Analysis of Wednesday trades:

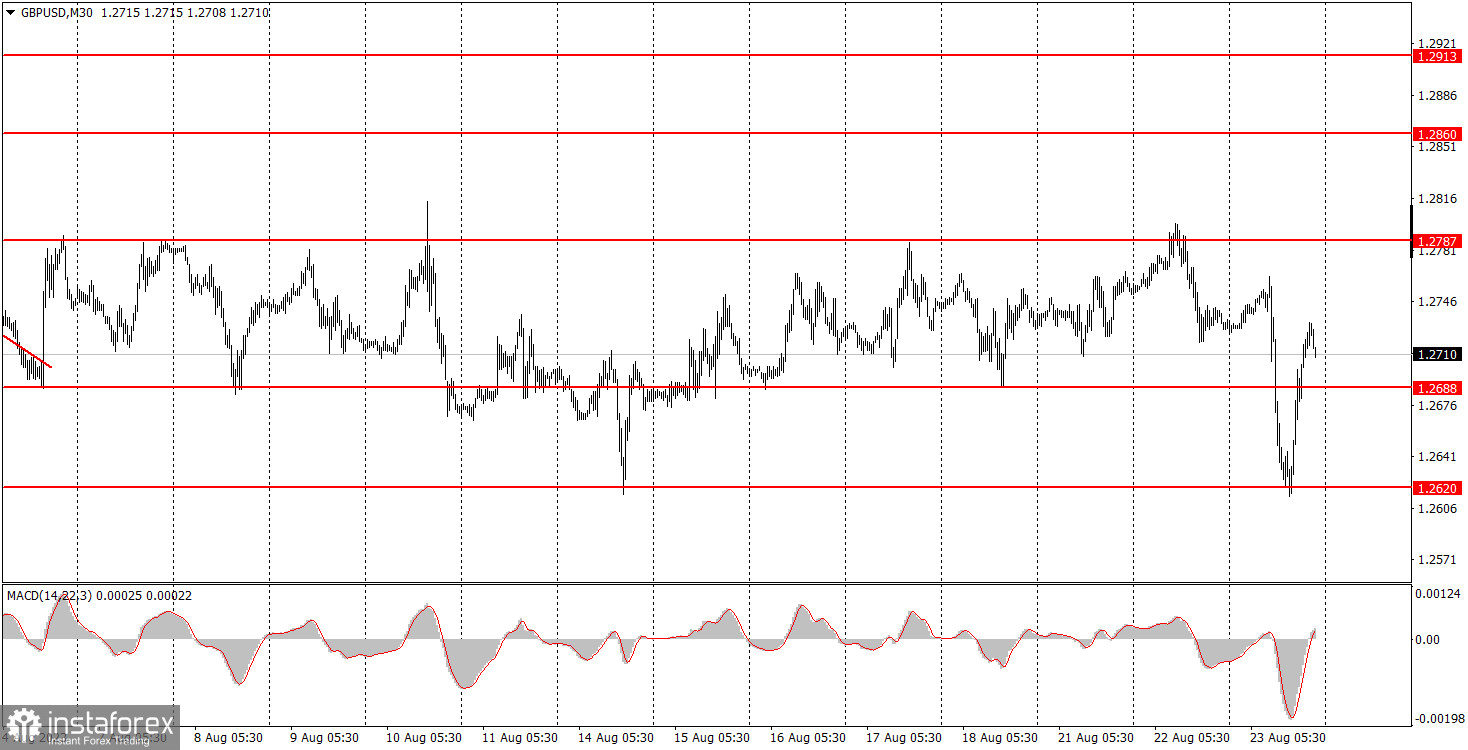

GBP/USD 30M chart

The GBP/USD pair ended Wednesday with an expected decline, touching the 1.2620 level. While technical indicators played a part, the overarching macroeconomic climate was a significant driver. In fact, just yesterday, we pointed out that if the pair tested the upper limits of its sideways channel, it could well retreat to the lower end. Notably, this played out in less than 24 hours. In the UK, business activity indices took a hit. The manufacturing sector stayed below the 50.0 benchmark, and the services sector dipped even further beneath that line. What does this signal? It underscores that the word "recession" isn't just a looming threat for the Bank of England anymore; it's becoming a tangible reality. A dip in business activity typically presages a downturn in other macroeconomic indicators, especially economic growth. And UK economic growth has already been at a standstill for several quarters. Currently, the pair is navigating within this lateral channel, but our outlook remains bearish.

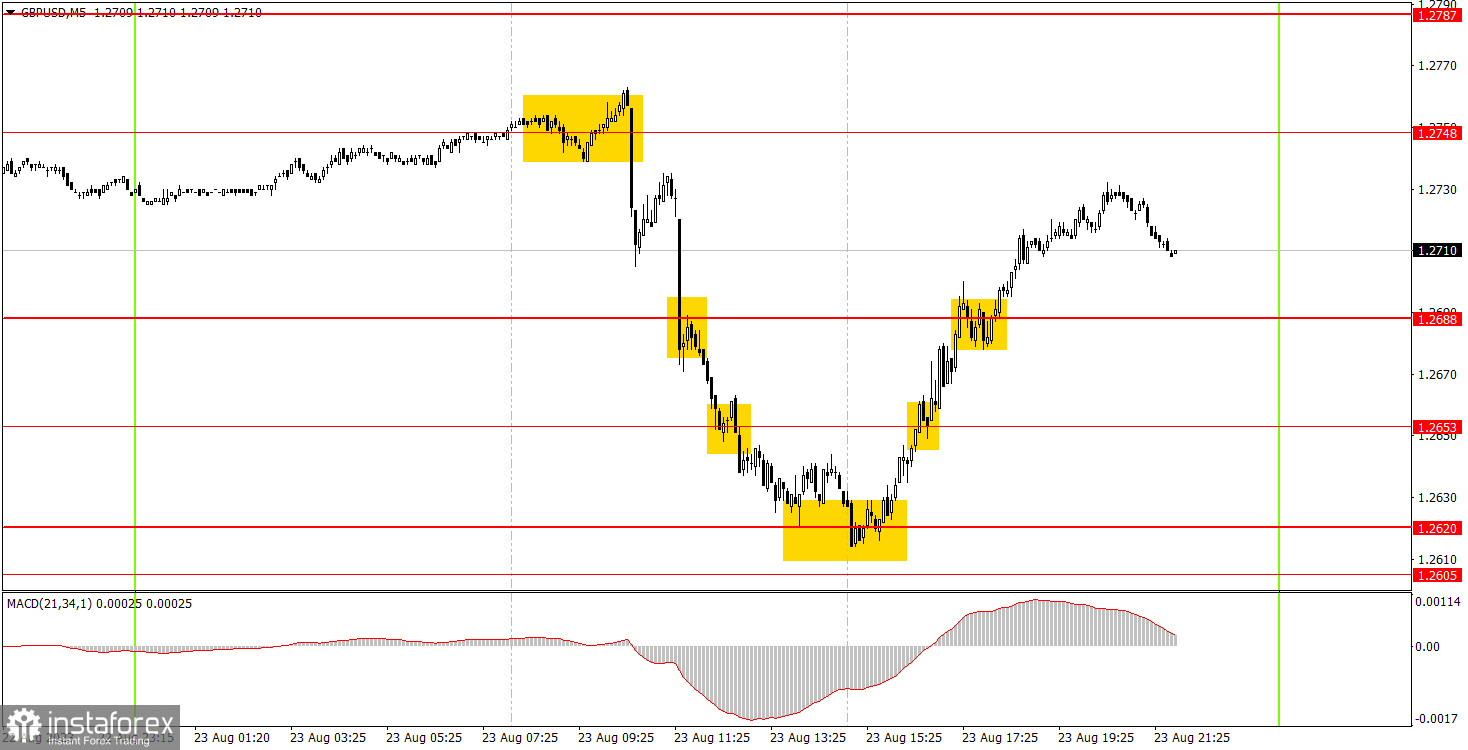

GBP/USD 5M chart

On Wednesday's 5-minute chart, we saw a wealth of trading signals, accompanied by commendable price movements. Traders could have immediately taken advantage of the initial sell signal around the 1.2748 level. Following that, the price dramatically dropped to 1.2620, rebounding twice and setting up an enticing buy signal. This short position alone brought in a handsome 85-pip profit. While the buy signal was worth exploring, the day didn't present any sell signals. Hence, a manual close towards the evening was the best call, culminating in an 80-pip gain.

Trading plan on Thursday:

On the 30-minute chart, the GBP/USD pair continues to tread within a sideways channel. We're still leaning towards a further decline in the British pound, believing it's currently overbought and unjustifiably pricey. However, the market seems to be taking a breather for now, giving novice traders a choice: either trade within the channel's boundaries or wait out the current consolidation. In the coming days, we could see the pound gaining around 100 pips since it's bounced off the channel's lower boundary. For day trading on the 5-minute chart tomorrow, consider levels like 1.2499, 1.2538, 1.2605-1.2620, 1.2653, 1.2688, 1.2748, 1.2787-1.2791, 1.2848-1.2860, and 1.2913. After initiating a trade, if the price moves 20 pips in the anticipated direction, it's prudent to set a break-even Stop Loss. As for Thursday, there's nothing particularly noteworthy slated in the UK, while in the US, we're expecting reports on unemployment claims and durable goods orders.

Basic rules of a trading system:

1) The strength of the signal depends on the time period during which the signal was formed (a rebound or a break). The shorter this period, the stronger the signal.

2) If two or more trades were opened at some level following false signals, i.e. those signals that did not lead the price to Take Profit level or the nearest target levels, then any consequent signals near this level should be ignored.

3) During the flat trend, any currency pair may form a lot of false signals or do not produce any signals at all. In any case, the flat trend is not the best condition for trading.

4) Trades are opened in the time period between the beginning of the European session and until the middle of the American one when all deals should be closed manually.

5) We can pay attention to the MACD signals in the 30M time frame only if there is good volatility and a definite trend confirmed by a trend line or a trend channel.

6) If two key levels are too close to each other (about 5-15 pips), then this is a support or resistance area.

How to read charts:

Support and Resistance price levels can serve as targets when buying or selling. You can place Take Profit levels near them.

Red lines are channels or trend lines that display the current trend and show which direction is better to trade.

MACD indicator (14,22,3) is a histogram and a signal line showing when it is better to enter the market when they cross. This indicator is better to be used in combination with trend channels or trend lines.

Important speeches and reports that are always reflected in the economic calendars can greatly influence the movement of a currency pair. Therefore, during such events, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement.

Beginning traders should remember that every trade cannot be profitable. The development of a reliable strategy and money management are the key to success in trading over a long period of time.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română