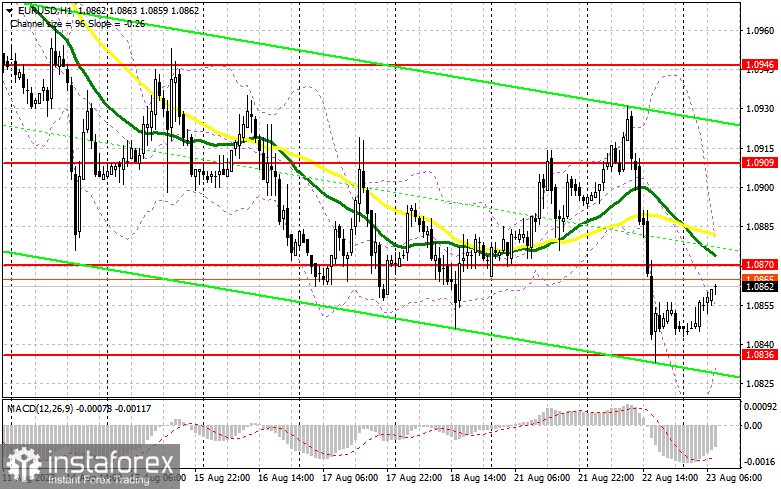

Yesterday, the pair formed only one signal to enter the market. Let's see what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0866 as a possible entry point. A decline to this level and its false breakout generated a buy signal although the pair moved up by only 15 pips. After that, the pair went back under pressure. No other good entry signals were formed for the rest of the day.

For long positions on EUR/USD

The remarks from the Federal Reserve officials negatively impacted the prospects of the European currency, leading to a substantial sell-off in EUR/USD. This tendency may intensify during today's European session. Bleak figures are expected from Germany and the Eurozone's Manufacturing Purchasing Managers Index (PMI), as well as the Services PMI. Any decline here could trigger an immediate sell-off in the euro. Therefore, it is advisable to trade on a dip following a false breakout around the monthly low of 1.0836, offering an optimal entry point for purchasing the euro. An immediate resistance target is set at 1.0870, where moving averages favor the bears. A breakout and a downward test of this range will strengthen demand for the euro, suggesting a bullish correction around 1.0909. The ultimate target is found at 1.0946, where I will be locking in profits. If EUR/USD declines and bulls are idle at 1.0836, the bear market will persist. Only a false breakout around the next support at 1.0808 will signal to buy the euro. I will initiate long positions immediately on a rebound from the low of 1.0777, aiming for a downward correction of 30-35 pips within the day.

For short positions on EUR/USD

Sellers benefited from yesterday's aggressive statements by the Federal Reserve officials, seemingly setting the stage for Jerome Powell's upcoming Friday speech. Today, to maintain the bearish momentum, sellers will have to assert their strength at the new resistance of 1.0870. The pair may test this level soon after the Eurozone statistical data is released. A false breakout of this level will lead to another descent towards the 1.0836 support. However, only a breakout below this range, followed by an upward retest, will generate another sell signal, paving the way to the low of 1.0808. A retest of this range will confirm a robust bearish trend. The ultimate target is seen at 1.0777, where I will be locking in profits. If EUR/USD moves upward during the European session and lacks bearish activity at 1.0870, the bulls may try to re-enter the market. In such a scenario, I would go short only when the price tests the new resistance at 1.0909 that was formed yesterday. Selling at this point is possible only after a failed consolidation. I will initiate short positions immediately on a rebound from the high of 1.0946, considering a downward correction of 30-35 pips within the day.

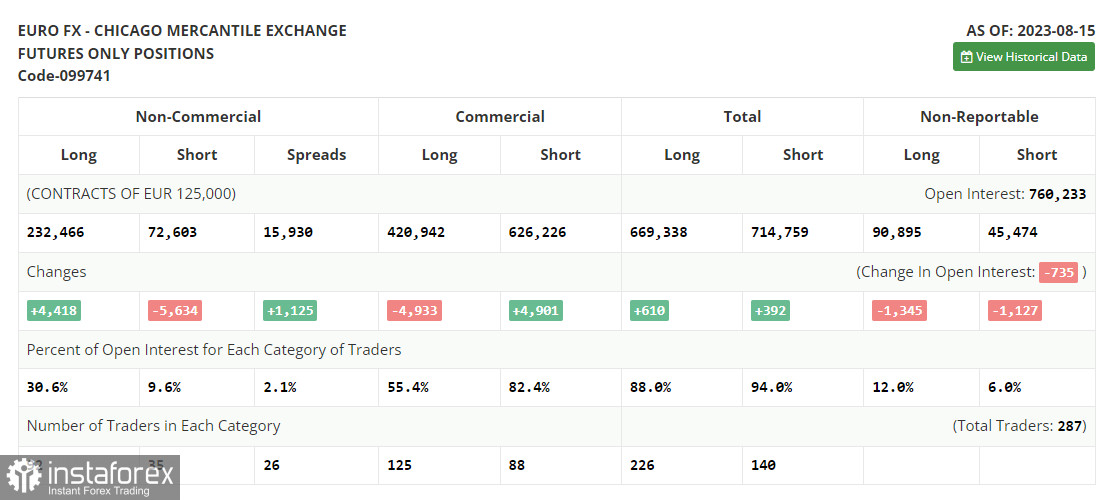

COT report:

The COT (Commitment of Traders) report for August 15 shows a notable increase in long positions and a drop in short positions. These figures already factor in the crucial US inflation data, which brought back some buyers to the market. The Federal Reserve meeting minutes released last week also indicated that not all committee members are aligned with the idea of raising interest rates to combat inflation. This keeps the chances of the euro's recovery alive, especially following the Jackson Hole symposium happening later this week where Federal Reserve Chairman Jerome Powell is scheduled to speak. His address might shed light on the central bank's future policy direction. It is important to note that the recent decline in the euro seems to be appealing to traders. The optimal medium-term strategy under current conditions remains buying risk assets on a dip. The COT report highlights that non-commercial long positions increased by 4,418 to stand at 232,466, while non-commercial short positions decreased by 5,634 to 72,603. Consequently, the spread between long and short positions surged by 1,125. The closing price was lower, settling at 1.0922 compared to 1.0981 the previous week.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates bears' attempt to regain control of the market.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 1.0836 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română