In the morning forecast, I emphasized the 1.0849 level and suggested using it as a reference point for market entry. Let's inspect the 5-minute chart and see what transpired. A false breakout at this level never materialized, leading to a reassessment of the technical outlook for the latter half of the day.

To open long positions in EUR/USD:

Low market volatility and the lack of fundamental statistics from the Eurozone had their impact. The second half of the day promises to be more interesting. The primary focus will be on data regarding initial jobless claims and changes in durable goods orders. Positive indicators in the reduction of benefits could renew demand for the dollar, as could hawkish comments from FOMC member Patrick T. Harker, inclined towards further interest rate hikes. Another significant event is the commencement of the economic symposium in Jackson Hole. At this event, central bank representatives will discuss plans for monetary policy regulation.

Considering that the technical outlook has been revisited, I'll await a decline and the formation of a false breakout around the support area of 1.0838 based on yesterday's results. This will signal the opening of long positions with a recovery perspective towards the nearest resistance of 1.0875, where sellers will reassert themselves. A breakthrough and top-down test of this range will increase demand for the euro, providing an opportunity for an upward surge and updating the 1.0910 mark. The ultimate target remains the 1.0950 zone, where I will lock in profits. If the EUR/USD declines and there's no activity at 1.0838 in the latter half of the day (which is quite possible given the apprehension leading up to Jerome Powell's crucial speech tomorrow), the pressure on the pair will only increase. In such a scenario, only the formation of a false breakout around the next support at 1.0804 (a new monthly low) will signal the purchase of the euro. I will immediately open long positions on a rebound from 1.0777 with a goal of an upward correction of 30-35 points within the day.

To open short positions on EUR/USD:

Sellers aren't pressing the issue too much after yesterday's "wind knocked out of them," which happened after weak statistics. Considering another set of U.S. data is on the horizon, further disappointment in the indicators might lead to an upward spike in the pair. For this reason, I only expect significant activity from large players around the nearest resistance of 1.0875. Forming a false breakout at this level will signal a sell to continue the bear market, paving a clear path to the new support at 1.0838. Only after breaking and consolidating below this range, followed by a bottom-up retest, can a sell signal be received, allowing EUR/USD to reach monthly lows around 1.0804. The ultimate target will be the 1.0777 area, signaling the continuation of a bearish trend. I will lock in profits there. If EUR/USD moves upward during the American session and there's no bearish activity at 1.0875, the situation will return to buyer control. If events unfold this way, I will defer short positions until the next resistance at 1.0910. I would also consider selling there, but only after unsuccessful consolidation. I will open short positions immediately on a rebound from the peak of 1.0950, aiming for a downward correction of 30-35 points.

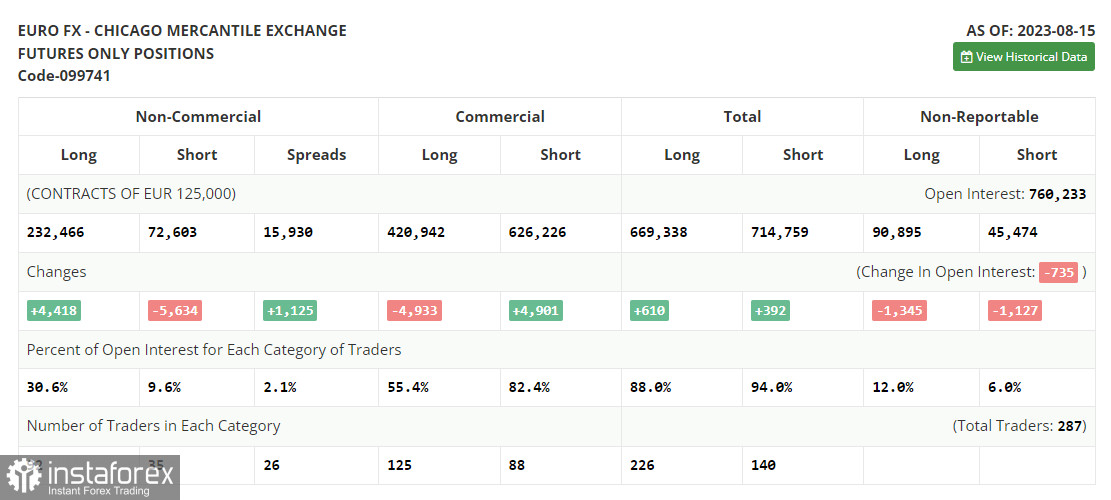

The COT (Commitment of Traders) report for August 15 observed a rise in long positions and a decline in shorts. These indicators have already been considered important U.S. inflation data, which, as we can see, brought some buyers back to the market. Minutes released last week from the Federal Reserve also indicated that not all committee members are prepared to raise interest rates to combat inflation. This keeps hopes alive for a euro recovery, especially after the symposium in Jackson Hole, where Federal Reserve Chairman Jerome Powell will speak. His speech might shed light on the central bank's future policy. It's worth noting that the recent decline in the euro is an attractive point since, despite this, the optimal medium-term strategy under current conditions remains buying risk assets on the dip. The COT report showed that non-commercial long positions increased by 4,418 to 232,466, while non-commercial short positions decreased by 5,634 to 72,603. As a result, the spread between long and short positions jumped by 1,125. The closing price dropped to 1.0922 from 1.0981 the previous week.

Indicator signals:

Moving Averages:

Trading occurs around the 30 and 50-day moving averages, indicating a lateral market trend.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differs from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In the case of an increase, the upper boundary of the indicator around 1.0875 will act as resistance.

Indicator Descriptions:

• Moving average (determines the current trend by smoothing out volatility and noise). Period 50. Highlighted in yellow on the chart.

• Moving average (determines the current trend by smoothing out volatility and noise). Period 30. Highlighted in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence) - Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet specific requirements.

• Non-commercial long positions represent the total long open position of non-commercial traders.

• Non-commercial short positions represent the total short open position of non-commercial traders.

• The net non-commercial position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română