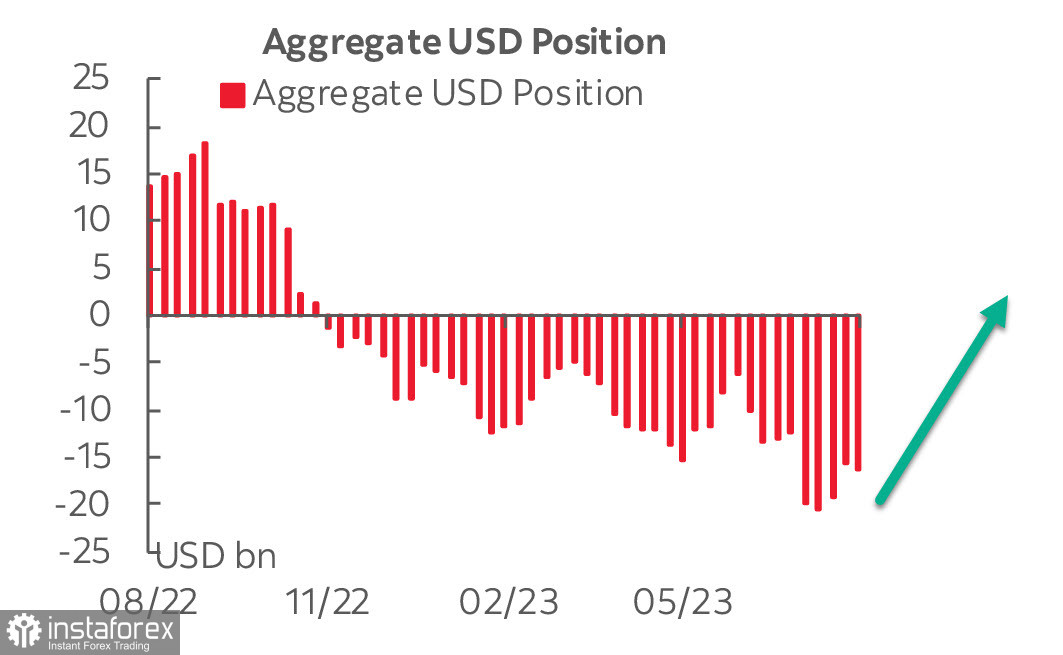

The net short position in USD grew by $490 million to -$16.272 billion over the reporting week after a strong correction a week earlier. The decline is largely related to long positions on the euro, and in terms of other major currencies, the notable trend is selling across all significant commodity currencies (Canadian, Australian, New Zealand dollars, and also the Mexican peso). The yen and franc are slightly doing better, i.e., there is demand for safe-haven currencies and a sell-off in commodity currencies. Since long positions in gold have decreased by $4.5 billion, we can expect increasing demand for the US dollar.

PMIs for the eurozone, the UK, and the US will be published on Wednesday, which can significantly influence the rate forecasts of the European Central Bank, the Bank of England, and the Federal Reserve. Last week, we witnessed a clear uptrend in bond yields, suggesting increased demand for risk amid more upbeat economic reports. At the same time, we see a sharp deterioration in China's economy, which, on the contrary, points to slowing demand. This dilemma may be resolved after the release of the PMIs, so we can expect increased volatility.

EUR/USD

The final estimate confirmed that the euro area annual inflation rate was 5.3% in July 2023, with core inflation unchanged at 5.5%. Since there are no seasonal factors that could explain the price increase at the moment, it would be best to assume the most obvious explanation - price growth is supported by broad price pressures in the growing services sector.

Stubborn inflation supports market expectations that the ECB will raise rates in September, and this increase is already reflected in current prices. The strong labor market is also in favor of a rate hike.

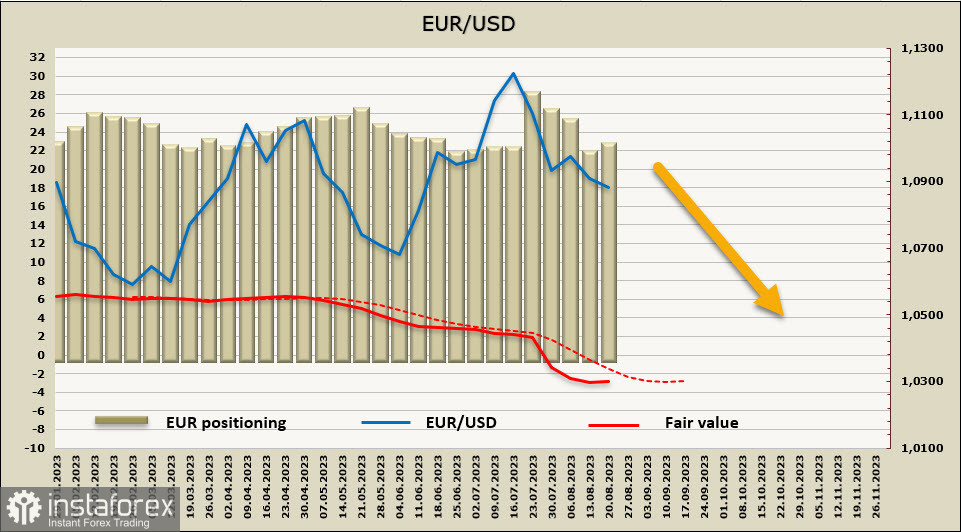

After a sharp decrease a week earlier, the net long position in the euro grew by $1.275 billion, putting the bearish trend into question. The settlement price is below the long-term average, giving grounds to expect a continuation of the euro's decline, but the momentum has noticeably weakened.

A week earlier, we assumed that the bearish trend would continue. Indeed, the euro consistently passed two support levels, but did not reach the 1.0830 level. The resistance at 1.0960, which the euro can reach if a correction develops, is still considered in the long term. We assume that the trend remains bearish, and the 1.0830 level will be tested in the short term.

GBP/USD

Inflation in July fell from 7.9% to 6.8%. This is mostly due to the fall in the marginal price of OFGEM (Office of Gas and Electricity Markets) from 2500 pounds to 2074. Without this decline, inflation would have still fallen, but much less - to 7.3%.

Despite the sharp decline, inflation remains at a very high level, and further falls in the marginal price of energy carriers are unlikely. The NIESR Institute suggests that, among the possible scenarios for future inflation behavior, we should choose between "very high", assuming an average annual inflation of around 5% over 12 months, and "high persistence", which is equivalent to an annual level of 7.4%. Needless to say, both scenarios imply inflation higher than in the US, so the likelihood of a higher BoE rate remains, leading to a yield spread in favor of the pound.

These considerations do not allow the pound to fall and support it against the dollar, while against most major currencies, the dollar continues to grow.

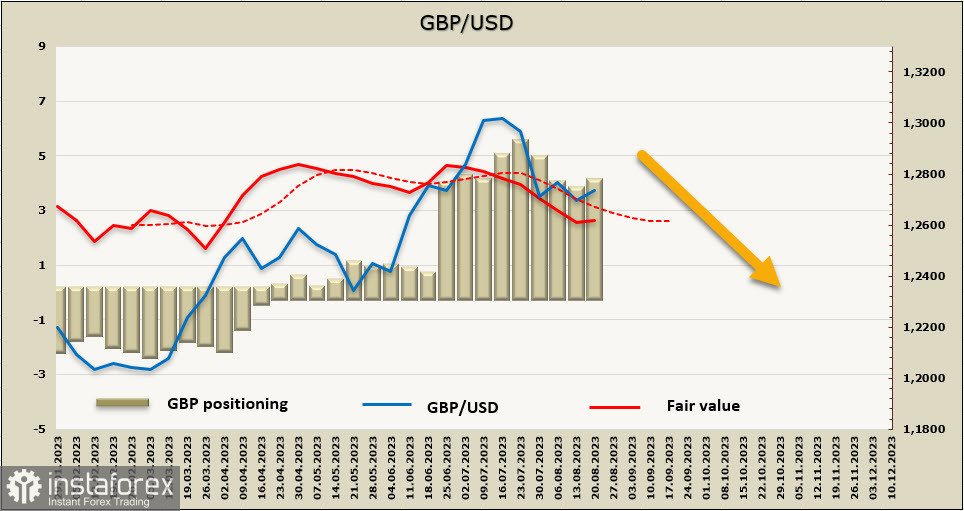

After three weeks of decline, the long position in GBP grew by $302 million to $4.049 billion. Positioning is bullish, the price is still below the long-term average, but, as in the case of the euro, an upward reversal is emerging.

In the previous review, we assumed that the pound would continue to decline, but UK inflation pressure remains stubborn, which changed the rate forecast and supported the pound. A correction may develop, and the nearest resistance level is 1.2813. If the pound goes higher, the long-term forecast will be revised. At the same time, we still consider the bearish trend, and the chances of restoring growth are high, with the nearest target being the support area of 1.2590/2620.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română