this does not happen, then the market reaction will be relatively muted.

Description of the chart:

Support and resistance levels are thick red lines near which the trend may end. They do not provide trading signals;

The Kijun-sen and Senkou Span B lines are the lines of the Ichimoku indicator, plotted to the 1H timeframe from the 4H one. They provide trading signals;

Extreme levels are thin red lines from which the price bounced earlier. They provide trading signals;

Yellow lines are trend lines, trend channels, and any other technical patterns;

Indicator 1 on the COT charts is the net position size for each category of traders;

Indicator 2 on the COT charts is the net position size for the Non-commercial group.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română