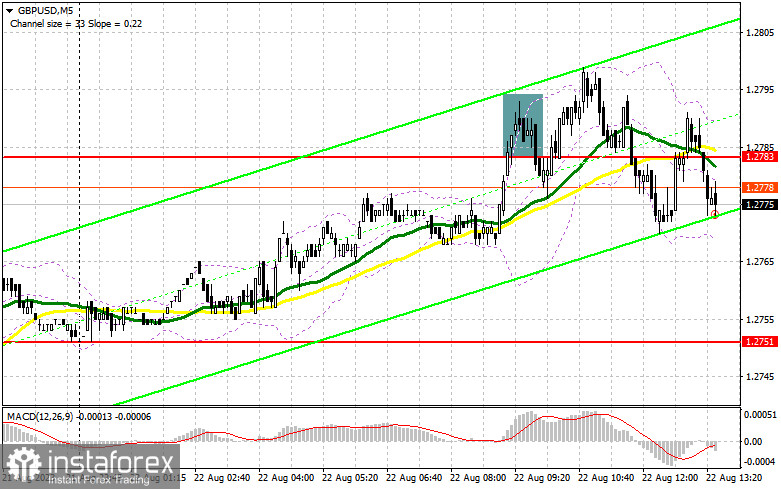

In my morning forecast, I drew attention to the 1.2783 level and recommended using it as a reference for market entry decisions. Let's look at the 5-minute chart and understand what happened there. Growth and formation of a false breakout at this level provided a good sell signal for the pound, but the pair did not experience a significant drop. A decision was made to exit the market and reevaluate the technical picture.

Requirements for opening long positions in GBP/USD:

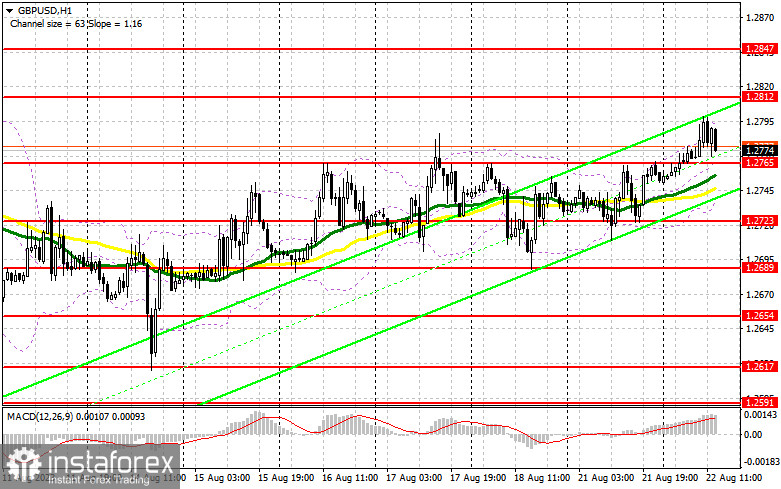

During the US session, we will review data on the volume of existing home sales in the US and the Richmond Fed manufacturing index. However, the speeches of FOMC members Thomas Barkin, Austan D. Goolsbee, and Michelle Bowman will be more interesting. Opinions among the Fed representatives vary greatly, so market volatility will be ensured. I plan to act on the decrease after forming a false breakout around the new support at 1.2765, formed in the first half of the day. This will provide an excellent entry point with a target for growth to resistance at 1.2812. A breakthrough and a top-down test of this range will provide an additional buy signal, restoring the pound's strength and allowing it to reach a high of 1.2847. In the case of moving above this range, we can talk about a surge to 1.2884, where I will be fixing profits.

In the scenario of a GBP/USD decline and a lack of buyers at 1.2765, and just below this level, the moving averages that support the bulls will come into play, returning pressure on the pair and leading to a more significant selloff. If this happens, I will postpone long positions to 1.2723. Purchases there will only occur on a false breakout. It is possible to immediately open long positions on GBP/USD on a rebound from 1.2689 with a target correction of 30-35 points within the day.

Requirements for opening short positions in GBP/USD:

The bears tried, but it didn't work out. In the case of the pair's rise in the second half of the day, only the formation of a false breakout around 1.2812 will provide a sell signal, aiming for a drop to the nearest support at 1.2765. If sellers are hoping for anything, they must move below this range as quickly as possible. A breakthrough and a reverse bottom-up test of 1.2765 will provide an entry point for selling to update 1.2723, bringing the pound back within the sideways channel. A more distant target will be the 1.2689 area, where I will fix profits.

In the event of a rise in GBP/USD and the absence of bears at 1.2812 in the second half of the day, the bulls will take control of the market. In such a case, only a false breakout in the area of the next resistance at 1.2847 will form an entry point for short positions. In the absence of activity, I advise selling GBP/USD from 1.2884, expecting a rebound of the pair downwards by 30-35 points within the day.

The COT report (Commitment of Traders) dated August 15 showed growth in both long and short positions. Traders increased their positions after data on UK GDP, which was better than economists' expectations. Falling prices in the US also influenced power distribution, supporting the pound, as did high core pressure in the UK. At the end of this week, there will be a symposium in Jackson Hole, which could further strengthen the British pound in the short term. It is very important what Fed Chairman Jerome Powell will say about the future monetary policy of the US. As before, the optimal strategy remains to buy the pound on the decline, as the difference in the policies of central banks will affect the prospects of the US dollar, putting pressure on it. The latest COT report said that long non-commercial positions increased by 7,302 to a level of 90,541, while short non-commercial positions jumped by 3,334 to 39,553. As a result, the spread between long and short positions narrowed by 607. The weekly price dropped and amounted to 1.2708 against 1.2749.

Indicator signals:

Moving Averages:

Trading is conducted above the 30 and 50-day moving averages, indicating an attempt by the bulls to continue the growth of the pound.

Note: The author considers the period and prices of moving averages on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands:

In case of a decline, the lower boundary of the indicator in the area of 1.2745 will act as support.

Description of indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD Indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română