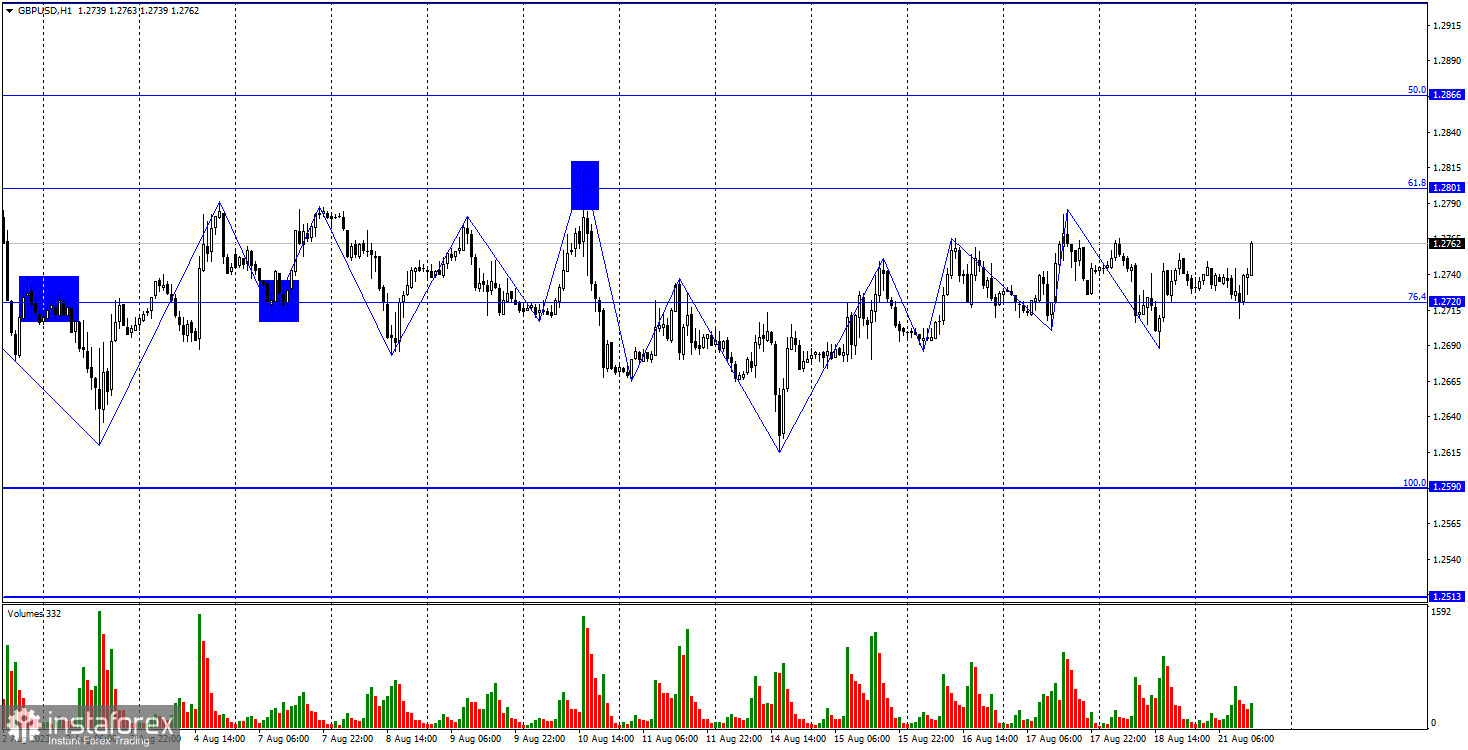

On the hourly chart, the GBP/USD pair made a new decline on Friday, but the levels are now irrelevant and ignored by traders. Waves best visualize the current market situation. They clearly show how bulls and bears tug on the rope, and neither side has an advantage. All waves are nearly identical in size. If there is a breakout of a certain peak or low, it is usually a few points. And if you scroll back the chart a bit, it is clear that the pound has been moving in a horizontal corridor for three weeks. All movements occur within this corridor and are divided into 3-5-7 waves each.

Thus, the pair can rise to the corrective level of 61.8% (1.2801), possibly rebound from it, and start a new decline of 5-7 small waves towards the 1.2615 level, where the previous two falling segments ended. Consolidating the pair above the 1.2801 level will favor continued growth towards the next level of 50.0% (1.2866).

The current news backdrop does not suggest further growth for the pound or a new rise for the dollar. On Friday, a very weak retail sales report was released in the UK, and the pound, with great difficulty, is climbing to the top of 1.2801. There is no news today, and tomorrow there will be no important economic data either. I can point out the existing home sales report in the US, but does anyone consider this report important enough to expect a pair's reaction? On Wednesday, business activity indices in the UK, US, and EU may influence traders' sentiment if significant changes are recorded for better or worse in August.

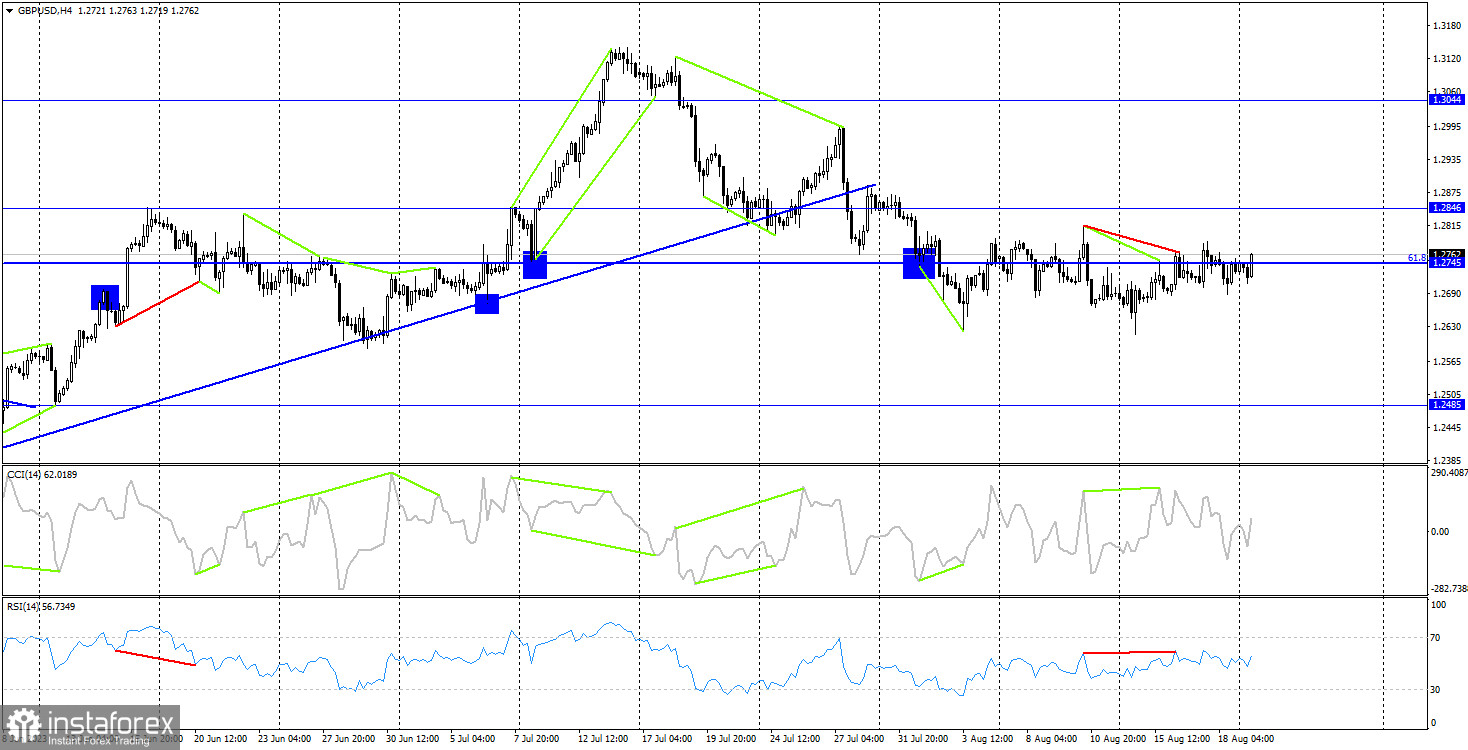

On the 4-hour chart, the pair has returned to the corrective level of 61.8% (1.2745), but there are already two "bearish" divergences with the CCI and RSI indicators. Thus, as I said earlier, I do not expect strong pair growth. A reversal in favor of the US dollar and a resumption of the decline toward the 1.2485 level is more likely. However, a full consolidation above the 1.2745 level will allow for the expectation of continued growth towards the 1.2846 level and cancel the divergences.

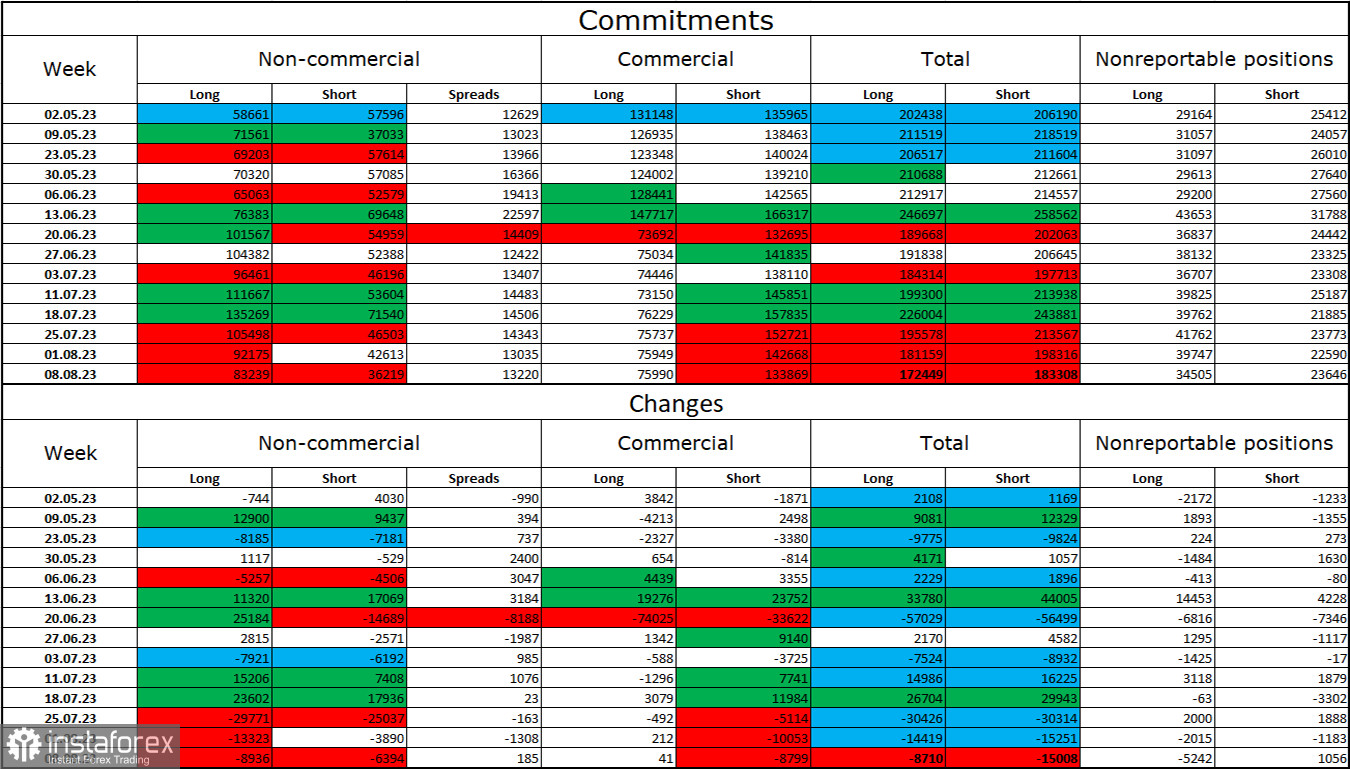

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category over the past reporting week has become less bullish. The number of long contracts held by speculators decreased by 8,936 units, while the number of short contracts decreased by 6,394. The overall sentiment of major players remains bullish, and there is more than a twofold gap between the number of long and short contracts: 83,000 against 36,000. The pound had good prospects for continued growth a few weeks ago, but many factors have favored the US dollar. Expecting a new strong rise in the pound is becoming more and more difficult. In recent weeks, we have seen bulls reduce their positions, with a decrease of almost 50,000. Bear positions are also falling, but the gap is only widening.

News calendar for the US and UK:

On Monday, the economic events calendar contains a few interesting entries. For the remainder of the day, the influence of the news backdrop will be absent.

GBP/USD forecast and trading advice:

Selling the pound is now possible upon a rebound from the 1.2801 level on the hourly chart. Targets are the nearest low waves on the hourly chart. For purchases, there is only one signal - a rebound from the 1.2720 level, but be cautious - the pound's rise may need to be stronger. The target is 1.2801.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română