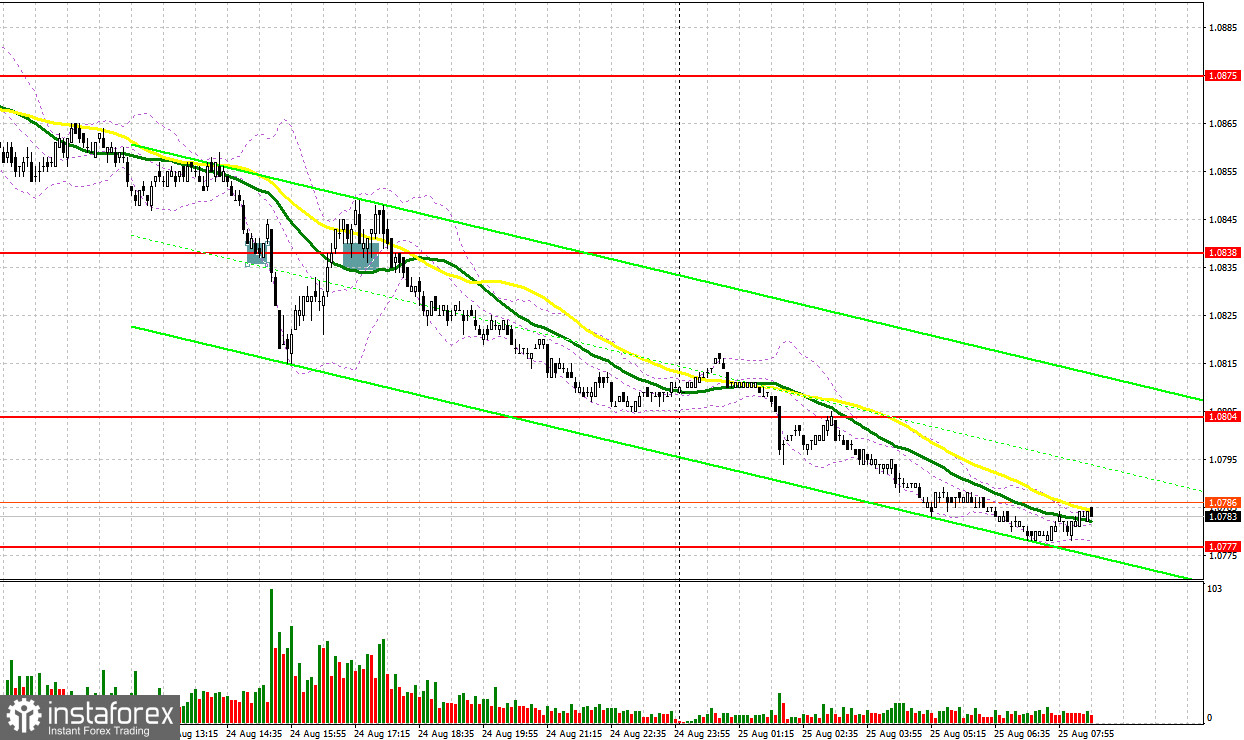

Yesterday, the pair formed several good signals to enter the market. Let's analyze what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0849 as a possible entry point. A false breakout was not formed at this level, so we revised the technical picture for the US session. In the second half of the day, safeguarding 1.0838 generated a buy signal, but the pair did not rise, which led to losses. A return and consolidation at the 1.0838 level by the middle of the US session produced a buy signal. But even if the euro repeatedly tried to grow, the single currency still continued its downward movement.

For long positions on EUR/USD:

An increasing number of market participants are counting on a more hawkish-than-expected message from Federal Reserve Chair Jerome Powell at Jackson Hole. Although two Fed officials signaled policymakers may be close to being done with interest-rate hikes, no one is safe from more rate hikes this fall. If Powell sticks to his hawkish policy today, the euro could fall further. It is unlikely that the reports on German GDP, business climate, current conditions and Ifo expectations scheduled for the first half of the day will have much impact on the market direction, so I'd rather focus on Powell's speech.

Therefore, it is advisable to trade on a dip following a false breakout near the new monthly low of 1.0777. An immediate resistance target is set at 1.0804, offering an optimal entry point for purchasing the euro. A breakout and a downward test of this range will strengthen demand for the euro, suggesting a bullish correction around 1.0838, which is in line with the bearish moving averages. The ultimate target is found at 1.0975, where I will be locking in profits. The pair will only be able to reach this level if Powell delivers hawkish remarks. If EUR/USD declines and bulls are idle at 1.0777, the bear market will persist. Only a false breakout around the next support at 1.0734 will act as a signal to buy the euro. I will initiate long positions immediately on a rebound from the low of 1.0705, aiming for an upward correction of 30-35 pips within the day.

For short positions on EUR/USD:

The sellers regained their advantage yesterday and we expect them to maintain control. Today, to maintain the bearish momentum, sellers will have to assert their strength at the new resistance of 1.0804. The pair may test this level soon. Weak data on Germany will help form a false breakout at 1.0804, which will lead to another descent towards the 1.0777 support. However, only a breakout below this range, followed by an upward retest, will generate another sell signal, paving the way to the low of 1.0734, where I expect big buyers. The ultimate target is seen at 1.0705, where I will be locking in profits. The pair may fall if Powell delivers hawkish remarks. If EUR/USD moves upward during the European session and lacks bearish activity at 1.0804, the bulls may try to re-enter the market. In such a scenario, I would go short only when the price tests the new resistance at 1.0838. Selling at this point is possible only after a failed consolidation. I will initiate short positions immediately on a rebound from the high of 1.0875, considering a downward correction of 30-35 pips within the day.

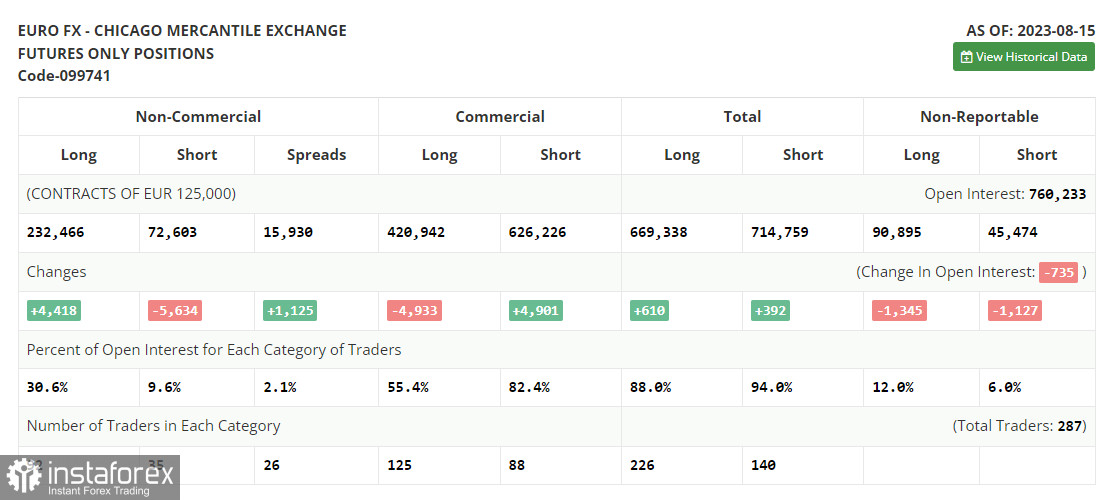

COT report:

The COT (Commitment of Traders) report for August 15 shows a notable increase in long positions and a drop in short positions. These figures already factor in the crucial US inflation data, which brought back some buyers to the market. The Federal Reserve meeting minutes released last week also indicated that not all committee members are aligned with the idea of raising interest rates to combat inflation. This keeps the chances of the euro's recovery alive, especially following the Jackson Hole symposium happening later this week where Federal Reserve Chairman Jerome Powell is scheduled to speak. His address might shed light on the central bank's future policy direction. It is important to note that the recent decline in the euro seems to be appealing to traders. The optimal medium-term strategy under current conditions remains buying risk assets on a dip. The COT report highlights that non-commercial long positions increased by 4,418 to stand at 232,466, while non-commercial short positions decreased by 5,634 to 72,603. Consequently, the spread between long and short positions surged by 1,125. The closing price was lower, settling at 1.0922 compared to 1.0981 the previous week.

Indicator signals:

Moving averages:

Trading below the 30- and 50-day moving averages indicates bears' attempt to regain control of the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

If EUR/USD declines, the indicator's lower border near 1.0770 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română