EUR/USD

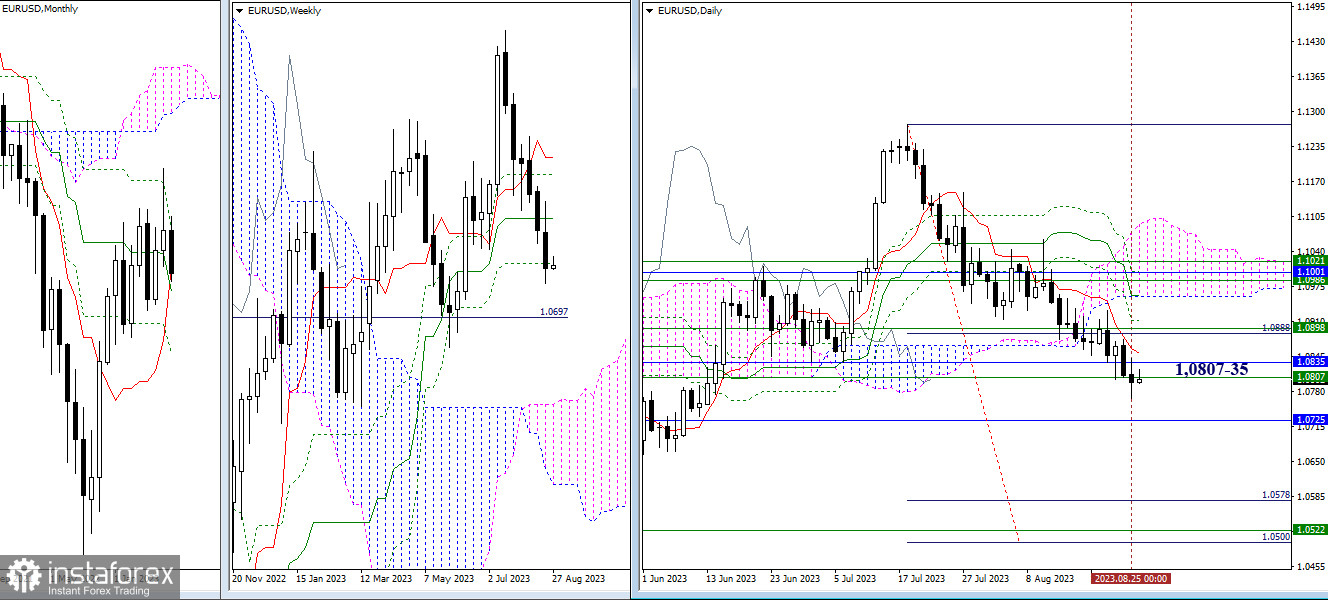

Higher Timeframes

Despite closing below key attraction levels, which are still combined in the 1.0807 – 1.0835 zone, their influence on the current situation remains. After liquidating the weekly golden cross of Ichimoku at 1.0807, the primary focus will shift to the passing of the monthly medium-term trend support, currently situated at the 1.0725 mark. Subsequent downward targets include the upper border of the weekly cloud (1.0522) and the target for breaking through the daily Ichimoku cloud (1.0500 – 1.0578). However, if the attraction of 1.0807–35 holds the pair and the decline is halted, the next immediate supports are at 1.0850 (daily short-term trend) and 1.0897 (weekly medium-term trend).

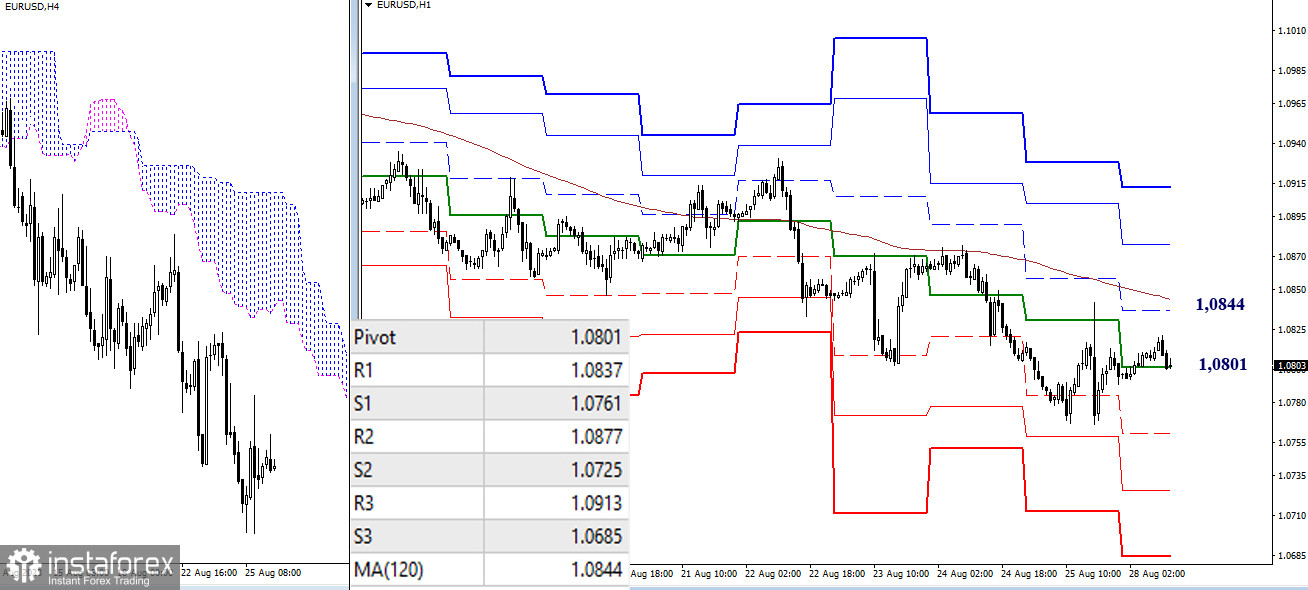

H4 – H1

The main advantage on the lower timeframes belongs to bearish players. However, the pair is in an upward trend correction zone, and as of writing, it has taken control of the central pivot point (1.0801). The key levels of the lower timeframes, 1.0801 – 1.0844 (central pivot point + weekly long-term trend), are currently bolstered by the influence of higher timeframes (1.0807 – 1.0835). Overcoming and securing above them could significantly impact the current balance of power. In the case of an upward move, additional resistances for bullish players within the day will be 1.0877 – 1.0913 (classic pivot points). If bearish sentiment returns and a decline develops, supports from classic pivot points at 1.0761 – 1.0725 – 1.0685 will become pertinent.

***

GBP/USD

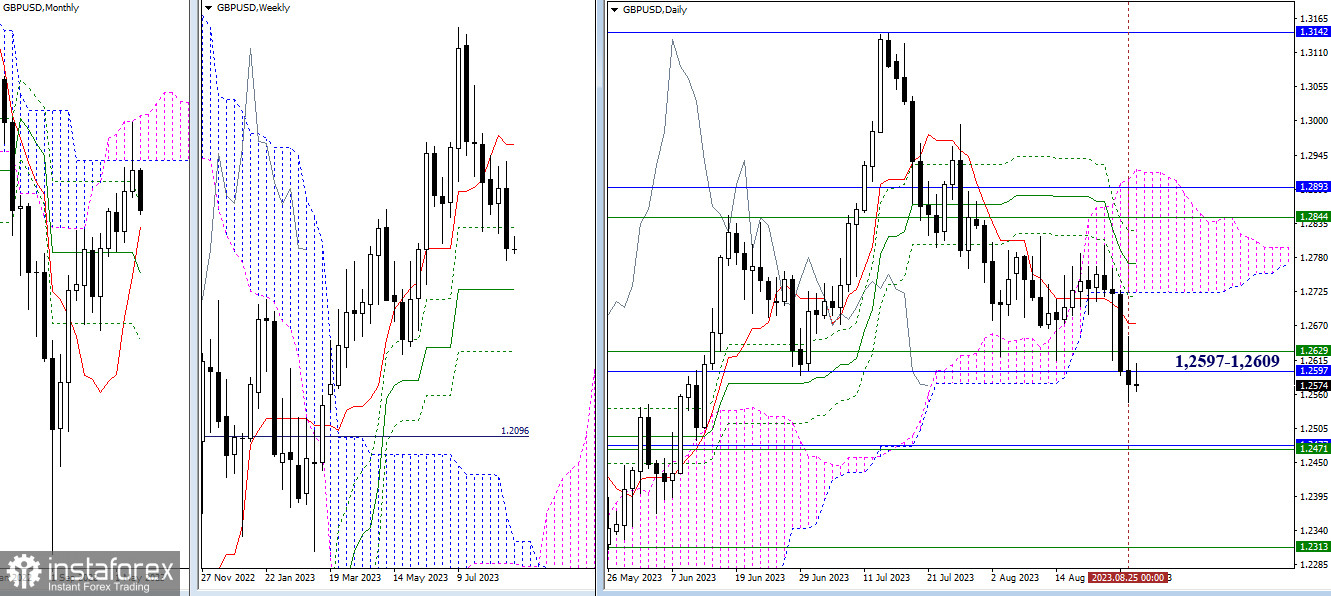

Higher Timeframes

The rebound from the monthly cloud, identified in July, has progressed. August will end in a few days, and the result is both interesting and significant. The nearest major support threshold, merging the monthly short-term trend and weekly medium-term trend, is at 1.2471. The current attraction and retention from continuing the decline are being exerted by the 1.2597 – 1.2629 zone (weekly and monthly Fibo Kijun).

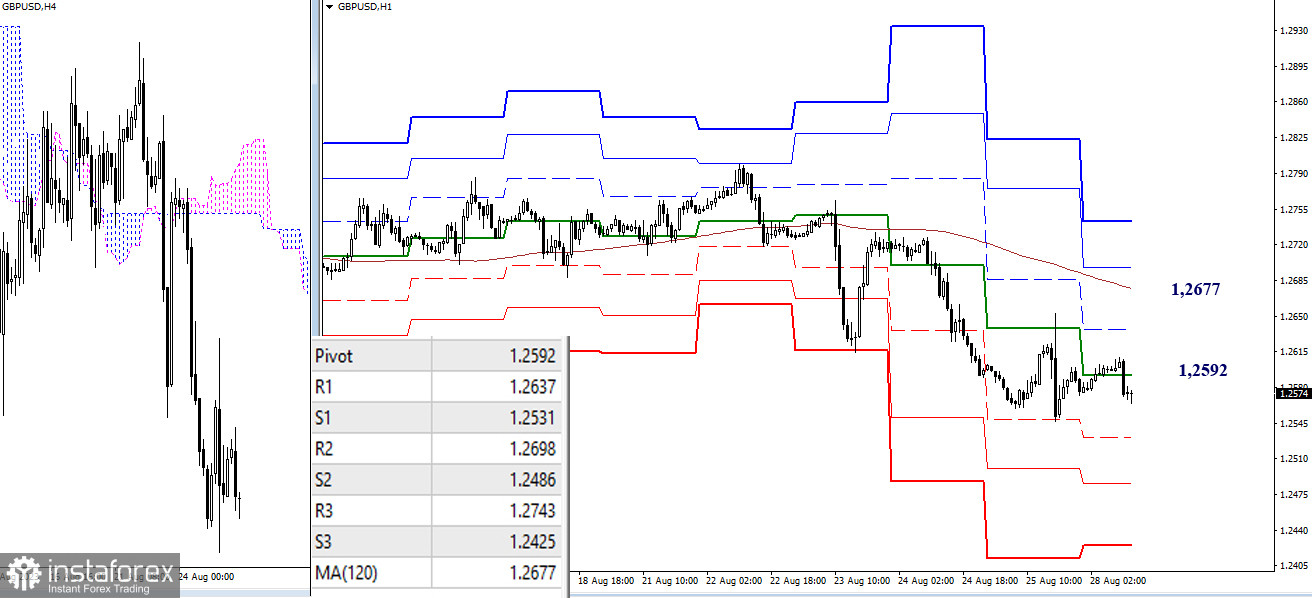

H4 – H1

On the lower timeframes, the development of the downward trend has paused, and we see another corrective decline. If the downward trend resumes, the support levels of the classic pivot points (1.2531 – 1.2486 – 1.2425) will be engaged. If bullish players wish to change the current balance of power, it will be crucial for them first to retain the central pivot point (1.2592) and then take over the weekly long-term trend (1.2677). Intermediate resistance on this path might be presented by R1 of classic pivot points (1.2637).

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română