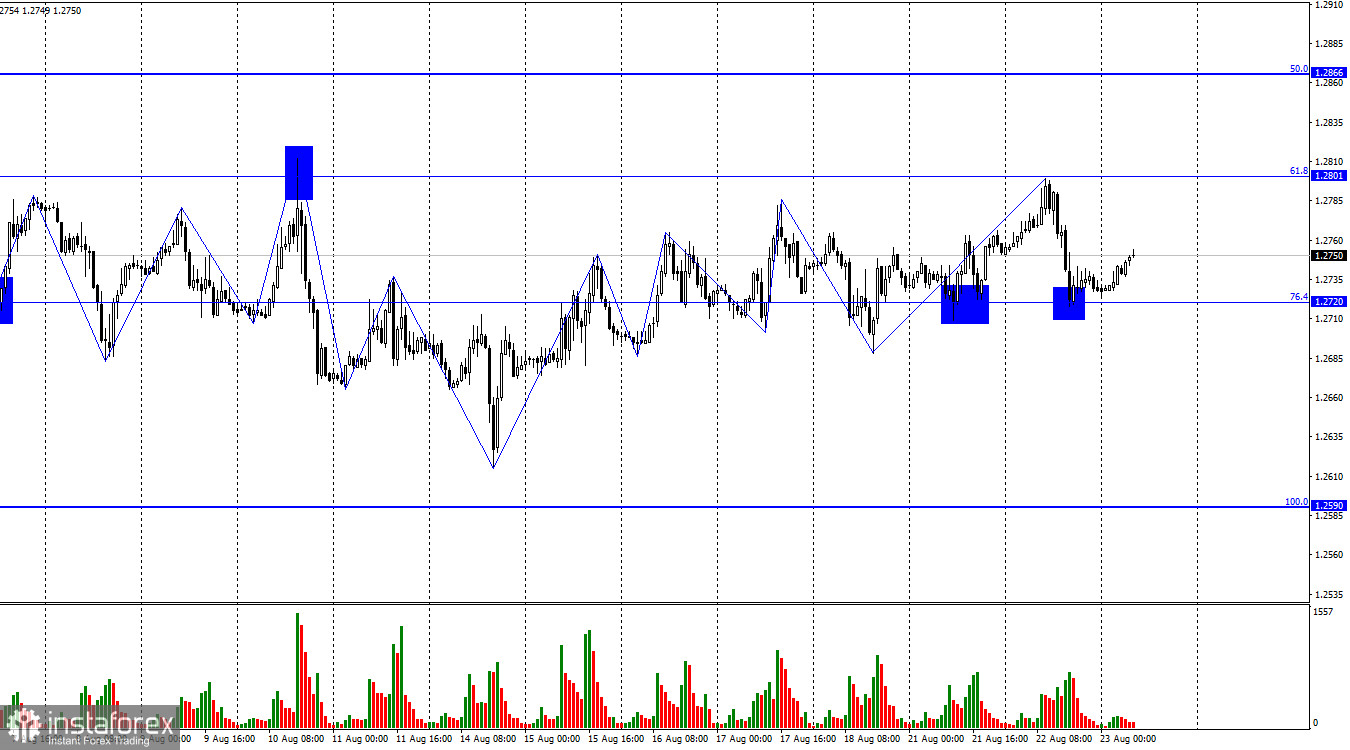

On the hourly chart, the GBP/USD pair on Tuesday rebounded from the corrective level of 61.8% (1.2801), with a reversal in favor of the US dollar and a drop to the corrective level of 76.4% (1.2720). The pair's rebound from this level favored the British pound, increasing growth towards 1.2801. Establishing rates below the 1.2720 level would indicate a potential further drop of the pound toward the 1.2630 level.

Yesterday's decline did not violate the "bullish" trend. However, I've already mentioned that this "bullish" trend is part of the horizontal movement we've observed for the past three weeks. Almost all recent upward waves have breached previous peaks, but they have failed to consolidate above the key level of 1.2801. Similarly, they failed to consolidate below the 1.2720 level, so there are no signs of the "bullish" trend ending at present. It is weak and doubtful, and below 1.2801, there remains a high likelihood of its termination at any moment.

There was no news background for the pound yesterday. In the upcoming hours today, business activity indices will be released in the UK, followed by the US in the afternoon. I don't consider these reports extremely significant (as traders have received much more important data in recent weeks), so I don't anticipate these reports to drive the pair out of the sideways trend. However, movements might intensify slightly, influencing the graphical picture. Today, the 1.2720 and 1.2801 levels are key factors for building a trading strategy.

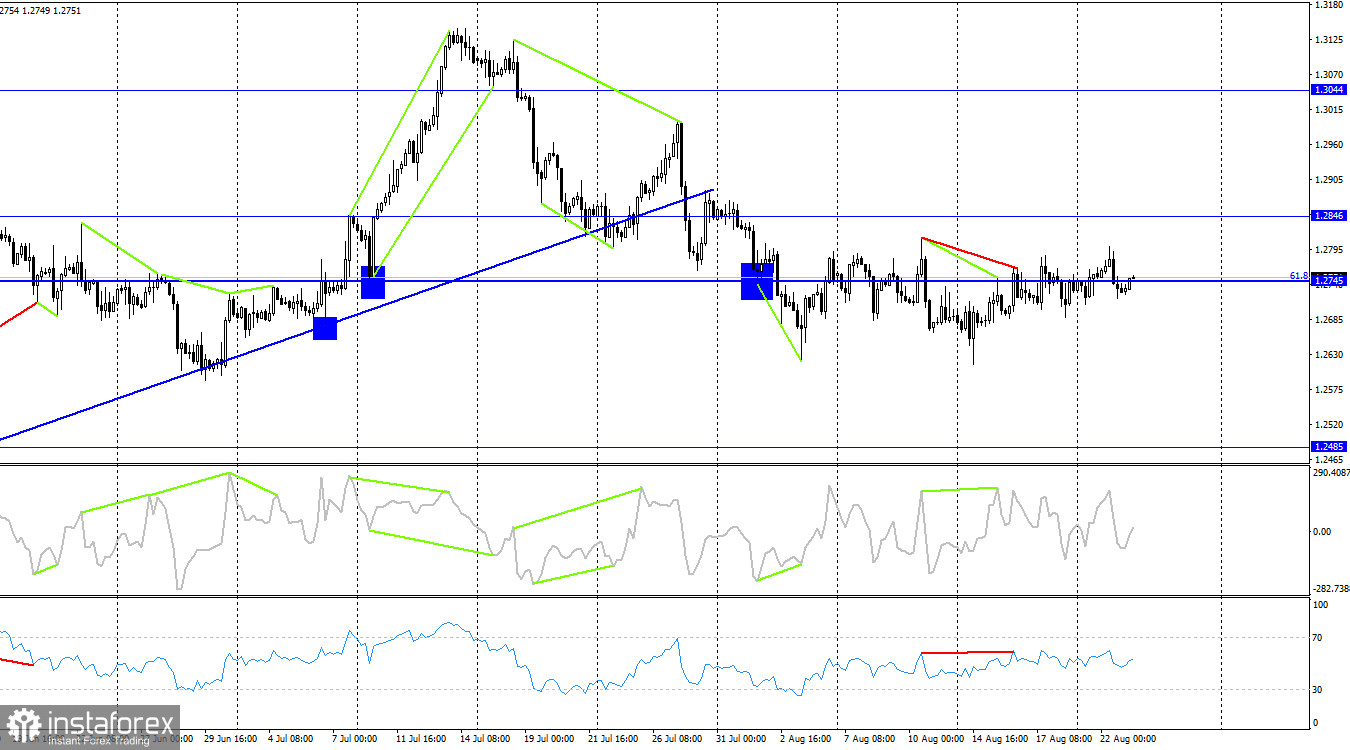

On the 4-hour chart, the pair returned to the corrective level of 61.8% (1.2745), but the CCI and RSI indicators previously formed two "bearish" divergences. Hence, as I mentioned earlier, I don't expect a strong rise in the pair. A reversal in favor of the US dollar and a renewal of the decline towards the 1.2485 level are more likely. The 1.2801 level on the hourly chart is currently more significant than levels on the 4-hour chart.

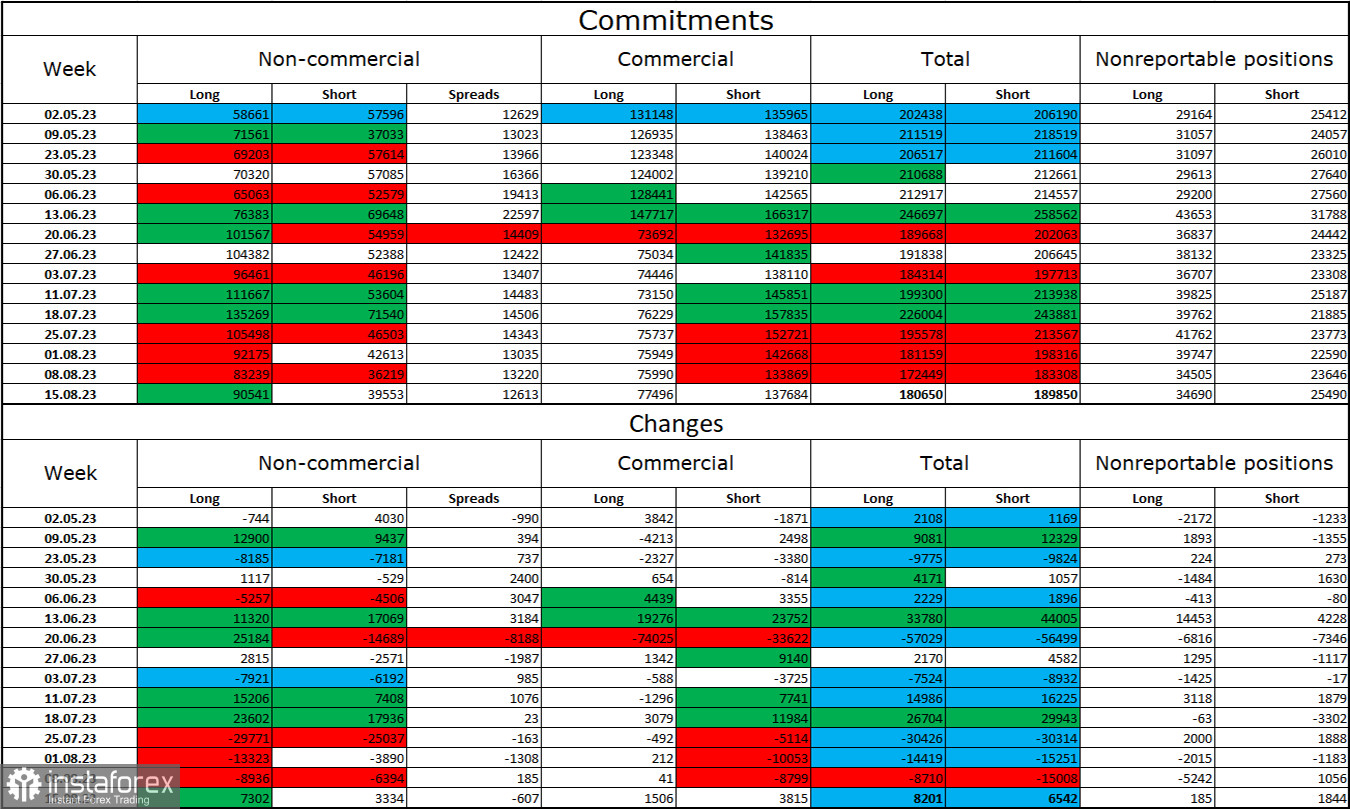

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" category of traders became more "bullish" during the last reporting week. The number of long contracts held by speculators increased by 7,302 units, while short contracts increased by 3,334. The overall sentiment of major players remains "bullish," with more than a twofold gap forming between the number of long and short contracts: 90,000 against 39,000. The British pound had promising growth prospects a few weeks ago, but many factors have favored the US dollar. Expecting a new strong rise in the pound is very challenging. In recent weeks, bulls have reduced their positions by almost 50,000. Bear positions are also decreasing, but the gap is mainly widening.

News calendar for the US and the UK:

United Kingdom - Manufacturing Sector Business Activity Index (PMI) (08:30 UTC).

United Kingdom - Service Sector Business Activity Index (08:30 UTC).

USA - Number of Building Permits Issued (12:00 UTC).

USA - S&P Global US Service Sector Business Activity Index PMI (13:45 UTC).

USA - S&P Global US Manufacturing Sector Business Activity Index (13:45 UTC).

USA - New Home Sales (14:00 UTC).

On Wednesday, the economic events calendar features several interesting entries. For the remainder of the day, the influence of the news background on market sentiment may be of moderate strength.

GBP/USD Forecast and Advice for Traders:

Selling the British pound was possible upon a rebound from the 1.2801 level on the hourly chart. The immediate target of 1.2720 has been reached. New sales are possible upon another rebound from 1.2801 or closing below 1.2720. There's only one signal for purchases today – a rebound from 1.2720, which has already occurred. The target is 1.2801.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română