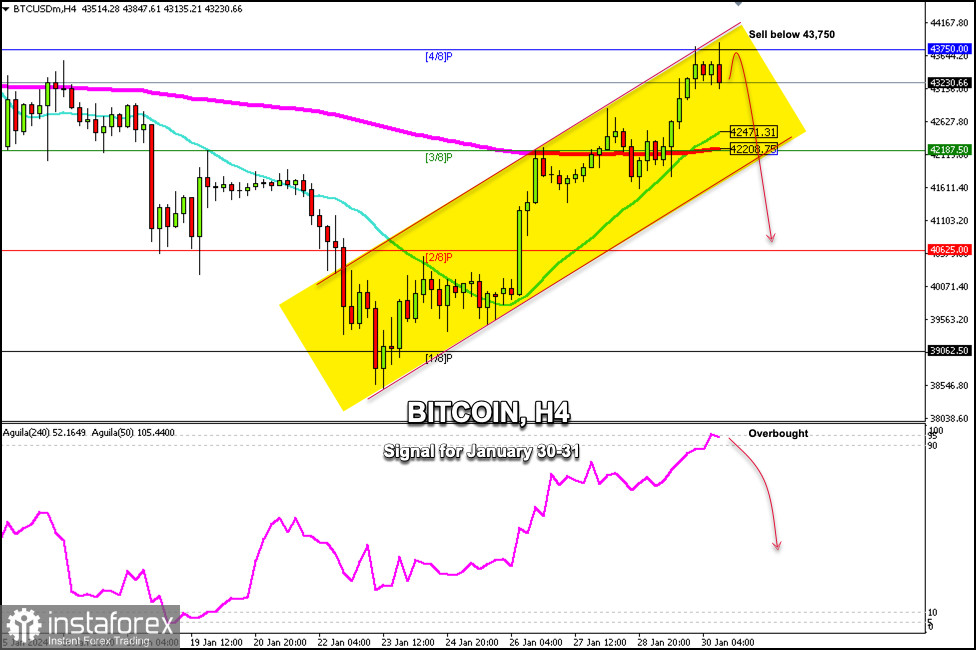

Early in the American session, Bitcoin is trading around 43,230 after having reached 4/8 Murray which represents strong resistance around 43,750. Bitcoin is showing signs of a probable technical correction in the coming hours. The key will be for the crypto leader to trade below 43,750, then it could return to levels of the 200 EMA located at 42,200 and or towards the 21 SMA located at 42,471.

In case the bearish force prevails and if Bitcoin breaks the bullish trend channel forming since January 23, the price could return towards 2/8 Murray at 40,650 and could even consolidate around the psychological level of $40,000.

If Bitcoin consolidates above 43,750 in the next few hours, we could expect it to reach the $45,000 level, but given that the eagle indicator is showing a sign of an extremely overbought market, it is likely that Bitcoin will consolidate below 43,750. This could be seen as a signal to sell.

If Bitcoin falls and bounces around the 200 EMA located at 42,208, this would be a good point to resume buying, since this area keeps BTC with a positive outlook. Since the eagle indicator is overbought now, with a technical correction, it could get relief and show a bullish signal again which would be seen as an opportunity to buy above 3/8 Murray (42,187).

Our strategy for the next few hours will be to sell Bitcoin below 43,750 with targets at 42,205 and 40,625. The eagle indicator is showing signs of an imminent technical correction which supports our bearish strategy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română