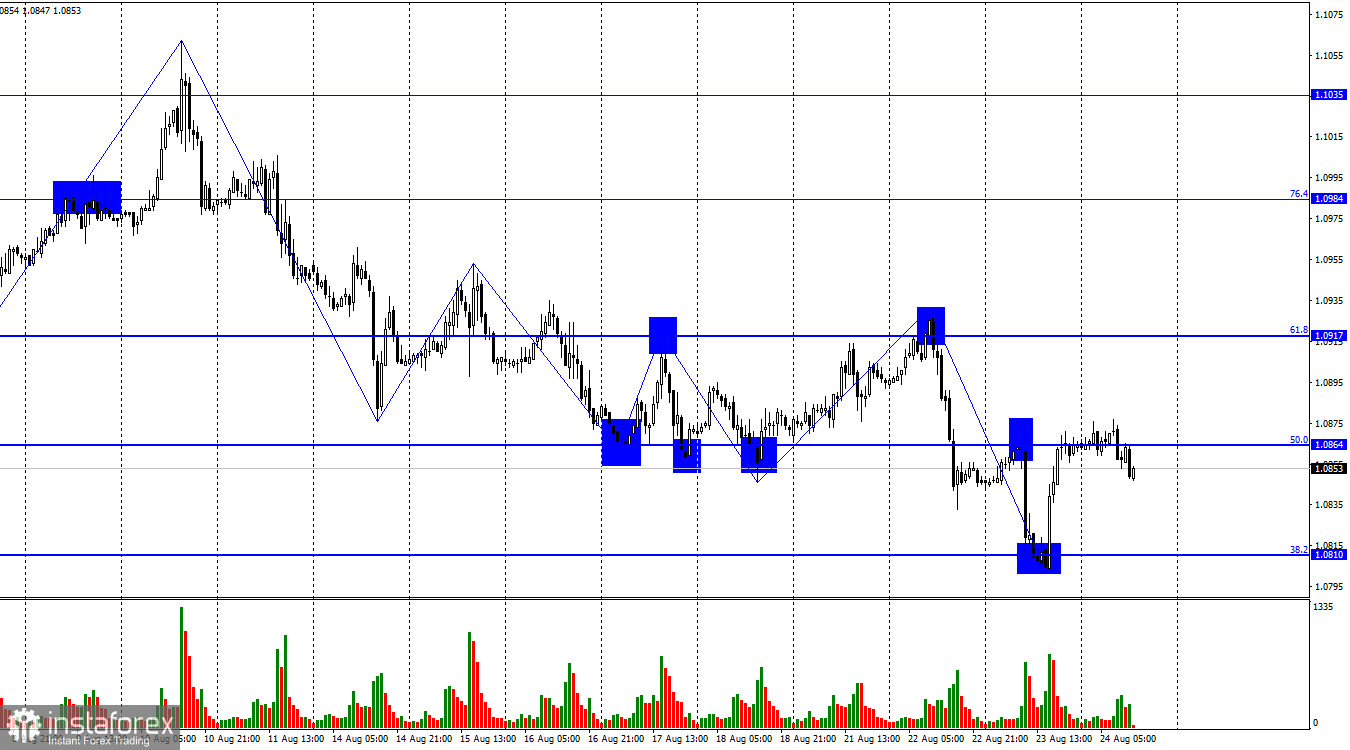

Yesterday, the EUR/USD pair rebounded from the corrective level of 50.0% (1.0864), reversing in favor of the US dollar, declining to the Fibonacci level of 38.2% (1.0810), rebounding from it, and returning to the 1.0864 level. These levels were virtually spot-on, allowing traders to earn a good profit. A rebound from the 1.0864 level will again favor the US dollar, leading to a renewed decline towards the 1.0810 level. If the pair's rate consolidates above 1.0864, it will favor the European currency and further growth toward the Fibonacci level of 61.8% (1.0917).

The waves continue to convey a single message: the "bearish" trend persists. The latest downward wave confidently breached the lows of the previous two waves, and the latest upward wave didn't even make it halfway to its last peak. Thus, there's no sign of the "bearish" trend ending.

Yesterday can confidently be labeled a setback for business activity in the EU and the US. Business activity indices in the European Union and Germany all dropped below 50; to be precise, the service sector declined below this mark, while manufacturing has been there for a while. The picture wasn't the most optimistic in the US, with business activity indices also notably declining in August. Consequently, we first saw a fall in the euro and a decline in the US dollar. The overall trend is "bearish," so today, we may witness a further decline in the euro. Only US unemployment claims and durable goods order reports can disrupt this. If they come out weaker than expected, the dollar may drop again, but not too much.

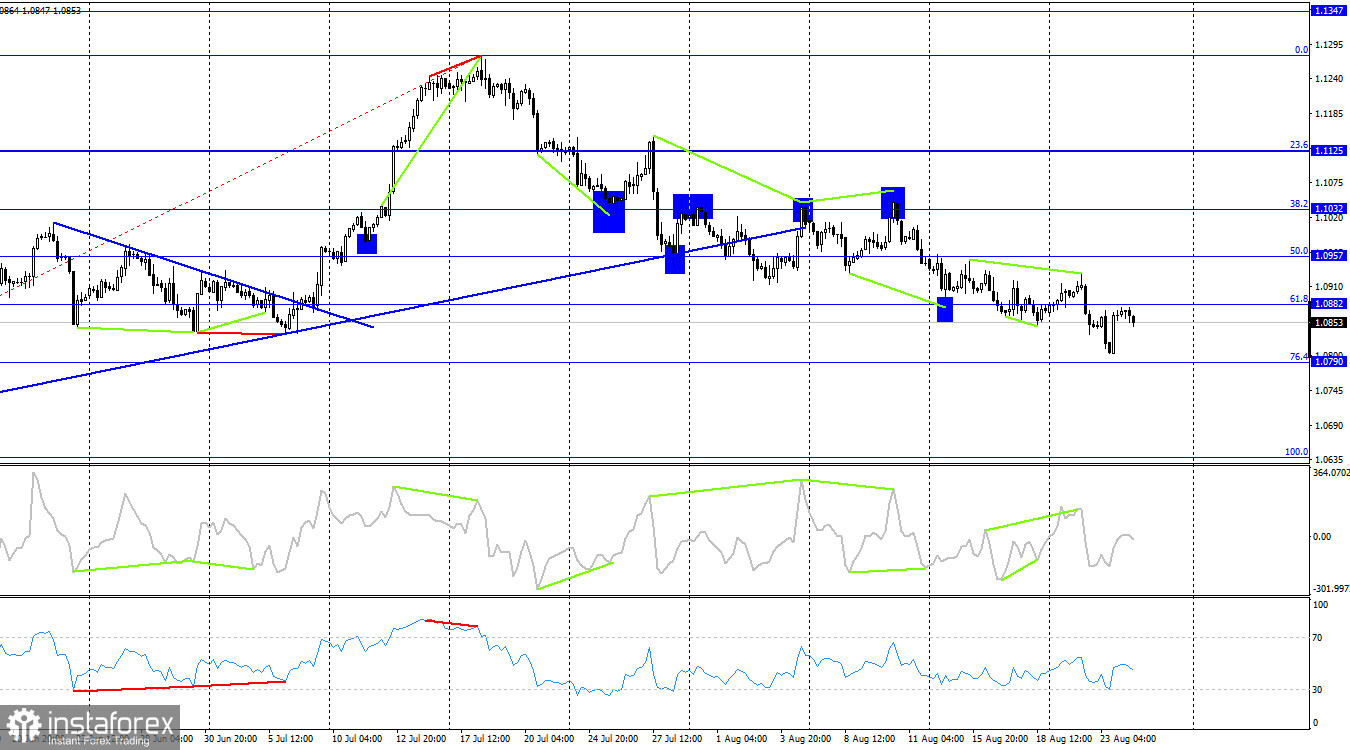

On the 4-hour chart, the pair consolidated below the ascending trend line and rebounded twice from the Fibonacci level of 38.2% (1.1032). Therefore, I anticipated a decline in the European currency to the corrective level of 61.8% (1.0882), and it happened. The pair has now reversed in favor of the US dollar after forming a bearish divergence at the CCI indicator and consolidating below the 1.0882 level. This suggests a continued decline towards the next Fibonacci level of 76.4% (1.0790).

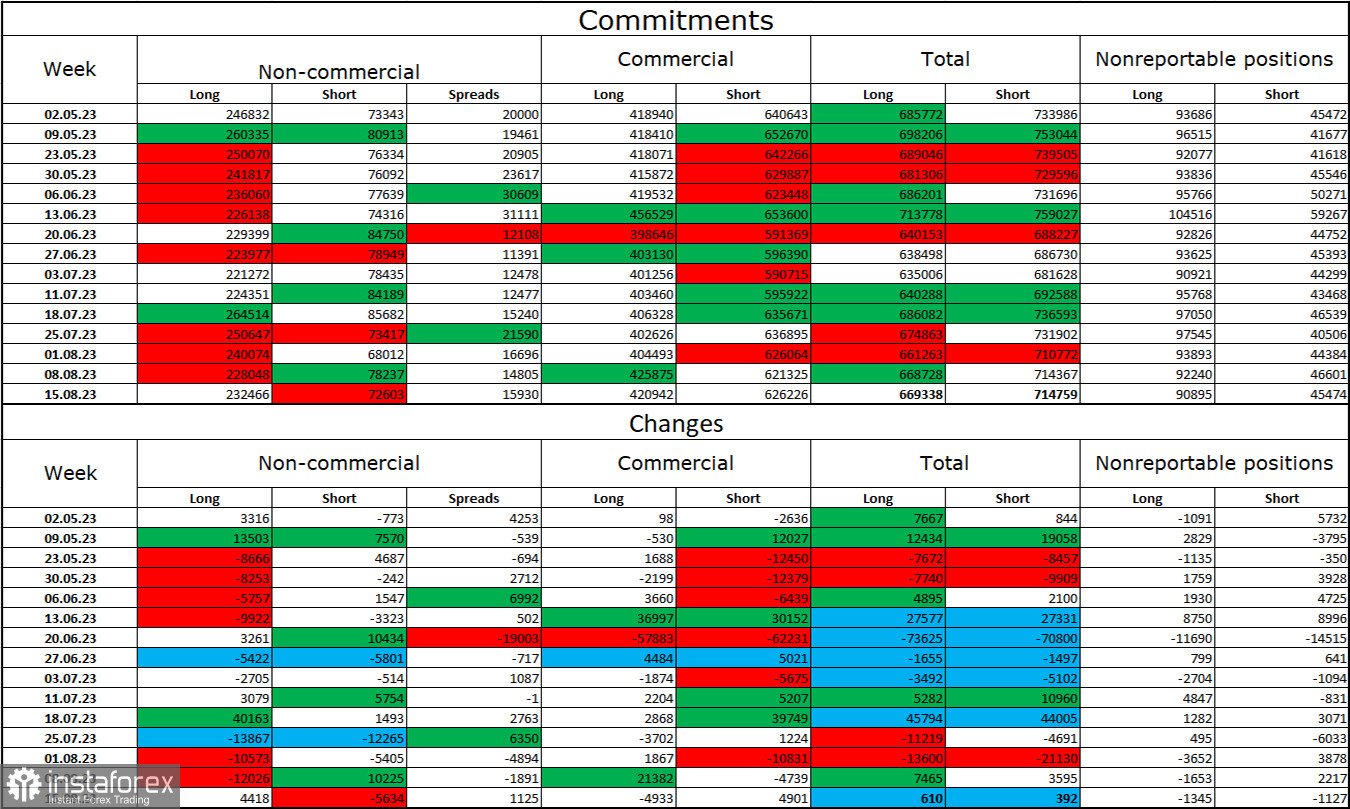

Commitments of Traders (COT) Report:

During the last reporting week, speculators opened 4,418 long contracts and closed 5,634 short contracts. The sentiment of major traders remains "bullish" and is starting to strengthen again. The total number of long contracts held by speculators now stands at 232,000, while short contracts number 72,000. The "bullish" sentiment persists, but I believe the situation will soon reverse. The high number of open long contracts indicates that buyers might close them soon – the current bias is too heavily towards the bulls. The current figures suggest a continued decline in the euro in the coming weeks. The ECB is increasingly signaling the imminent end of its tightening procedure.

News calendar for the US and the European Union:

US – Core Durable Goods Orders (12:30 UTC).

US – Initial Unemployment Claims (12:30 UTC).

The economic events calendar for August 24 features two potentially significant entries. The influence of the news backdrop on traders' sentiment throughout the day might be of medium strength.

EUR/USD Forecast and Advice for Traders:

I had advised selling on the rebound from the 1.0917 level on the hourly chart with a target level of 1.0864. The target was reached, and a rebound from the 1.0864 level from below allowed for another sale with a target of 1.0810. Purchases are possible upon consolidation above 1.0864 with a target of 1.0917 or a rebound from 1.0810 aiming for 1.0864.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română