On Tuesday, the GBP/USD currency pair also declined, though not as sharply as the European currency. Given the nearly empty event calendar for Tuesday, it's hard to pinpoint what exactly prompted the strengthening of the US currency. We are inclined to think it was nothing in particular. A pair can move in any direction regardless of a macroeconomic backdrop. Yesterday was such a day when the price moved without clear fundamental reasons. Considering the pound is in a flat trend and the euro traded with minimal volatility for the 6-7 days prior, nothing extraordinary happened.

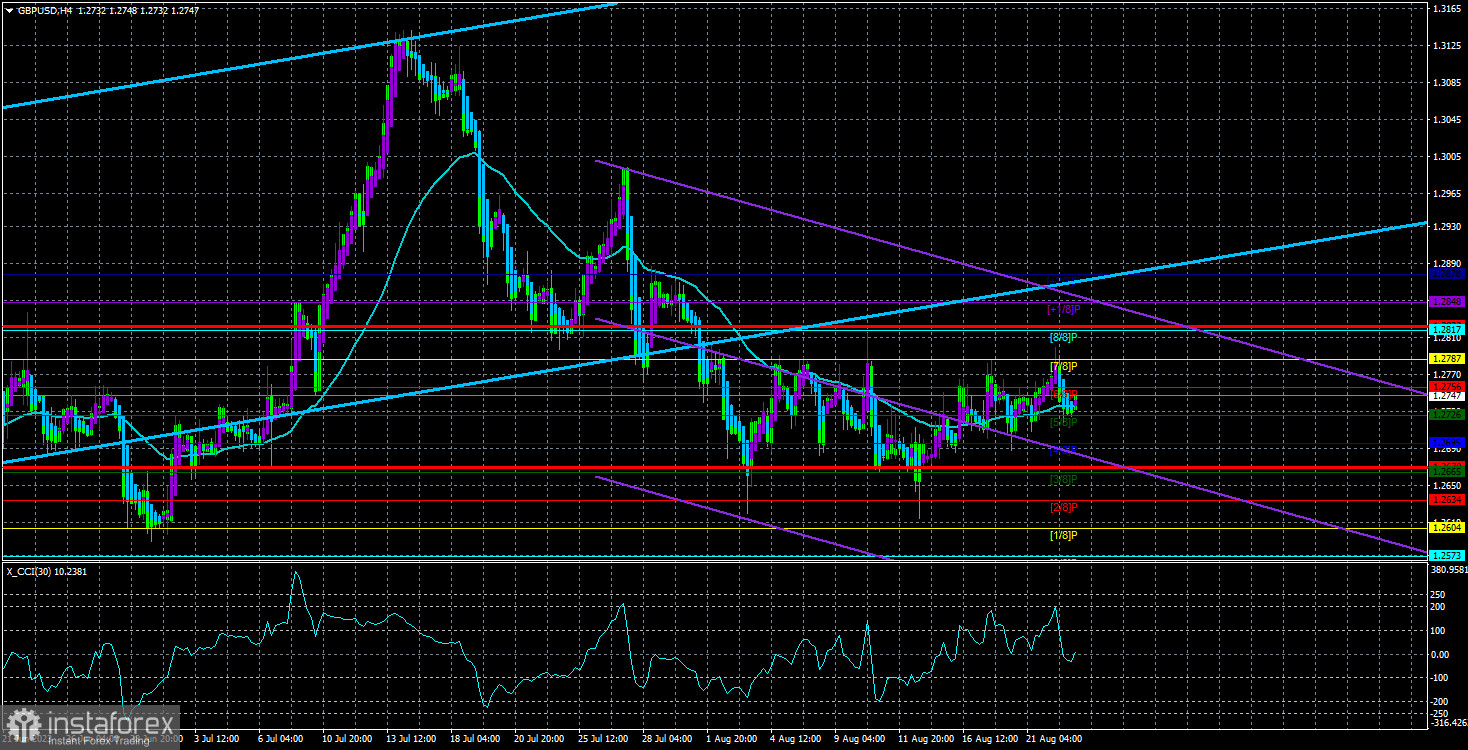

The British currency remains within a sideways channel, with approximate boundaries at 1.2634 and 1.2787. Over the past week, the upper boundary was tested twice, so now we can expect a decline in the lower boundary. However, be cautious: trading on a flat trend always poses increased risks. It's possible to trade on the rebound from the boundaries of the sideways channel, but, for example, the previous rebound from the 1.2787 level did not trigger a drop to 1.2634.

A flat trend is almost always unpredictable. Therefore, traders now face the following dilemma: wait for the flat trend to end or try to gain a few dozen points of profit within the flat at increased risks. It's more prudent to wait for the price to exit the sideways channel, especially since the technical picture is ambiguous.

The biggest question is about the 24-hour time frame (TF). On it, the price remains inside the Ichimoku cloud and hasn't even attempted to settle below it. The Senkou Span B line has risen, making it challenging to determine which price value of this line to reference— the old one (1.2573) or the new one (1.2722). In any case, settling below the Ichimoku cloud will increase the likelihood of a further fall in the pound, but we need to wait for it. We have a flat trend on the 4-hour TF and the Ichimoku cloud daily.

The Fed will continue to tighten at a modest pace.

Several speeches by members of the Fed's monetary committee are scheduled for this week. Yesterday, the line-up was opened by Richmond Fed's President Thomas Barkin, who stated that the Fed's primary goal remains to return inflation to 2%. This statement carries a "hawkish" tone, suggesting another rate hike in 2023 since US inflation rose to 3.2% y/y by the end of July, and core inflation still doesn't show signs of slowing. As we've mentioned several times, the August report will be decisive. If inflation doesn't drop to 2.7-2.8% or higher, another tightening by the Fed is almost guaranteed. Also, Michelle Bowman and Austan Goolsbee were supposed to speak yesterday, but there needs to be more information available about these events so far.

As we can see on the daily timeframe, the pair doesn't seem too keen to decline. We've only witnessed a basic downward retracement, so additional support for the dollar wouldn't hurt. The more "hawkish" statements we hear from the Federal Reserve, the more likely we'll see a continuation of the logical and fair decline of the pound and the rise of the dollar. Therefore, on Friday, Jerome Powell is entrusted to demonstrate the most stringent stance regarding inflation among all possibilities. The market still doesn't heavily penalize the dollar in the long term, and the inertial upward trend might still be renewed. This is the main danger for traders who link pair movements with fundamentals and macroeconomics.

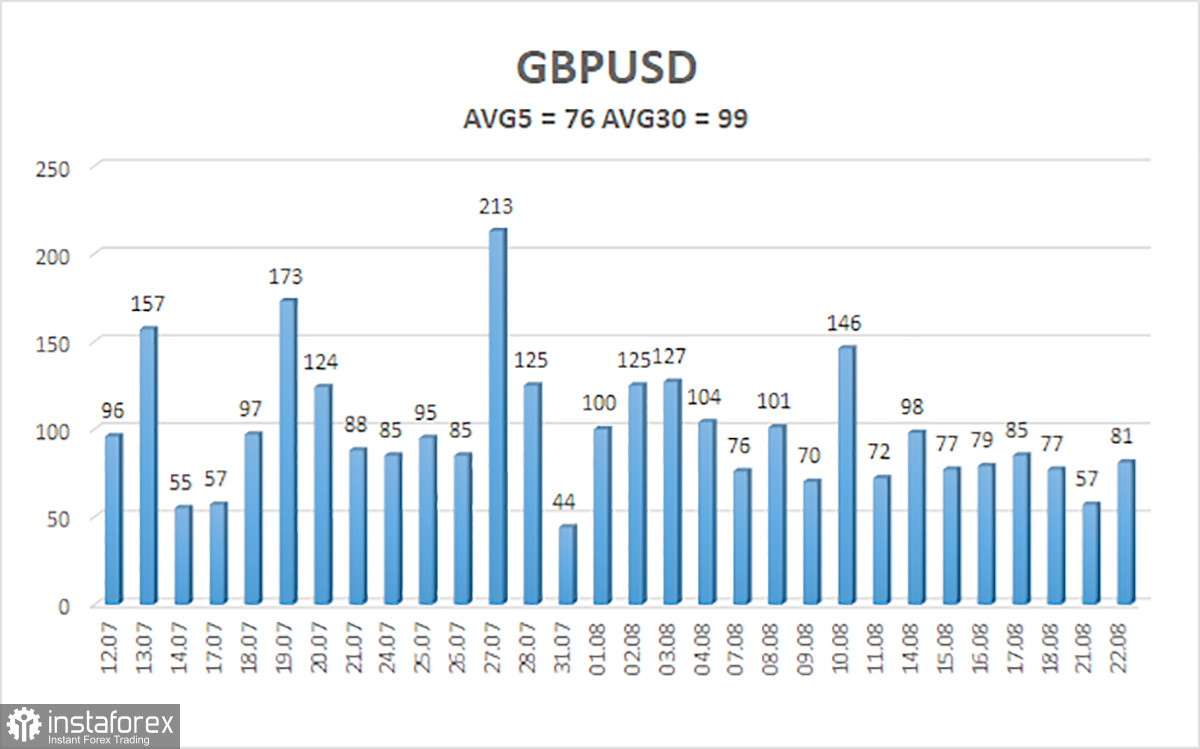

The average volatility of the GBP/USD pair over the past five trading days is 76 points. For the pound/dollar pair, this value is "average." On Wednesday, August 23rd, we thus expect movement within the range limited by the levels 1.2670 and 1.2822. A reversal of the Heiken Ashi indicator upwards would signal a new upward turn within the sideways channel.

Nearest support levels:

S1 – 1.2726

S2 – 1.2695

S3 – 1.2634

Nearest resistance levels:

R1 – 1.2756

R2 – 1.2787

R3 – 1.2817

Trading recommendations:

The GBP/USD pair in the 4-hour timeframe remains above the moving average, but overall, the trend remains flat. One can trade now on a rebound from the upper (1.2787) or lower (1.2634) boundaries of the sideways channel, but reversals can occur without reaching them. The moving average might be breached frequently; it doesn't signify a trend change.

Illustration explanations:

Linear regression channels - help identify the current trend. If both are oriented in one direction, the trend is strong.

Moving average line (settings 20.0, smoothed) - determines the short-term trend and the direction in which one should currently trade.

Murrey levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into the oversold area (below -250) or the overbought area (above +250) indicates an impending trend reversal in the opposite direction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română