The economic symposium in Jackson Hole, US has started. Investors around the world will be expecting to listen to remarks from Federal Reserve Chair Jerome Powell, and European Central Bank President Christine Lagarde. In this article, we'll discuss what to expect from Powell.

The consensus market opinion is as follows: Powell could announce readiness to raise the interest rate again, as inflation has begun to rise, and the labor market remains strong enough for tightening. Or he could avoid such declarations but hint at a prolonged period of maintaining peak rates. It's difficult to determine which of these two scenarios is more hawkish. The market might increase demand for the dollar if Powell mentions an interest rate hike in September or November. Recall that there have been no official statements about ending the monetary tightening process. A few months ago, Powell announced that the central bank has slowed the pace of its rate hikes, now set at 0.25% per two meetings. And if the rate went up by 0.25% at the last meeting, it should remain unchanged in September. However, this doesn't imply it can't be raised in November...

Given that the market has been favorably inclined towards the US currency in the last month or so, I believe that the greenback might see a slight increase by the end of the week. Frankly, no one is expecting a dovish stance from Powell right now. The recent economic reports from recent weeks and months suggest that the Fed is in a position where it can reasonably raise the rate again. Inflation has accelerated, GDP is growing at high rates, unemployment remains low, and the labor market is still strong. These four factors should be enough to tighten policy once or twice more.

However, Powell might intentionally take a pause until September, as it's crucial to see how inflation behaves in August. If inflation accelerates again, then another tightening will be unavoidable. But if inflation quickly returns to July's figures, there will be a pause in rate hikes in September as originally planned.

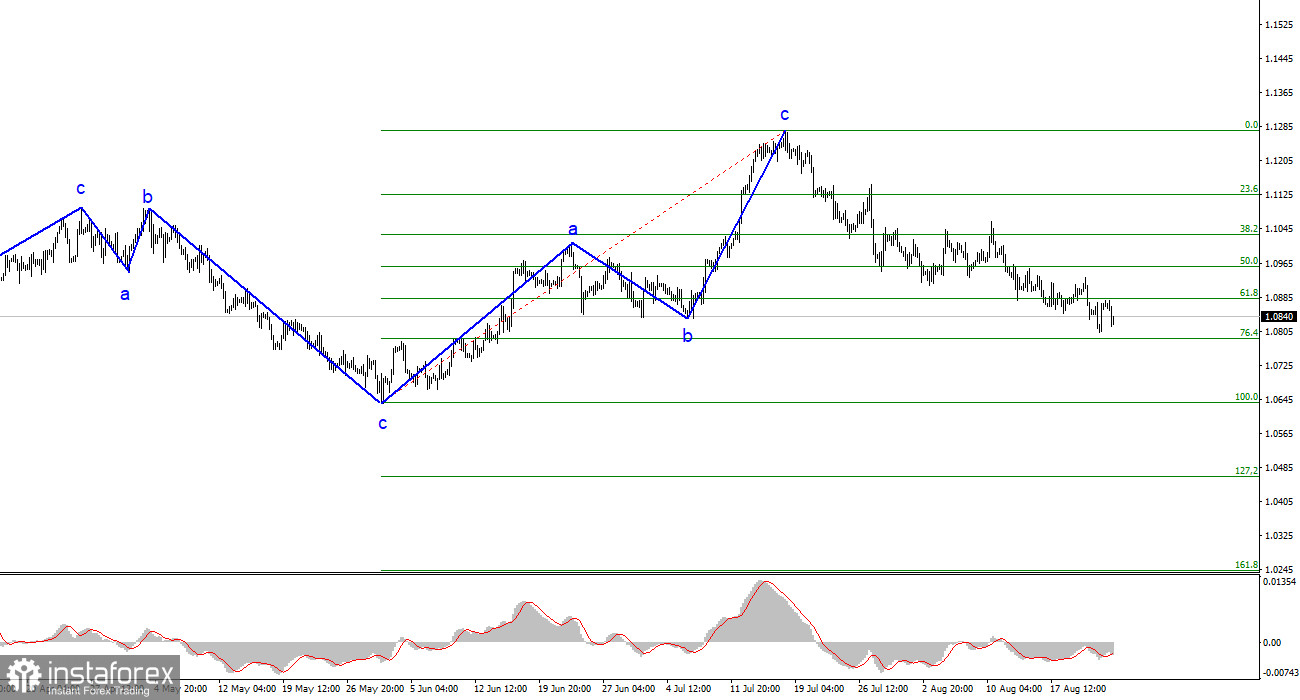

Based on the conducted analysis, I came to the conclusion that the upward wave pattern is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets set around the 1.0788 and 1.0637 marks. I believe that the bearish segment will persist, and a successful attempt at 1.0880 indicates the market's readiness for new short positions.

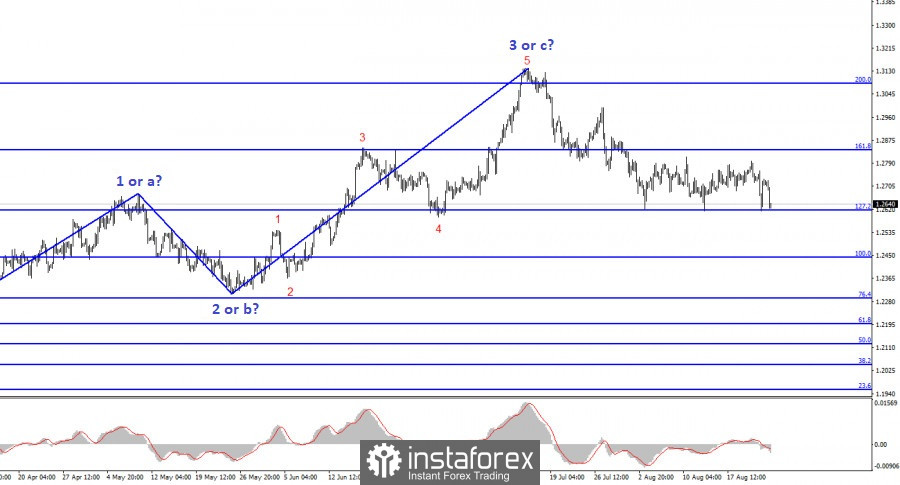

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave "d" and not "1". In that case, wave 5 could start from current levels. However, in my opinion, we are currently seeing the construction of a corrective wave within a new downtrend segment. If this is the case, the instrument will not rise much above the 1.2840 mark, and then a new downward wave will commence. We should brace for new short positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română