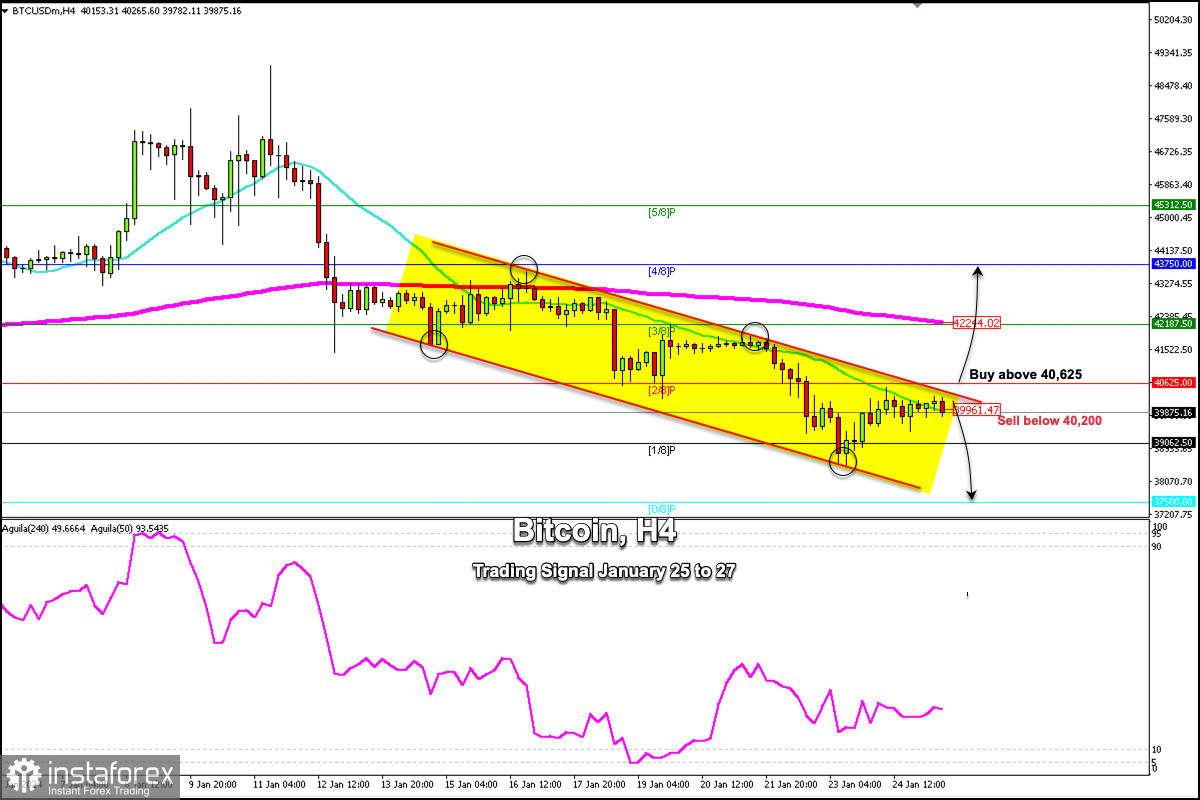

Bitcoin is trading around 39,875, below the 21 SMA, and inside the downtrend channel forming since January 12. During the last few hours, we can observe the formation of consolidation candles. This could signal an exhaustion of the bullish force, so Bitcoin could resume its bearish cycle. This scenario could occur only if Bitcoin falls and consolidates below $40,000.

Should Bitcoin break sharply above the downtrend channel, it could be the start of a sustained recovery and we could expect Bitcoin to reach the 200 EMA at 42,244. The price could even return to 4/8 Murray levels at 43,750.

On the contrary, if Bitcoin settles below 39,961, it is likely to reach 1/8 Murray at 39,062 in the coming days. Finally, the token could reach the 0/8 Murray zone around 37,500.

Bitcoin is following the overall bearish trend and it is likely to resume in the coming days as the eagle indicator is giving a negative signal. There is still room left for the price to reach oversold levels.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română