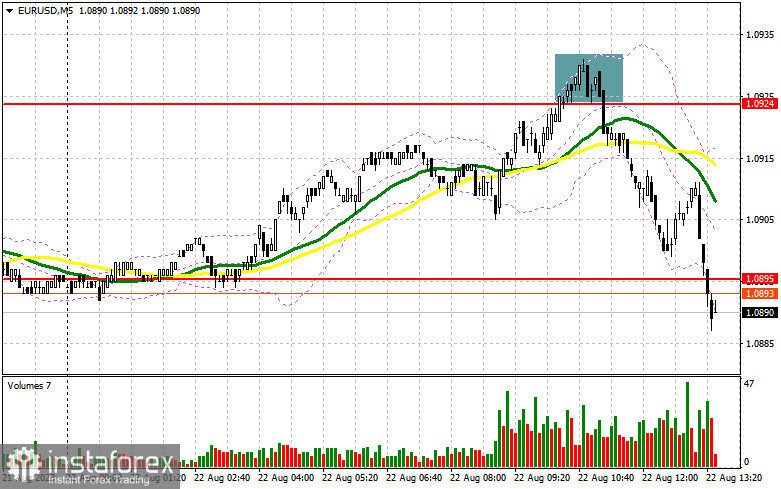

In the previous review, I drew your attention to the level of 1.0924 and recommended entering the market from it. Let's take a look at the 5-minute chart and analyze the situation there. The euro/dollar pair rose and formed a false breakout at this level, giving a sell signal, leading to a significant drop in the pair by more than 30 pips. The technical outlook was reconsidered for the second half of the day.

Long positions on EUR/USD:

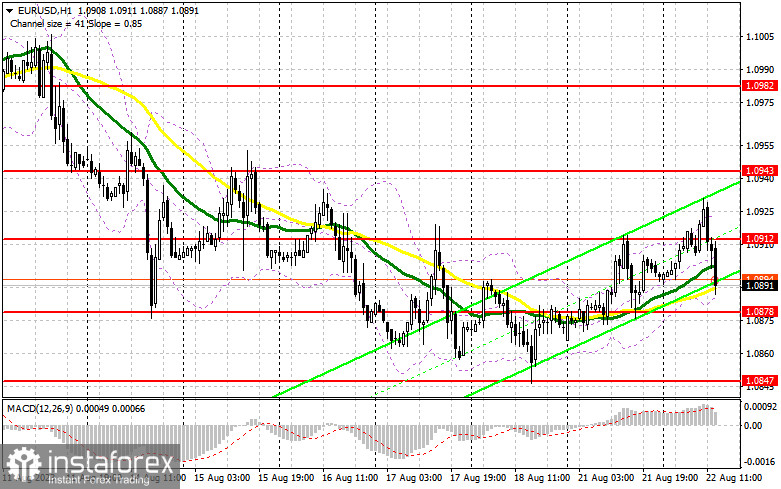

Considering the substantial series of interviews and speeches by Federal Reserve representatives planned during the US session, heightened volatility is anticipated. Hawkish comments from FOMC member Thomas Barkin and Austan Goolsbee are likely to further strengthen the dollar and cause the euro/dollar pair to decline. The prospect of a dovish tone only rests with FOMC's Michelle Bowman. Hence, it is better to wait for a dip and a false breakout around the new support at 1.0878, slightly above the pivotal moving averages that are favoring bulls. This would provide a suitable entry point for long positions, targeting an upward correction towards the resistance at 1.0912. A breakthrough and a test of this range may bolster demand for the euro, potentially leading to an upward surge and a retest of 1.0943. The ultimate target remains around 1.0982, where profit-taking can be considered.

In the scenario of the euro/dollar pair dropping and limited activity around 1.0878 in the second half of the day—which is plausible given the upcoming data on secondary housing sales in the US market and the Federal Reserve Bank of Richmond's manufacturing index—the pressure on the pair is likely to intensify. In such a case, only a false breakout around the next support at 1.0847, a new monthly low, may give a buy signal for the euro. One can open long positions on a rebound from 1.0808, allowing an intraday upward correction of 30-35 pips.

Short positions on EUR/USD:

Bears have made it clear they have not gone anywhere. If the pair rises in the second half of the day, we can anticipate bearish activity around the new resistance at 1.0912, formed after the European session. A false breakout at this level may signal a renewed selling opportunity, extending the bearish trend and paving the way toward the new support at 1.0878. Only after breaking and confirming below this range, followed by a bottom-up retest, will a sell signal be valid, allowing the pair to reach monthly lows near 1.0847. The next target would be near 1.0808, indicating a continuation of the bearish trend. You can lock in profits at that level. If the pair rises during the American session and lacks bearish momentum at 1.0912, control will return to bulls. In such a scenario, it is better to postpone short positions until the next resistance at 1.0943. Selling could also be considered there, but only after an unsuccessful confirmation. You can also open short positions on a rebound from the high of 1.0982, allowing a downward correction of 30-35 pips.

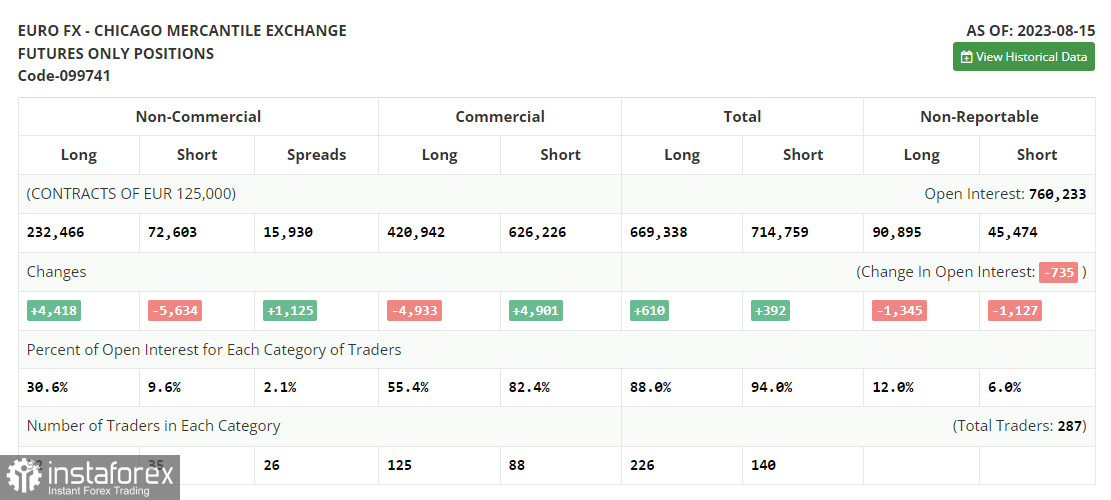

The COT report for August 15 logged an increase in long positions and a reduction in short positions. These metrics already factor in the significant inflation data in the US, which, as we can see, brought some bulls back into the market. The US Federal Reserve's minutes released last week also indicated that not all committee members were ready to raise interest rates to combat inflation. This keeps the chance for the euro's recovery alive, especially after the Jackson Hole Symposium scheduled for the end of this week, where Fed Chair Jerome Powell will speak. His speech might shed light on the central bank's future policy. Notably, the recent euro decline presents an attractive opportunity, as the optimal mid-term strategy in the current conditions remains buying risk assets on dips. The COT report indicates that non-commercial long positions increased by 4,418 to 232,466, while non-commercial short positions decreased by 5,634 to 72,603. Consequently, the spread between long and short positions widened by 1,125. The closing price dropped to 1.0922 from 1.0981.

Indicator Signals:

Moving Averages

Trading is occurring around the 30 and 50-day moving averages, indicating bearish attempts to reverse the market.

Note: The author considers the period and prices of moving averages on the hourly H1 chart, which differ from the general definition of classical daily moving averages on the daily D1 chart.

Bollinger Bands

In the case of an increase, the upper boundary of the indicator around 1.0925 will act as resistance.

Indicator Descriptions:

- Moving Average determines the current trend by smoothing volatility and noise. Period 50. Marked in yellow on the chart.

- Moving Average determines the current trend by smoothing volatility and noise. Period 30. Marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence). Fast EMA 12. Slow EMA 26. SMA 9.

- Bollinger Bands. Period 20.

- Non-commercial traders are speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes, meeting specific requirements.

- Long non-commercial positions represent the total long open position of non-commercial traders.

- Short non-commercial positions represent the total short open position of non-commercial traders.

- Total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română