This week, the news backdrop will be relatively weak. Business activity indices, durable goods orders, and speeches by Federal Reserve Chair Jerome Powell and European Central Bank President Christine Lagarde at the annual Jackson Hole symposium on the agenda. Take note that each year, central bank chiefs gather several times at various conferences, symposiums, and forums. So, the event in Jackson Hole is not unique. It is just another economic forum where opinions and perspectives will be shared. It would be foolish to expect revelations from Lagarde or Powell during their speeches on Friday. Nor should we expect the discussion to revolve around rates or the prospects of monetary policy. Certainly, both Lagarde and Powell may touch upon this topic, but the scope and depth of their responses may be quite superficial.

I also want to remind you that we are interested in a certain event to the extent that it influences a particular instrument. It is impossible to predict what the ECB and Fed presidents will announce on Friday. The market is unlikely to be pricing in any specific rhetoric from Powell and Lagarde at the moment. Based on this, both instruments will move as it was planned. And the plan is as follows.

For the British pound, the 1.2620 level is significant, and it has resisted the pressure from sellers twice. Therefore, it is more likely for a corrective wave to form. The euro continues to fall, but it is gradually getting weaker. This means that a corrective wave is also possible for this instrument. Since the euro and the pound often move quite similarly, it would be great if both instruments start to rise. However, I do not think that the corrective waves will be strong.

This week's news background is weak, and we still have to make it to Friday. Even if I am wrong and Lagarde and Powell shock the market with their rhetoric, all movements will come at the very end of the working week, which is when we will need to think about closing deals, not opening them. Over the weekend, we can carefully analyze both speeches to find all the hints of future changes in approaches to monetary policy.

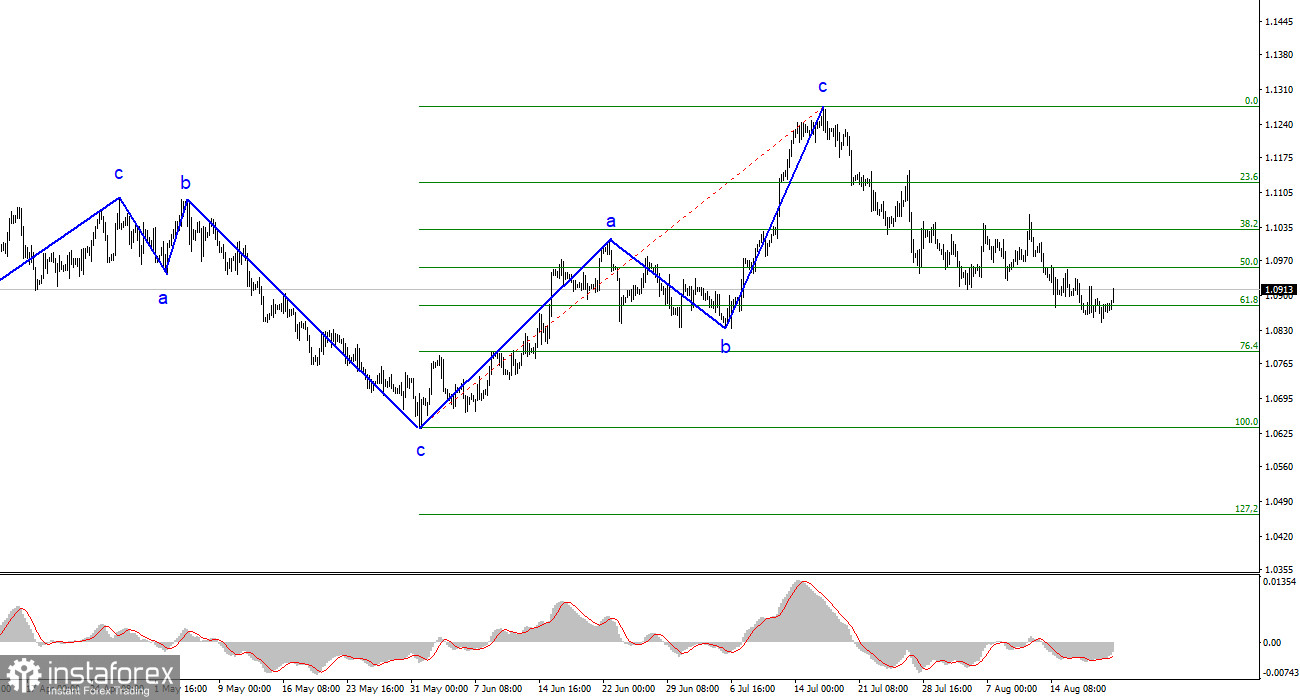

Based on the analysis, I conclude that the construction of the upward wave set is complete. I still believe that targets in the 1.0500-1.0600 range are quite realistic, and with these targets in mind, I advise selling the instrument. The a-b-c structure appears complete and convincing. Therefore, I advise selling the instrument with targets around 1.0836 and below. I believe that the bearish segment will persist, and the successful attempt at 1.0880 indicates the market's readiness for new short positions.

The wave pattern of the GBP/USD pair suggests a decline within the downtrend segment. There is a risk of ending the current downward wave if it is wave d and not 1. In that case, wave 5 could start from current levels. However, in my opinion, we are currently seeing the construction of a corrective wave within a new downtrend segment. If this is the case, the instrument will not rise much above the 1.2840 mark, and then a new downward wave will begin. We are preparing for new shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română