A powerful headwind has significantly battered gold, but hasn't knocked it off its feet. When the yield of 10-year Treasury bonds hits its highest level since 2007, the U.S. dollar strengthens, and the odds of a federal fund rate hike to 5.75% increase, precious metals should flee the battlefield. However, its decline seems more like an orderly retreat. The bulls are clearly gathering strength for a counterattack, and it might be triggered at Jackson Hole.

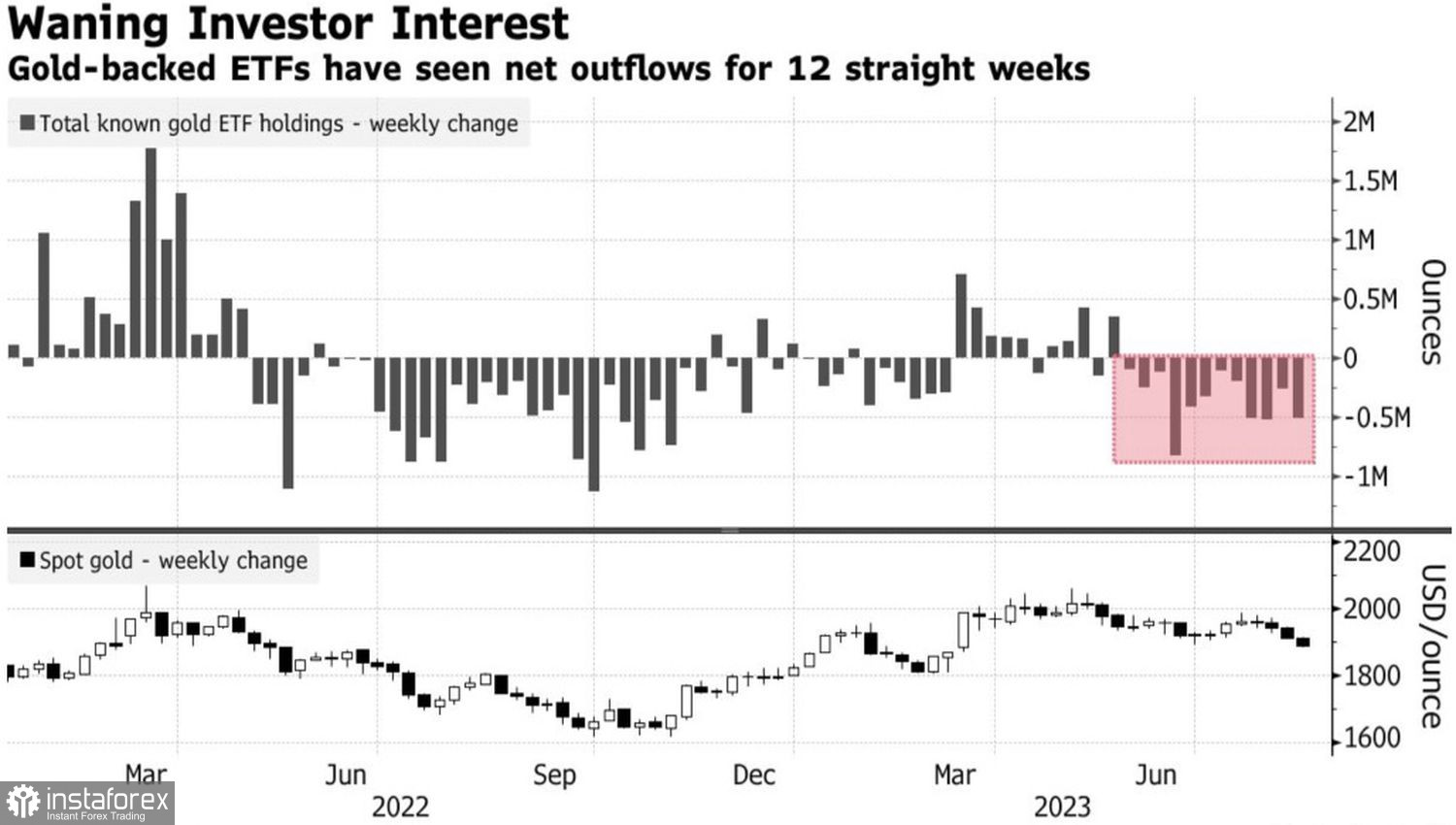

Amidst a 12-week capital outflow from gold-focused ETFs, the longest since November, the optimism of major players seems odd. According to a Bloomberg survey, 5 out of 12 asset managers plan to increase the proportion of precious metals in their investment portfolios in the next 12 months. None of the respondents intend to reduce it. Moreover, two out of three managers foresee price growth, with five expecting new record highs for XAU/USD.

Dynamics of gold and capital flows in ETFs

The consensus forecast for gold among 602 investor respondents from MLIV Pulse suggests a price increase to $2021 per ounce within a year. Key drivers for the rise in precious metal quotes include ongoing geopolitical tensions, including between China and the U.S., the armed conflict in Ukraine, central bank gold purchases, high consumer demand, and the approaching end to the Fed's monetary tightening cycle.

DWS Group anticipates deferred demand from investors, expecting that the process of raising the federal funds rate has come to an end. The company forecasts gold prices to reach a record $2250 per ounce at some point in 2024. Observing gold's resilience to current headwinds, one begins to believe in its "bullish" prospects.

Another driver for the XAU/USD rally could be a crisis of confidence in U.S. government debt. The higher Treasury bond yields rise, the more panic there will be about a potential default. Ultimately, this would trigger a surge in demand for safe-haven assets, a drop in U.S. bond yields, and a spike in precious metal quotes.

Thus, what is currently happening with gold seems less like fleeing or retreating, and more like a coiling spring. And it may well uncoil at Jackson Hole. If Jerome Powell announces the end of the monetary policy tightening cycle, contrary to the FOMC's June forecast of a rate hike to 5.75%, gold will soar. The likelihood of such an outcome from the central bank heads meeting is slim, but it exists.

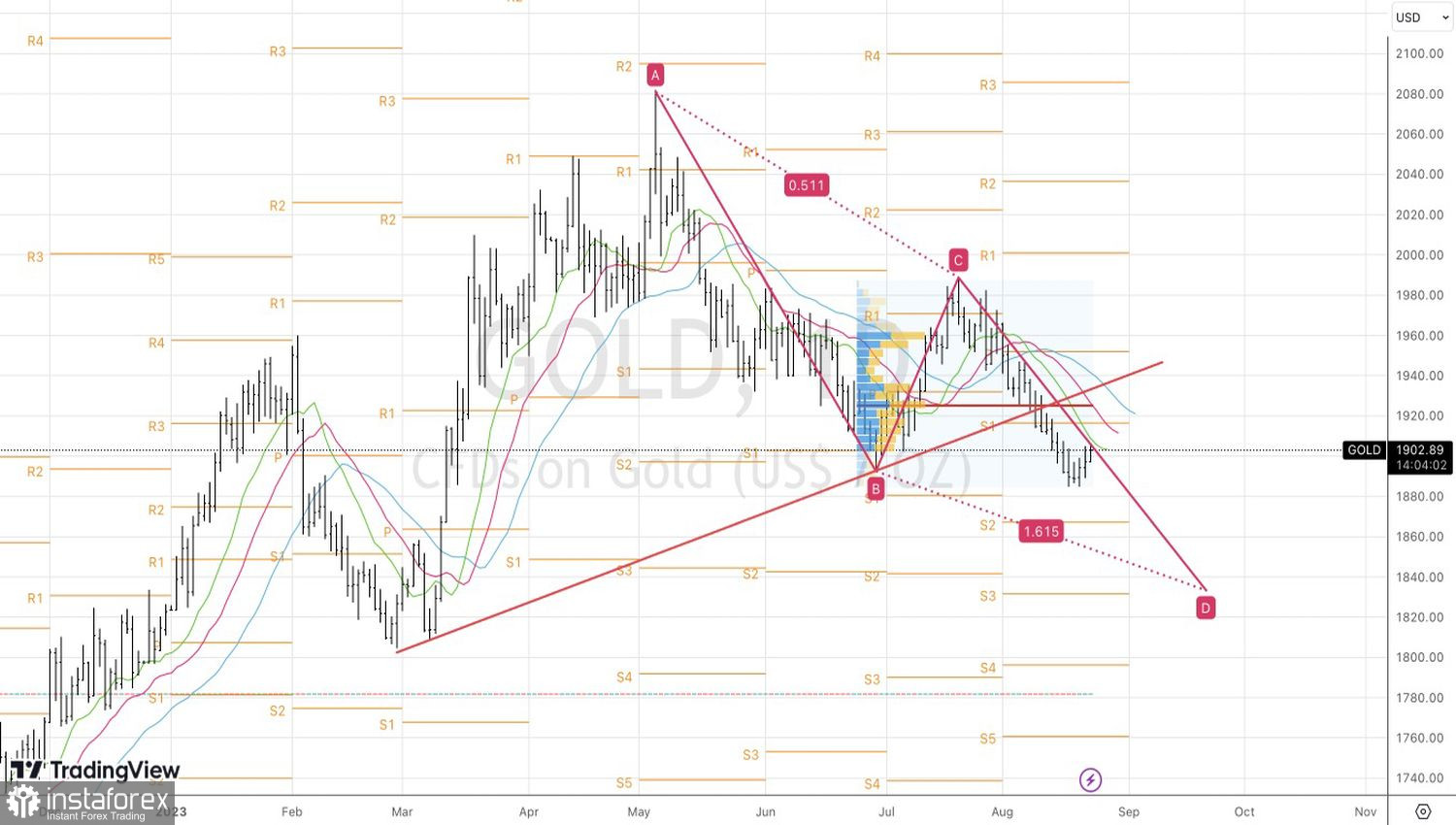

Technically, after several days of decline, gold rebounded above $1900 per ounce. Nevertheless, the 161.8% target in the AB=CD harmonic trading pattern hasn't been revoked. It remains close to the $1832 per ounce mark. Thus, consider using price growth with subsequent rebounds from resistance at $1917, $1925, and $1935 for sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română