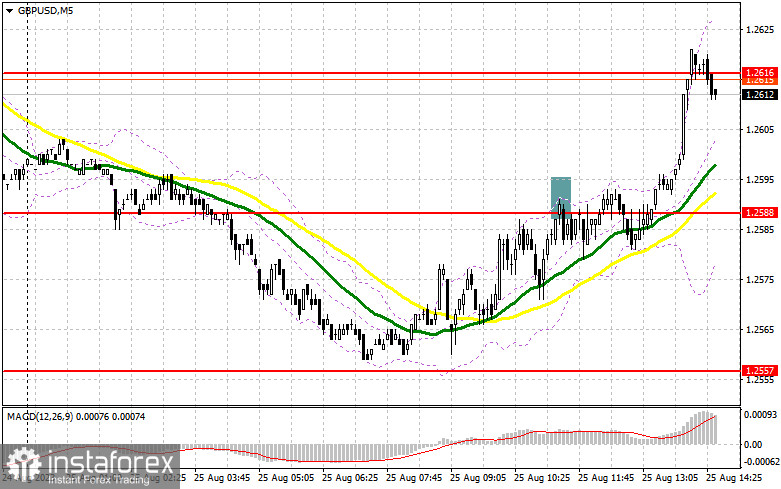

In my morning forecast, I pointed out the level of 1.2588 and recommended using it as a reference for market entry decisions. Let's examine the 5-minute chart to understand what happened there. The rise and formation of a false breakout at this level provided an excellent selling entry point. It could have played out, but the jittery mood leading up to Jerome Powell's speech prevented a new sell-off of GBP/USD. The technical outlook was revised for the second half of the day.

To open long positions on GBP/USD:

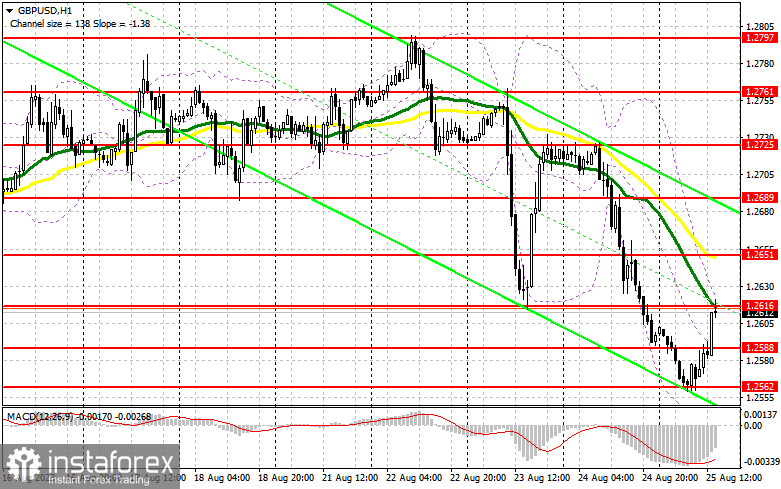

"Where there's smoke, there's fire" – this phrase can aptly describe today's market. The strict stance of the Fed Chairman concerning inflation control and direct hints at another rate hike, or maybe even two, will likely lead to a new decline of the pound towards the monthly lows and possibly even breaking through them. A softer "wait and see" approach might help the GBP/USD cope with the selling pressure. Given the jittery market mood, I plan to act only after Powell's speech, buying on a decline after forming a false breakout near the new support at 1.2588, formed during the European session. This would provide an excellent entry point for the resistance at 1.2616, currently under contention. A breach and top-down test of this range, against a dovish tone from the Fed Chairman, would be an additional buy signal, returning the pound's strength and allowing it to reach 1.2651. If it breaks above this range, we might see a surge to 1.2689, where I would book profits. If the GBP/USD drops and finds no buyers at 1.2588, which is also plausible, the pressure on the pair will persist, leading to another significant sell-off. If this occurs, I will delay long positions until 1.2562. Buying there would only be based on a false breakout. Rebounding directly from 1.2523 to open long positions on GBP/USD with a correction target of 30-35 points within the day is also possible.

To open short positions on GBP/USD:

The bears tried to make their presence felt but couldn't. For this reason, I will wait for a false breakout around the resistance level of 1.2616, which would form a selling signal, anticipating further decline and a test of the new support at 1.2588. A breakthrough and reverse test from the bottom-up of this range against a hawkish Powell would provide a selling entry point, renewing the level of 1.2562 and solidifying the sellers' presence in the market. The next target is the 1.2523 area, where I book profits. If the GBP/USD rises and there's no bearish activity at 1.2616, it should be quick if a decline from this level occurs. The bulls might attempt to return to the market. In such a case, only a false breakout around the next resistance at 1.2651 would form a short position entry point. If there's no activity, I suggest selling GBP/USD from 1.2689, aiming for a 30-35 point rebound downwards within the day.

Indicator signals:

Moving Averages:

Trading is below the 30 and 50-day moving averages, indicating further declines for the pound.

Note: The author considers the period and prices of moving averages on the hourly H1 chart and differs from the general definition of classic daily moving averages on the D1 chart.

Bollinger Bands:

In the event of a decline, the lower border of the indicator, around 1.2562, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders are speculators such as individual traders, hedge funds, and major institutions that use the futures market for speculative purposes and meet certain requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română