USD/JPY

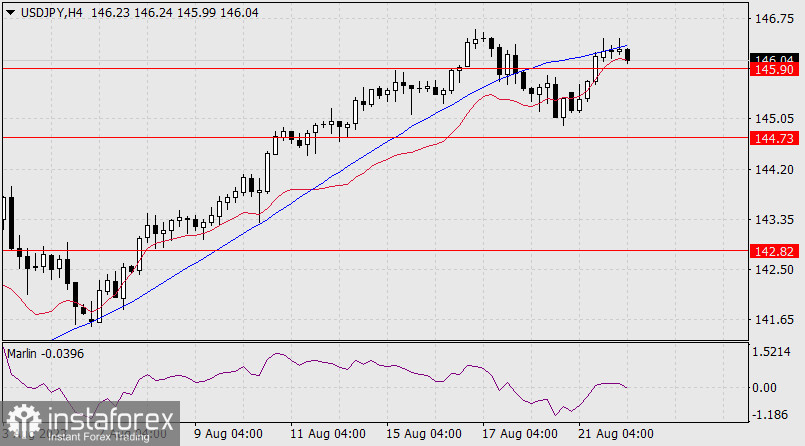

Yesterday, the USD/JPY pair broke above the resistance level of 145.90. The 147.95 level is just ahead – an embedded line of the global price channel, and slightly above it is the target level of 148.50. However, the Marlin oscillator is turning downwards on the daily chart, which could indicate that the bearish correction has not yet ended.

The nearest support for this correction is the 144.73 mark, which the MACD line (blue moving average) is approaching. If the price consolidates below the level of 144.73, it may fall to 142.82. This morning, the price was unable to overcome the resistance of the MACD line on the four-hour chart. The signal line of the oscillator is returning to the area of negative values.

The first condition for restoring the correction is the price consolidating below the level of 145.90 on this chart. The first sign of succeeding growth will be the price consolidating above yesterday's high, which will automatically turn into a consolidation above the MACD line.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română