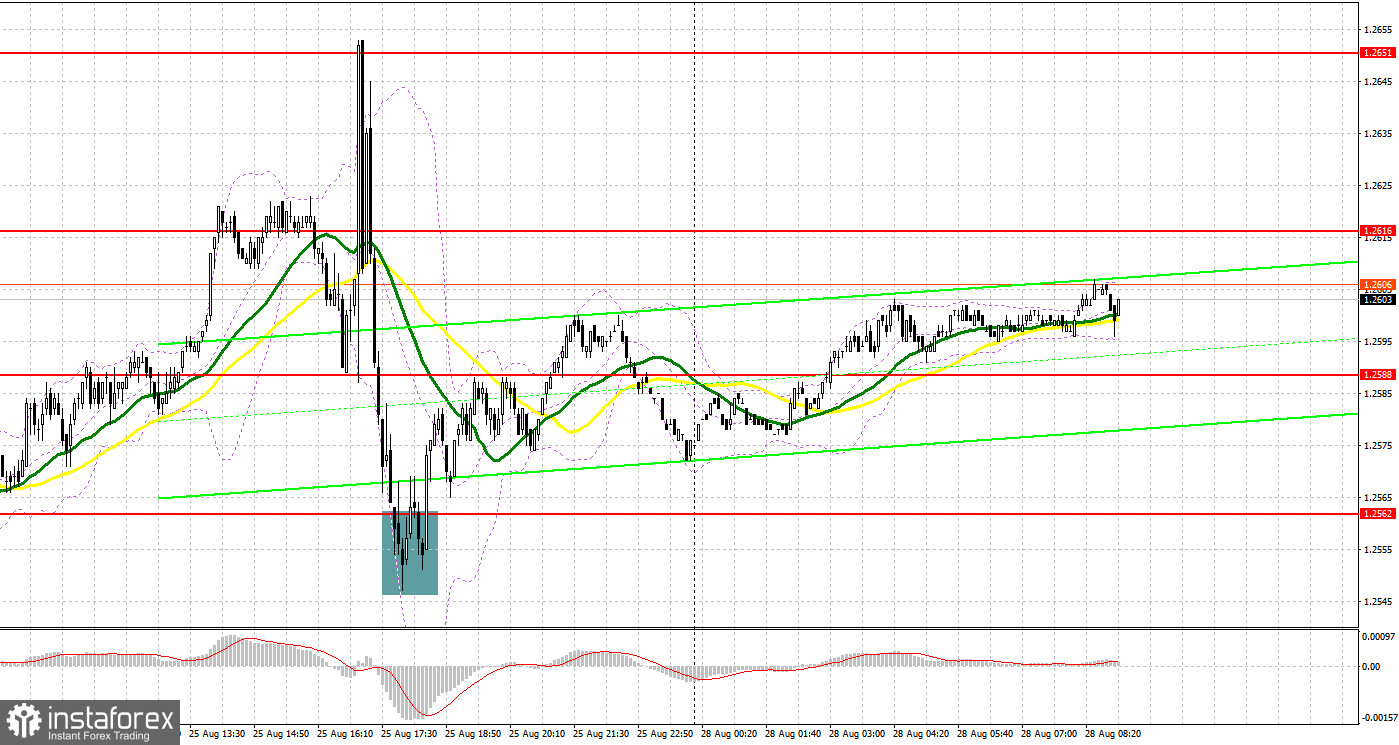

Several market entry signals were formed last Friday. Let's examine the 5-minute chart and delve into what happened there. In the previous forecast, I drew your attention to the level of 1.2588 and recommended entering the market from it. The rise and a false breakout at this level created a sell signal, however, since traders were cautious ahead of Federal Reserve Chair Jerome Powell's speech, this did not lead to a new GBP/USD sell-off. In the second half of the day, a false breakout at 1.2562 provided a good entry point for buying the British currency, leading to a rise of over 40 pips.

For long positions on GBP/USD:

The pound fell in response to Powell's remarks, suggesting that interest rates will remain high and might rise even further if the economy and inflation don't cool down. In his speech at the US central bank's conference in Jackson Hole, Powell emphasized that the Fed's work on combating inflation is not yet finished, noting the progress in slowing price growth. However, the pound's decline was quickly picked up around its monthly low, giving buyers a chance to stop the bearish market.

With no other fundamental data from the UK, it is better to buy the currency after a dip. Only a false breakout near the new support level of 1.2578 may provide an entry point into long positions, anticipating a recovery and an update of the nearest resistance at 1.2614, formed based on last Friday's results. A breakthrough and a consolidation above this range may restore buyer confidence, preserving chances to reach 1.2651. The next target will be near 1.2689, where profits can be taken. If the pair declines to 1.2578 with a lack of buyers in the market, pressure on the pound will increase, as will the chances of a new bear market. In that case, protecting the next area at 1.2548, along with a false breakout, can give a buy signal. I plan to consider buying the British currency on a bounce only from the low of 1.2523, allowing an intraday correction of 30-35 pips.

For short positions on GBP/USD:

The bears tried, but failed to regain control of the market, and it's now crucial not to miss the nearest resistance level at 1.2614, which will be quite challenging. I will only act after an unsuccessful consolidation at this mark. This would give a sell signal with a potential decline toward 1.2578. A breakthrough and an upward retest of this level may significantly dent the bulls' positions, enabling further development of a bearish market, possibly reaching 1.2548. The next target remains at the 1.2523 area, where one can lock in profits. If the pair rises and we see weak trading at 1.2614, bulls will gain a significant advantage - especially after the strong resistance that occurred last Friday following Powell's speech. It would be better to postpone shorts until the pair forms a false breakout at 1.2651. If downward movement stalls there, one can sell the British pound on a bounce from 1.2689, allowing an intraday correction of 30-35 pips.

COT report:

The COT report for August 15 logged that long and short positions saw an increase. Traders were building positions after the UK's GDP data, which exceeded economists' expectations. Price decreases in the US also affected the balance, supporting the pound, as did the high underlying pressure in the UK. The Jackson Hole Symposium at the end of this week could lead to further short-term strengthening of the British pound. It's crucial to hear Fed Chair Jerome Powell's views on future US monetary policy. As before, buying the pound on dips remains the optimal strategy, as the divergence in central bank policies will influence the prospects of the US dollar, exerting pressure on it. The latest COT report shows that non-commercial long positions increased by 7,302 to 90,541, while non-commercial short positions jumped by 3,334 to 39,553. The spread between long and short positions decreased by 607. The weekly price dropped to 1.2708 from 1.2749.

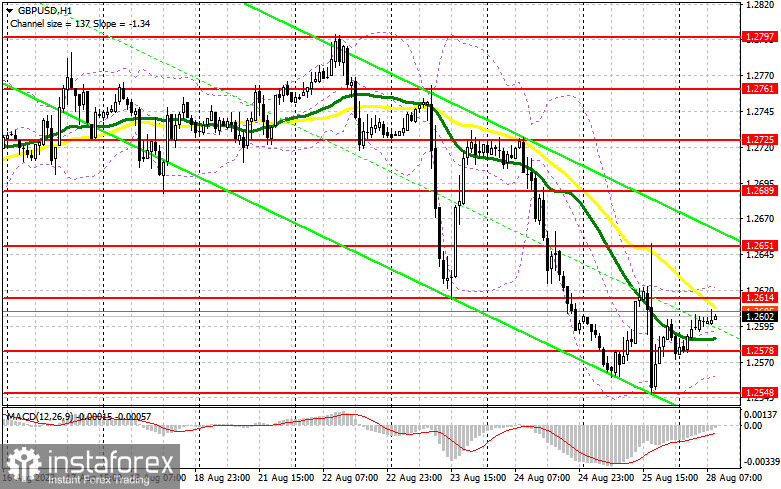

Indicator signals:

Moving Averages

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2557 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română