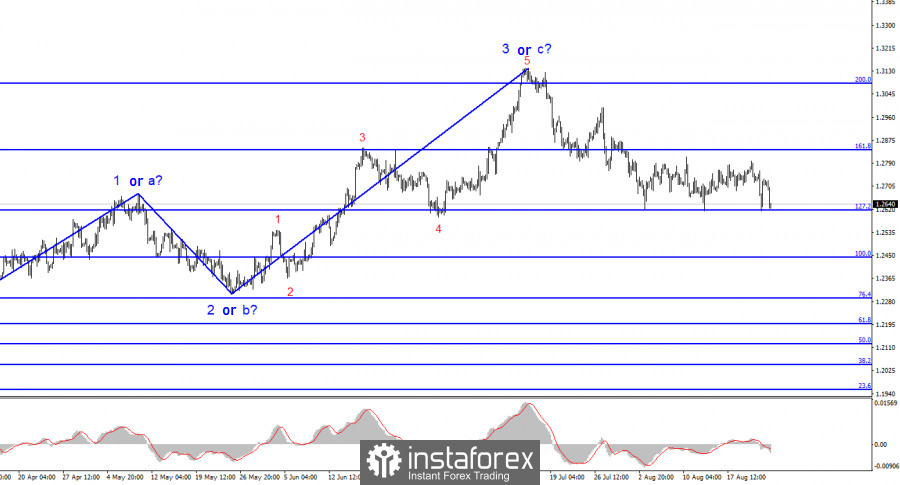

The wave analysis for the GBP/USD remains straightforward and clear. The construction of the bullish wave 3 or c is completed, and the presumed start of a new bearish trend section has begun, which could theoretically still be wave d. The pound has no reason to resume its rise, yet the wave count did evolve into a more complex one. The wave 3 or c has extended more than many analysts had expected a few months ago. The entire bullish trend section might still form a five-wave pattern if the market finds new reasons for long-term buying.

In any case, I anticipate the continuation of the bearish wave that began almost right on schedule. If the current wave develops a five-wave internal structure, it can be deemed the initial impulse, and a further decline of the pound can be expected (after the construction of corrective wave 2 or b). There have been three unsuccessful attempts to breach the 127.2% Fibonacci level, but the price has returned to this mark again. The more such attempts, the higher the likelihood of eventually overcoming it.

The demand for the pound is growing slowly.

The GBP/USD exchange rate dropped by 75 basis points on Thursday, which is quite significant. The European currency lost much less today, even though the news background was the same. With such active selling, the market indicates that it is ready to continue increasing the demand for the US dollar. This aligns perfectly with my expectations, as I am certain that the decline won't end around the 1.2618 mark.

As I mentioned earlier, two reports were released in the US today: one was disappointing, and the other was encouraging. Therefore, it would have been more logical to see a neutral movement throughout the day. However, the 1.2618 mark magnetically draws the price, and the pound will drop much lower than the current levels.

Yesterday in the UK, business activity indices were released for the service and manufacturing sectors. They were weak, but the pound was only saved because similarly weak indices were released in the US. Still, this situation doesn't change anything in the overall wave picture. Assuming that business activity indices could reverse the trend would be naive. The demand for the pound has been declining for over a month. It's not a death sentence; new "hawkish" decisions by the Bank of England could bring buyers back to the market, and the bullish trend section could still form a five-wave pattern. However, such a scenario is unlikely. Those same business activity indices show that the UK economy continues to face issues that the Bank of England will need to grapple with for years. An economy is not a bus; it's harder to accelerate.

General conclusions:

The wave pattern for the GBP/USD pair suggests a decline within the downward trend segment. There's a risk of the current downward wave ending if it's wave 'd' rather than '1'. In this case, the construction of wave '5' may begin from the current levels. However, we are currently witnessing the formation of the first wave as part of a new declining trend segment. If this is the case, the pair won't rise significantly above the 1.2840 mark, and then the construction of a new downward wave will begin. We are preparing for new sales.

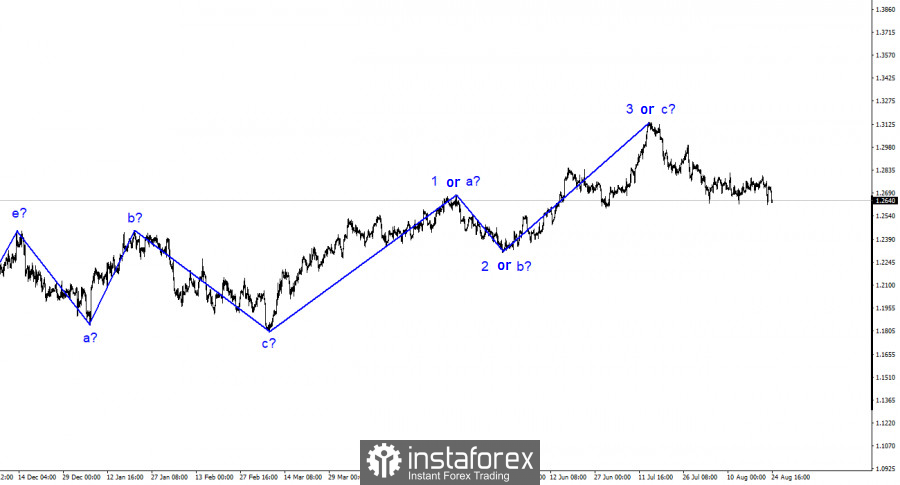

The pattern resembles the EUR/USD pair on a larger wave scale, but there are still some differences. The downward correctional trend segment is complete, and the construction of a new upward one is underway, which might either be already completed or take on a full-fledged five-wave form.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română