The GBP/USD currency pair continued its decline on Friday, a trend that has persisted for several days after the price broke out of the sideways channel. As such, the downward movement should continue in the medium-term perspective. However, we said the same thing a week, a month, and several months ago. This is mainly because the British pound has not had a basis for growth for quite some time. The market has been buying it for a long time, primarily out of inertia, while also anticipating perpetual aggressive actions from the Bank of England to curb inflation. Yet, every "fairytale" ends sooner or later. Of course, the market might continue buying the pound for another year, two, or even three. The market does not always have to follow the fundamental and macroeconomic backdrop. Still, more often than not, it does; otherwise, these two types of analyses would be rendered irrelevant.

The only aspect currently casting doubt on the further decline of the pound in the upcoming week is the oversold status of the CCI indicator. Moreover, it's a double oversold condition since the indicator entered this zone twice. Additionally, a divergence has formed on these two indicator lows. Hence, a rebound might occur next week, the duration of which will depend on the macroeconomic backdrop. Several essential US labor market reports will be released next week. Plus, the market might still be under the influence of Jerome Powell's speech at the Jackson Hole symposium on Monday.

It's also worth noting the failure to overcome the Murrey level of "6/8"-1.2573 on the 4-hour timeframe and the Senkou Span B line on the 24-hour chart. Thus, as we approach the new week, we have several factors pointing towards a potential rise in the British currency over the next 3-5 days. On the other hand, if these barriers are breached, the likelihood of the pound's logical decline will significantly increase.

Next week, there will be only a few significant events in the UK. What can we highlight? The Business Activity Index in the manufacturing sector for August in its second assessment? A speech by the Bank of England's chief economist, Huw Pill? While undoubtedly interesting, the market's likelihood of reacting to these events is minimal. Mr. Pill might provide the market with valuable information on future rate changes, but it's unlikely to make waves. Most likely, the chief economist of the Bank of England will stick to general statements.

In the US, there will be much more significant data. On Tuesday, the JOLTs job openings report will be released. On Wednesday, there will be reports on the GDP for the second quarter and ADP data. On Thursday, data on personal income and expenses of the American population, the PCE index, and unemployment benefits claims are due. On Friday, we expect the Non-Farm Payrolls, unemployment rate, wage data, and the ISM index for the manufacturing sector. These are just the most important publications, not considering the secondary ones. As we can see, the macroeconomic background will be very strong, so we can expect significant movements from both pairs. Naturally, the direction of the pair's movement will depend on the nature of the American data. If most statistics underperform, the euro and pound may correct upwards, as the CCI indicator's current oversold condition demands. At the same time, strong reports help overcome significant barriers, breaking the oversold condition.

According to forecasts, we shouldn't expect super-strong statistics from across the ocean, but remember, the actual report values matter less than whether they meet or miss the forecasts.

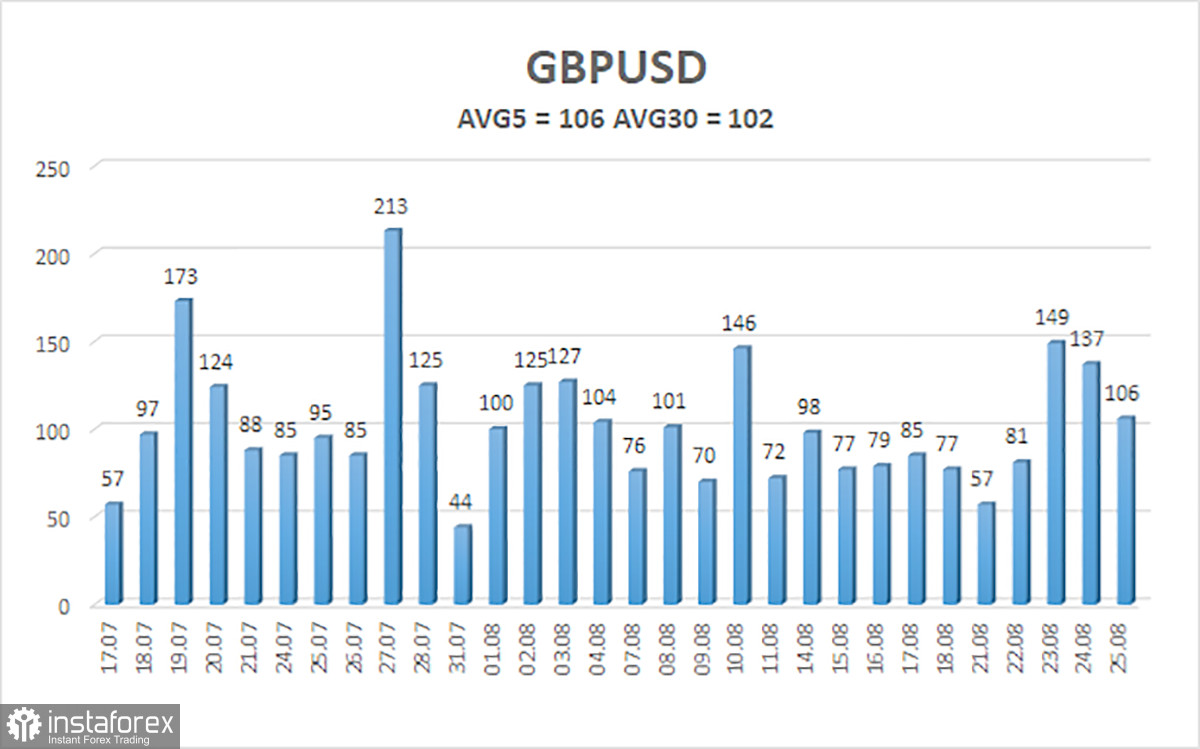

The average volatility of the GBP/USD pair over the last five trading days is 106 points. For the pound/dollar pair, this value is "medium." On Monday, August 28, we expect movement within the range limited by levels 1.2470 and 1.2682. The Heiken Ashi indicator's turnaround signals a new wave of upward correction.

Nearest support levels:

S1 – 1.2573

S2 – 1.2543

S3 – 1.2512

Nearest resistance levels:

R1 – 1.2604

R2 – 1.2634

R3 – 1.2665

Trading Recommendations:

The GBP/USD pair in the 4-hour timeframe has resumed its downward trend. Thus, at this time, it's advisable to stay in short positions with targets at 1.2512 and 1.2470 until the Heiken Ashi indicator turns upwards. Consider long positions only after the price firmly settles above the moving average line, with targets at 1.2756 and 1.2817.

Illustration Explanations:

- Linear regression channels help determine the current trend. If both point in the same direction, the current trend is strong.

- The moving average line (settings 20.0, smoothed) determines the short-term trend and the current trading direction.

- Murray levels are target levels for movements and corrections.

- Volatility levels (red lines) are the probable price channel the pair will trade over the next day, based on current volatility indicators.

- The CCI indicator – its entry into the oversold area (below -250) or the overbought area (above +250) indicates an imminent trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română