The latest Australian consumer inflation data will be released on Wednesday (at 01:30 GMT). A slowdown in the annual CPI is anticipated, from 5.4% to 5.2% in July, which will be another negative factor for AUD.

Economists believe that if the interest rate is raised at the RBA meeting on September 5th, it will be the last hike in the current cycle of tightening credit and monetary policies. It is likely to be a bearish factor for the Australian dollar.

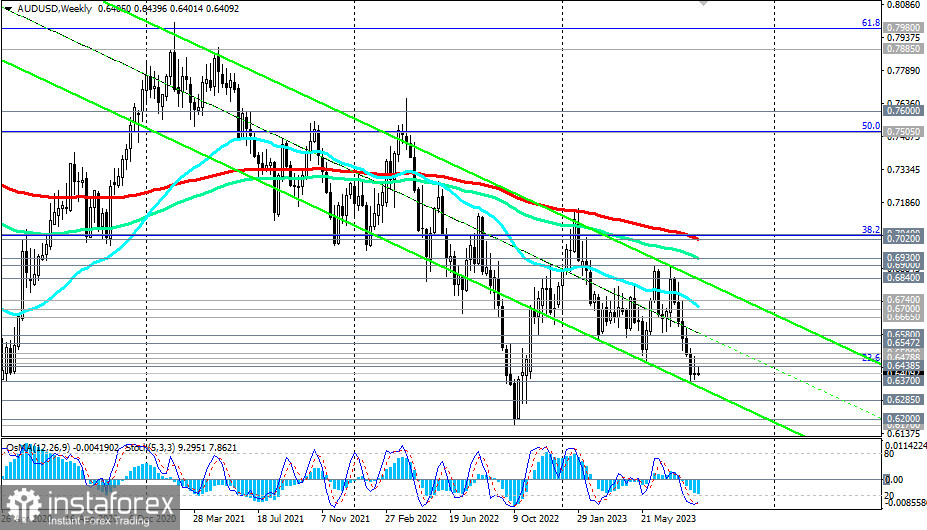

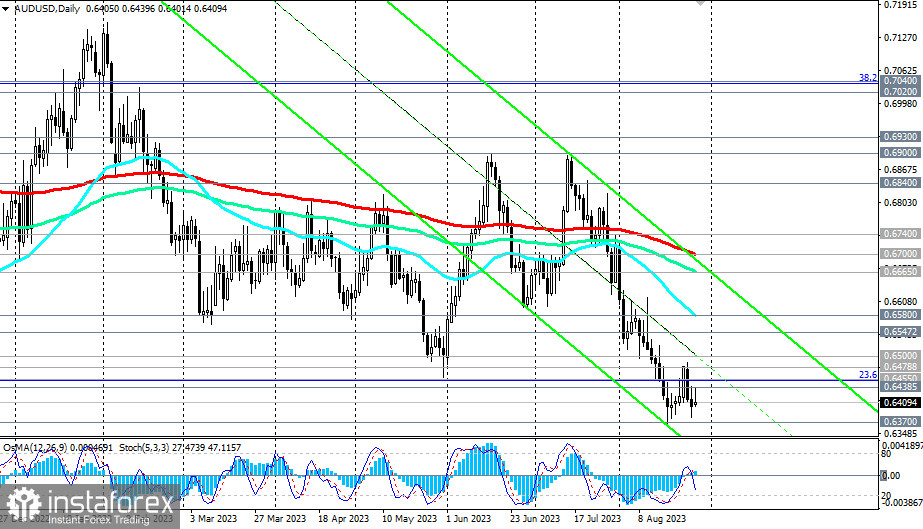

From a technical perspective, AUD/USD is showing a downward trend, delving deeper into the downward channels on daily and weekly charts, heading towards their lower boundaries and levels of 0.6340, 0.6300.

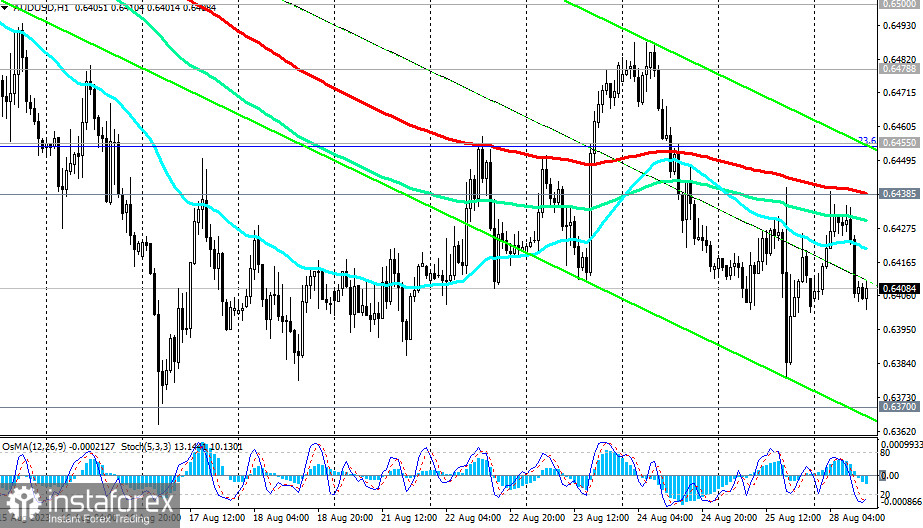

Breaking today's low of 0.6401 could be the 'quickest' signal to increase short positions, while breaking the local support level of 0.6370 would serve as confirmation.

A confirmed break of local support at 0.6400 would hasten this decline towards the lower boundary of the downward channel on the weekly chart, close to the levels of 0.6285, 0.6200, 0.6170 (2022 lows and the bottom boundary of the downward channel on the weekly chart).

The downward targets are located in the zone of local lows and levels of 0.6285, 0.6200, 0.6170 (2022 lows).

In an alternative scenario, breaking the significant short-term resistance level of 0.6438 (200 EMA on the 1-hour chart) might serve as a signal to initiate long positions.

Breaking above the local resistance level of 0.6500 will confirm the onset of a corrective rally.

The medium-term upward targets in this scenario are the key resistance levels at 0.6665 (144 EMA on the daily chart) and 0.6700 (200 EMA on the daily chart).

However, only by breaking the key resistance levels of 0.7000, 0.7020 (200 EMA on the weekly chart), and 0.7040 (38.2% Fibonacci level of the decline from 0.9500 to 0.5510) will AUD/USD move into a long-term bullish zone.

Support Levels: 0.6400, 0.6370, 0.6300, 0.6285, 0.6200, 0.6170

Resistance Levels: 0.6438, 0.6455, 0.6478, 0.6500, 0.6547, 0.6580, 0.6600, 0.6665, 0.6700, 0.6740, 0.6800, 0.6840, 0.6900, 0.6930, 0.7000, 0.7020, 0.7040.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română