Global bond yields have noticeably fallen in the last 24 hours after softer-than-expected preliminary PMI data. A significant drop in activity has been noted in the eurozone's services sector, especially in Germany. This reduces the chances of the European Central Bank raising rates in September and mounts pressure on the euro.

On Thursday, the market focused on the report on durable goods orders and the weekly unemployment benefits.

USD/CAD

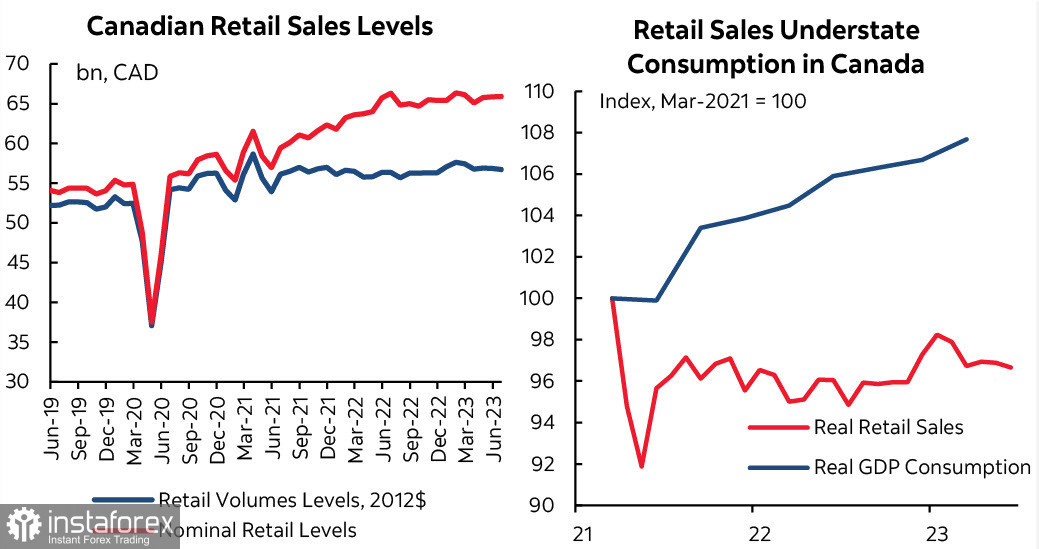

Retail sales in Canada showed weak results, leading to a decline in yields of short-term Canadian government bonds and a decrease in the CAD exchange rate.

At the same time, the pace of growth in average wages remains high, as the labor market supply falls behind demand. To curb inflation, there needs to be a swift deceleration in wage growth, which is only possible in conditions of a saturated labor market or a general economic slowdown. Another route is an increase in productivity, which remains low and has no signs of improvement yet.

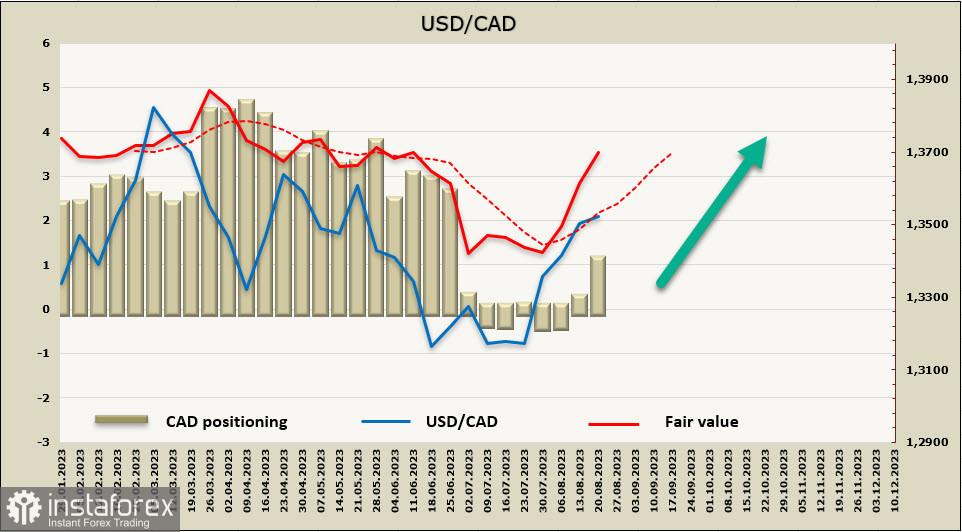

The net short position on CAD increased by CAD 799 million for the reporting week, reaching CAD -845 million. Positioning is bearish, and the price is moving upwards.

A week earlier, we assumed that the upward movement would progress, and the main target is the upper band of the channel at 1.3690/3720. This target remains relevant. The consolidation is due to technical reasons rather than fundamental ones, and after the consolidation or minor correction concludes, we expect to see further growth. We see support in the middle of the channel at 1.3360/80, but a potential decline to this zone before an upward reversal seems unlikely.

USD/JPY

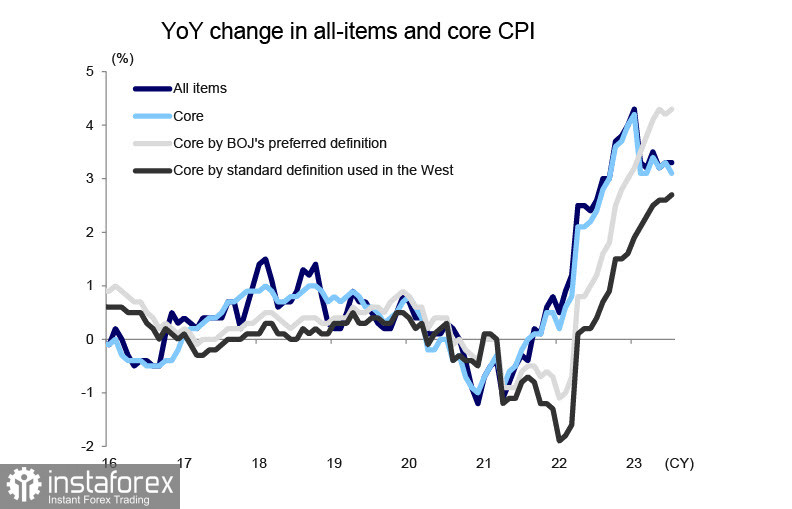

The core inflation rate (excluding fuel and food prices) accelerated from 4.2% to 4.3% in July, indicating that the Bank of Japan's cautious policy hasn't yielded significant results yet. The BOJ is the only central bank that continues an ultra-loose policy, based on the assumption that inflation is largely imported and will go down as soon as global energy prices stabilize and the previously disrupted supply chains of goods and raw materials are restored.

This approach may be justified, but the rise in core inflation shows that there is more to it than that, and the Bank needs to be very careful about how it proceeds. The Ministry of Finance plans to allocate 28,142.4 billion yen to service the national debt in the 24th fiscal year, which is 2,892.1 billion yen more than in the 23rd fiscal year. The rate used to calculate JGB bond servicing costs remained at 1.1% for seven years, from the 17th to the 23rd fiscal year. If the BOJ starts to raise the discount rate, the estimated rate for servicing will also be increased for the first time in 17 years.

Currently, there are no problems in servicing the public debt, but by the end of the 22nd fiscal year, the outstanding volume of JGBs amounted to a staggering 1,027 trillion yen. If Japan's economy continues to grow, increasing tax revenues will allow the debt to be serviced without significantly increasing borrowing. However, if the global economic crisis intensifies, an increase in the BOJ's rate will lead to a rapid increase in the government's debt servicing expenses.

For now, we must assume that any hints at an interest rate hike will lead to the yen's growth, complicating the debt servicing situation due to a deteriorating trade balance and reduced budget revenues. The Japanese government fears this scenario, so it will continue to be very cautious in its monetary policy statements. In the current circumstances, the yen is more likely to depreciate than strengthen.

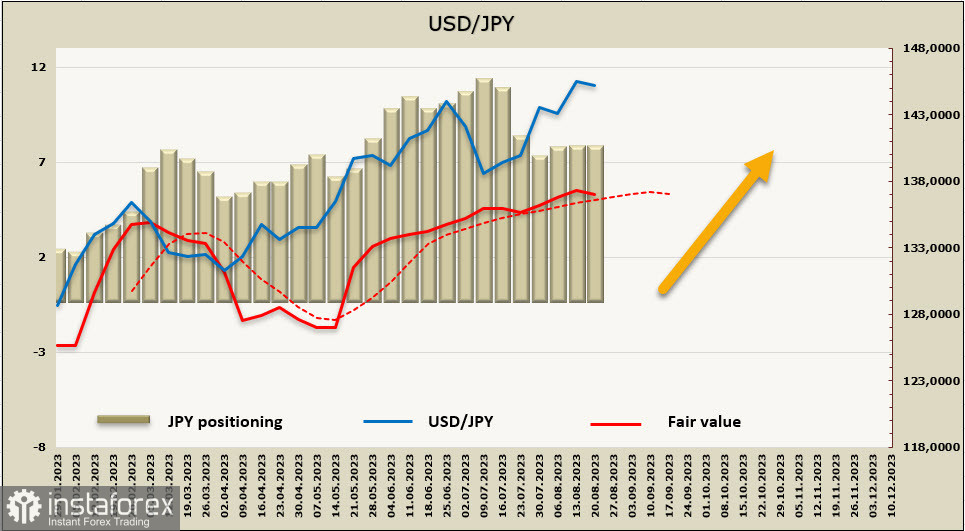

The net short position on JPY was slightly adjusted by 300 million, to -6.952 billion, with positioning firmly bearish. The price is above the long-term average, the trend remains bullish, but the chances of an extended consolidation or a shallow correction has become higher.

We expect an uptrend from the USD/JPY, with the upper band of the channel at 147.80/148.10 as the target. The risk of a deeper correction to the middle of the channel at 142.50/80 has increased, but the long-term trend remains bullish, and there's also no reason to anticipate a reversal at the moment.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română