Attempts by EUR/USD to counterattack due to a rebound in U.S. stock indices were not successful. In 2023, the Nasdaq Composite grew thanks to shares of major technology companies, one of which was Nvidia. Expectations of its strong corporate profits pushed the market upward, but purchases based on rumors are usually followed by sales on facts. Investors are preparing for a new wave of sell-offs in stock indices, which brought the euro back to earth from the sky.

The strength of the U.S. economy is giving birth to a bearish bond market, as demand for safe-haven assets decreases. At the same time, rising bond yields force stocks to correct. In such conditions, the U.S. dollar feels like a fish in water. Moreover, the budget deficit is increasing, and the Fed continues to implement a quantitative tightening program.

According to the July forecasts of the Congressional Budget Office, budget expenses will exceed revenues by $1.7 trillion, not $1.5 trillion as previously assumed. The Treasury requires additional resources to finance the growing deficit. At the same time, the issuance of bonds is one of the drivers for increasing yields, which strengthens the U.S. dollar. Meanwhile, the Fed is reducing its balance sheet by about $900 billion a year. The securities that have been retired from circulation need to be replaced with something, and that is another tranche of issuance. It's not surprising that the yield on 10-year debt obligations has reached its highest level since 2007.

Dynamics of real bond yields in the U.S.

The higher the U.S. Treasury bond rates, the greater the capital inflow into the corresponding ETFs, the stronger the dollar's position. The euro needs to make a significant effort to respond to this. And so far, no strong arguments are being found. Moreover, a 6% drop in producer prices in Germany in July signals the imminent end of the ECB's monetary tightening cycle, depriving EUR/USD bulls of an essential advantage. Actual PPI turned out better than Reuters experts' forecasts in both annual and monthly terms.

Considering that "hawks" on the Governing Council are mainly represented by the pro-German lobby, it is not surprising that they are silent. Not only is the German economy experiencing serious problems, but inflation also risks declining rapidly in the near future. If the Fed and the ECB stop raising rates simultaneously, EUR/USD bulls will have to jump high to restore the upward trend.

The consensus forecast of Reuters experts at 1.12 for the main currency pair at the end of the year looks doubtful. Its short-term prospects will depend on the release of data on business activity in the euro area and Jerome Powell's speech in Jackson Hole.

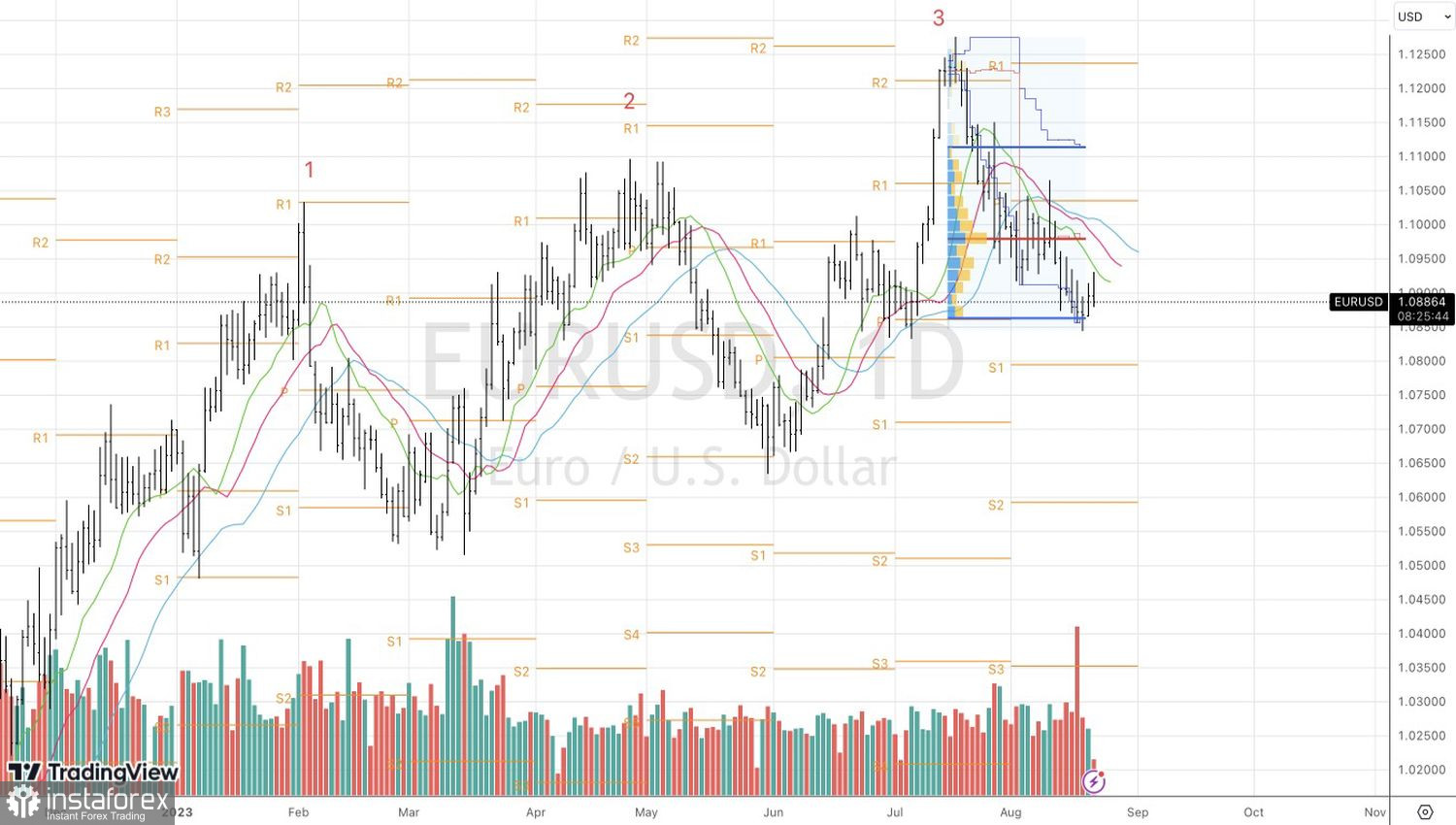

Technically, on the daily chart, EUR/USD buyers attempted to test the dynamic resistance in the form of a moving average. The fact that the bulls could not do this speaks of their weakness. A fall of the euro below $1.086 will be a reason for sales.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română