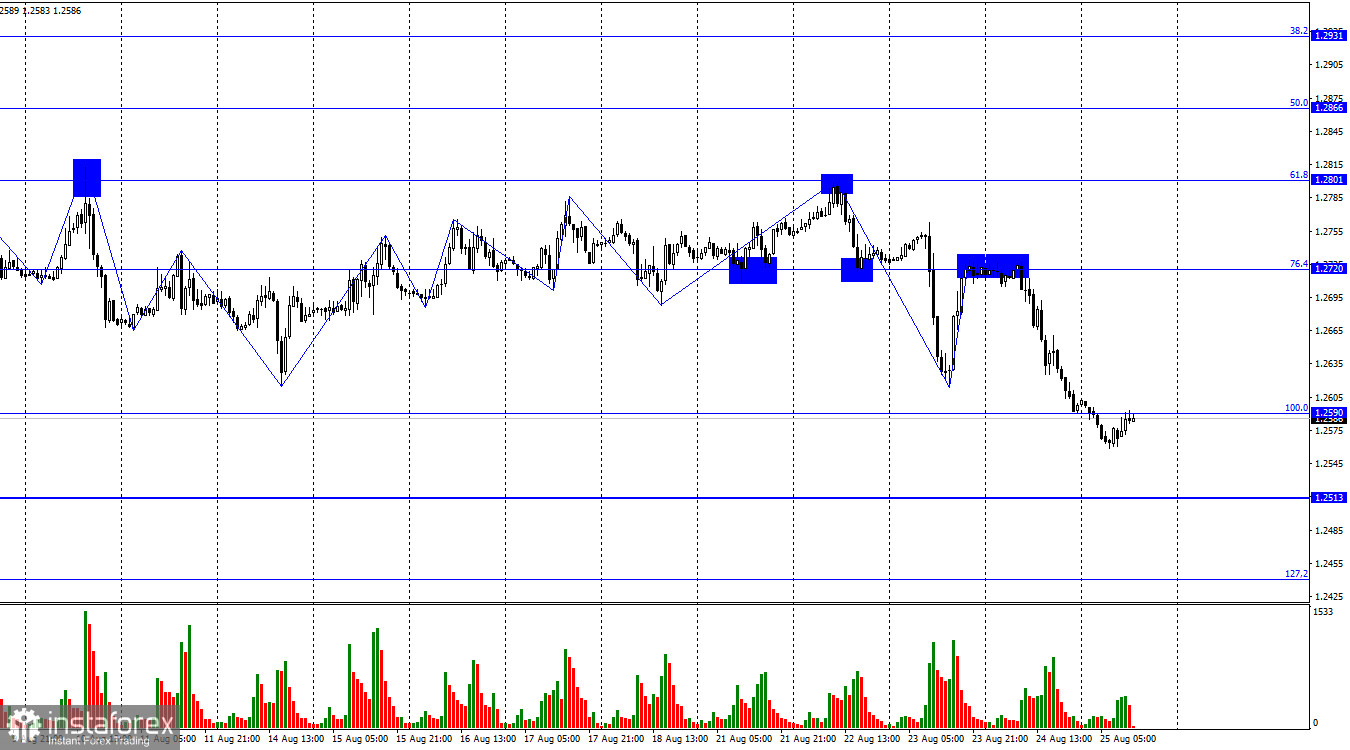

On the hourly chart, the GBP/USD pair rebounded from the corrective level of 76.4% (1.2720) and fell below the Fibonacci level of 100.0% (1.2590) on Thursday. Thus, the decline might continue towards the next level at 1.2513. If the pair's rate consolidates above 1.2590, it will favor the pound and cause a slight upward movement toward the Fibonacci level of 76.4%.

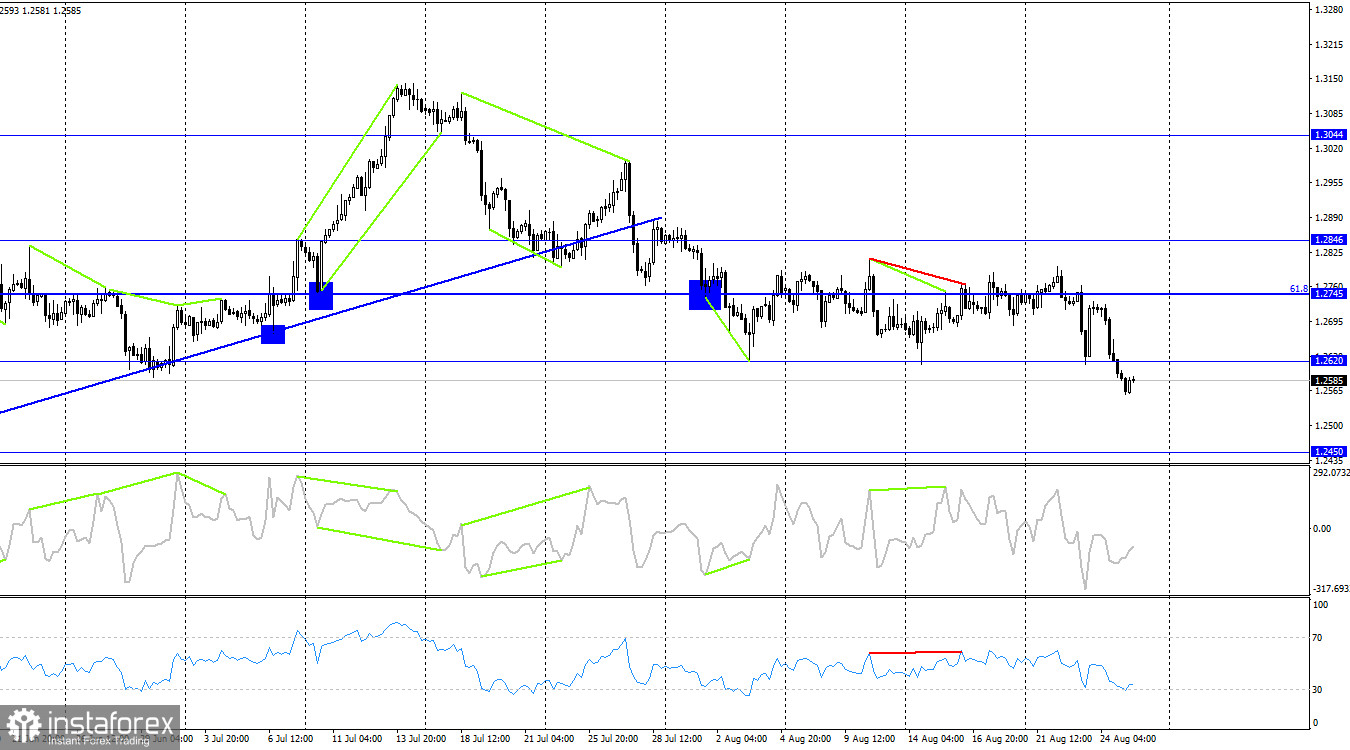

The waves still indicate one thing: the "bearish" trend continues. Yesterday, the upward wave failed to surpass the previous peak, and the subsequent downward wave confidently breached the previous low. Currently, there is no sign of the "bearish" trend ending. Today, we might see an upward wave, but it has to break the 1.2720 level for the "bulls" to break the current trend.

Today's key event is Jerome Powell's speech in Jackson Hole. At the beginning of the week, economists started speculating about what Powell might inform the market about. Still, his colleague Patrick Harker spoke midweek, hinting at the end of the monetary tightening procedure. This "dovish" rhetoric didn't deter the bears, who continued to shift from the euro in favor of the dollar. However, there's a difference between Patrick Harker and Jerome Powell.

If the Federal Reserve Chairman also talks today about the current sufficient level of interest rates, it might significantly impact the position of the US currency. But I think that will happen later. There's still a month until the next meeting, and the latest inflation report showed an increase. There will be another inflation report based on which conclusions can be drawn. Why should Powell rush to conclusions and make unnecessary promises to the market? He will maintain a neutral tone today, which won't significantly influence traders' sentiments.

On the 4-hour chart, the pair reached the 1.2620 level for the third time in recent weeks, but on the fourth attempt, this level was eventually breached. Thus, the pair has exited the horizontal channel, and the decline may continue towards the next level at 1.2450. The CCI and RSI indicators show potential "bullish" divergences, so we might expect the pair to rise soon.

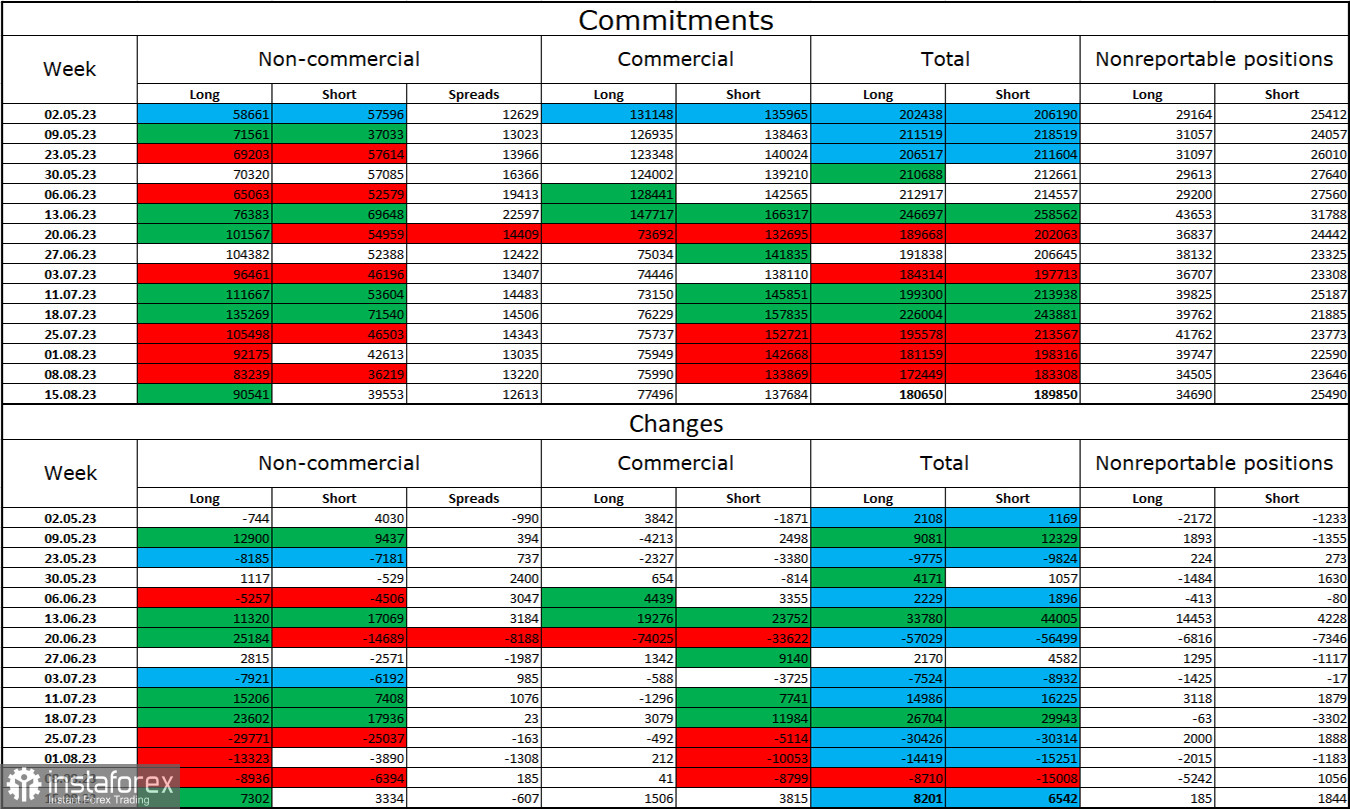

Commitments of Traders (COT) report:

The sentiment of the "Non-commercial" category of traders has become more bullish over the past reporting week. The number of long contracts held by speculators increased by 7,302 units, while the number of short contracts grew by 3,334. The overall sentiment of major players remains bullish, and a gap more than twice the size has formed between the number of long and short contracts: 90,000 against 39,000. The British pound had promising growth prospects a few weeks ago, but many factors have shifted in favor of the US dollar. Expecting a strong rise in the pound is very challenging. In recent weeks, we've seen bulls reduce their positions, which have decreased by almost 50,000. The bear positions are also dropping, but the gap is mainly widening.

News calendar for the US and the UK:

USA – Consumer Sentiment Index from the University of Michigan (14:00 UTC).

USA – Speech by Federal Reserve Chairman Mr. Powell (14:05 UTC).

On Friday, the economic events calendar contains two notable entries. The influence of the news background on market sentiment might be significant for the rest of the day.

GBP/USD forecast and trading tips:

Selling the pound was possible upon closing below the 1.2720 level on the hourly chart or rebounding from below. The nearest target of 1.2590 has been met. Upon rebounding from the 1.2590 level or closing below it, new sales will occur with targets at 1.2513 and 1.2450. For buying today, there is only one signal - consolidating above 1.2590. The target is 1.2720.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română