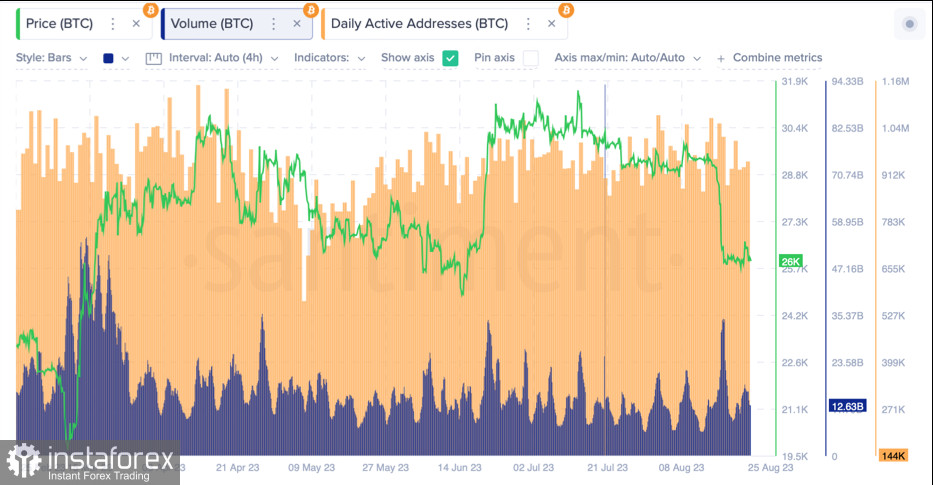

The current week turned out to be predictably calm for the main cryptocurrency. After a downward breach of the trendline, Bitcoin found a local support zone near the $26k mark, where the asset's consolidation is taking place. Trading activity has once again dropped to $13 billion, and the fear and greed index has moved from neutral indicators to the fear zone.

At the same time, the consolidation period was intermittently disrupted by impulsive attempts from both bulls and bears to shift the price in their favor. As a result, Bitcoin tested the $25.3k–$25.5k area, which is a key support level for the bulls. Buyers managed to reach the $26.8k mark, but couldn't hold this line.

Fundamental Factors

The languid price movement of Bitcoin was largely due to the absence of significant news and market stabilization after the FUD regarding SpaceX's sale of BTC. This week also lacked crucial macroeconomic news, though there were presentations by members of the Federal Reserve at the Jackson Hole symposium.

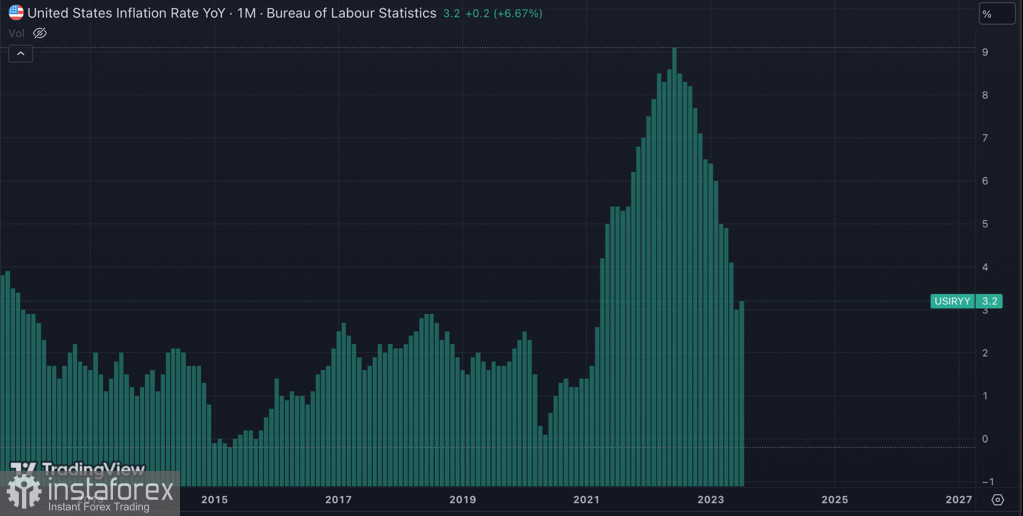

Philadelphia Fed President Patrick Harker continued a positive and reassuring rhetoric concerning the key rate. The official stated he doesn't see the need to raise the key rate if there are positive inflation figures for August. Harker also noted that, in his opinion, the inflation rate will continue to decline, making a rate hike irrational.

Harker's statement did not significantly influence global markets. However, a speech by Federal Reserve Chairman Jerome Powell is expected today, and his words will be of greater importance to investors. Considering Powell's aggressive rhetoric, financial market turbulence can be expected, including in the cryptocurrency market.

BTC/USD Analysis

Depending on Powell's statement, the price of Bitcoin might retest one of the boundaries of its current oscillation channel. Betting on a full breakout and progression in one direction or another seems less likely. If Powell's rhetoric points to a further increase in the key rate, BTC might retest the $25.3k–$25k zone. With positive signals from the Fed Chairman, correspondingly, the levels might be $26.5k–$26.7k.

As of August 25th, we see a consistently low trading activity for BTC, as well as weak activity of unique addresses in the asset's network. Technical metrics maintain the trend of the current week and indicate a complete dominance of sellers. The three primary indicators, MACD, RSI, and stochastic, are in the oversold zone, which ultimately could lead to a local shift in market sentiment.

For a local shift in market sentiment, a strong piece of news is required, which today's speech by Powell might provide. Otherwise, the reversal process will be prolonged, and the price will spend the weekend in a consolidative movement within the range of $25.5k–$26.5k. In any scenario, there are significantly more sellers in the BTC market so any local growth will occur strictly within the context of a corrective movement.

Considering potential targets for the upward corrective movement, it's worth highlighting the $27.5k mark as the ultimate target. Meanwhile, the most likely and key target for the bulls would be reaching the psychological level of $27k. The bears' objectives remain the same, regardless of the fundamental agenda of the week—to break through and establish below the $25.3k–$25.5k zone.

Conclusion

Volatility in the Bitcoin market is minimal, as is trading activity. The correlation with the stock market doesn't provide any significant boost to price impulses, and the fundamental backdrop lacks major economic events. Powell's speech is the only thing worth noting for the current trading week. If there are indications of a rate hike, it might be wise to open a short position. Otherwise, BTC will continue its consolidation with minimal price movements.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română