Throughout the past week, the EUR/USD currency pair continued its somewhat sluggish decline; however, this decrease was consistent. The European currency was losing several dozen points daily, precisely the turn of events we had predicted. The process of restoring balance is underway but still needs to be completed. The European currency had been rising for long without substantial reasons or grounds. Meanwhile, the dollar fell for 11 months even though the Federal Reserve (Fed) had been raising rates more robustly and quickly than the European Central Bank (ECB). As mentioned, the market had already priced the Fed's rate hikes. However, it should also have priced in all of the ECB's rate hikes in that case. So, the euro should be declining, whichever way you look at it.

Currently, on the 4-hour timeframe, the price isn't even trying to secure a position above the moving average line, so there's no talk of an upward movement or purchases. However, by the end of this week, the CCI indicator entered the oversold territory, which might suggest that the pair is preparing for a more significant correction. Therefore, next week, we can reasonably expect an upward movement of around 200 points, especially if the macroeconomic backdrop is favorable.

However, the fundamental backdrop for the euro continues to deteriorate. If the market previously bought euros based on high ECB rate expectations, over the last month, several members of the ECB's monetary committee have stated that there might be a pause in tightening in September. Moreover, Christine Lagarde, who spoke at the symposium in Jackson Hole on Friday, talked about maintaining rates at high levels rather than new tightenings. Thus, the ECB's rhetoric has started to soften, which could put additional pressure on the euro.

Inflation in the EU may pose new challenges for the euro.

Next week in the European Union, there will be a limited number of significant events, but there will be some. On Monday, the head of the Bundesbank, Joachim Nagel, will deliver a speech. This address is likely more interesting than Christine Lagarde's, yet Mr. Nagel might make a few essential statements regarding the rate. However, it's crucial to remember that individual statements from the chair of one of the 27 central banks in the European Union carry less weight than a speech by Christine Lagarde.

On Wednesday in Germany, a report on inflation for August will be published, which may slightly slow down compared to the previous month. On Thursday, the European Union will release the Consumer Price Index (CPI) for August, and here, the market also expects a slight slowdown to 5-5.1%. At the same time, core inflation might drop to 5.3%. In addition to the inflation report, there will also be an unemployment report, which is of secondary importance. The speech of the European Central Bank's (ECB) Vice President, Luis de Guindos, is also scheduled for Thursday. On Friday, only the Business Activity Index for the manufacturing sector in August will be released in its final assessment. As we see, the key event will be the inflation report. Since the CPI continues to slow down, the ECB, initially less "hawkish" than the Federal Reserve (Fed) or the Bank of England (BOE), has fewer reasons to maintain its "moderately tight" key rate hike pace. This is a critical factor supporting the euro.

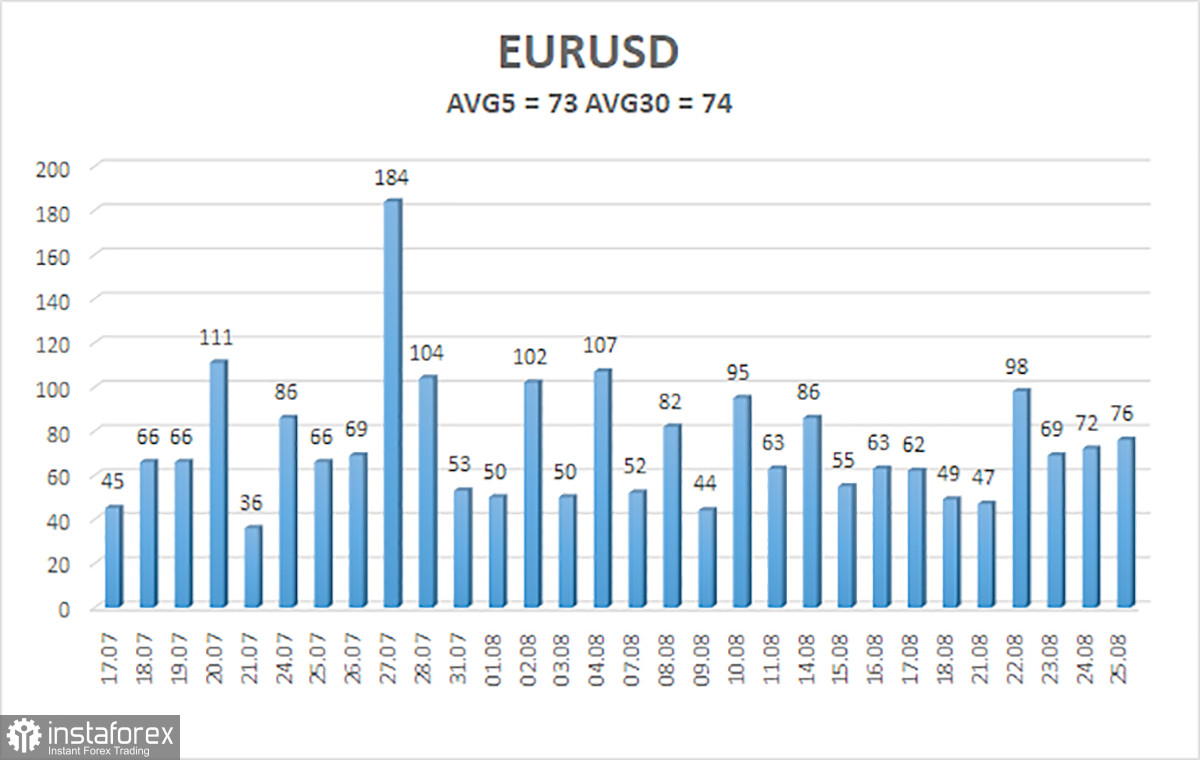

The average volatility of the EUR/USD currency pair over the past five trading days as of August 27 is 73 points and is characterized as "average." Thus, we expect the pair's movement between the levels of 1.0723 and 1.0869 on Monday. A downturn in the Heiken Ashi indicator will indicate a continuation of the pair's decline.

Nearest support levels:

S1 – 1.0742

S2 – 1.0681

S3 – 1.0620

Nearest resistance levels:

R1 – 1.0803

R2 – 1.0864

R3 – 1.0925

Trading recommendations:

The EUR/USD pair currently maintains a downward trend. New short positions should now be considered with targets at 1.0742 and 1.0723 if the Heiken Ashi indicator turns downward. Long positions can be considered if the price consolidates above the moving average line with targets at 1.0925 and 1.0986.

Illustration explanations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which trading should be conducted.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română