Long-term perspective.

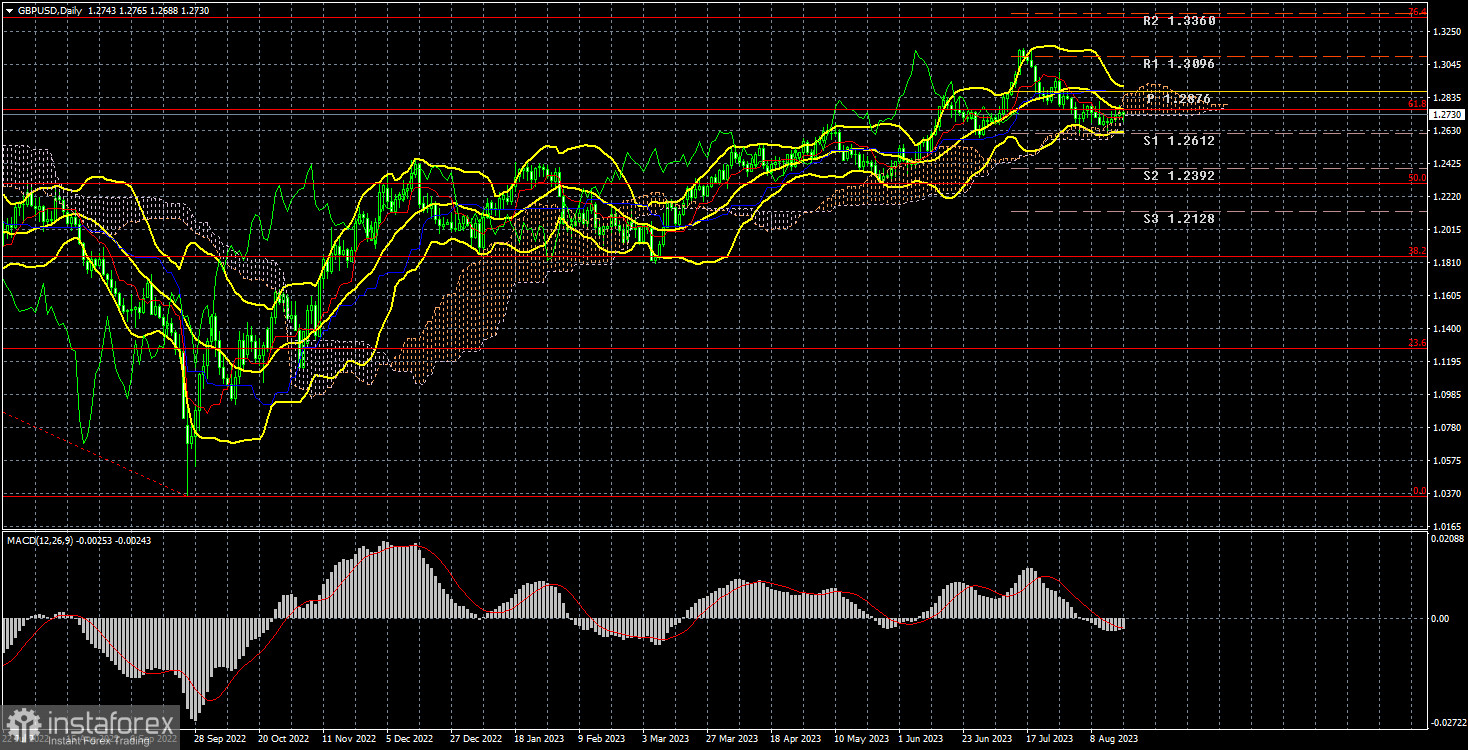

The currency pair GBP/USD showed no movement during the current week. In the 24-hour time frame, it isn't easy to notice any movement of the pair, as the candles are minimal in size. Having reached the lower border of the Ichimoku cloud, which has always been close to the price in 2023, the downward movement stopped. And now the pair is in a stalemate. The market needs to be ready to sell the pound, but there is no basis for its new growth. Therefore, the conclusion can be made as follows: there are no longer any technical reasons for selling over the past week. The fact that the price has crossed the critical line is good. But look at the movement of the pair over the past eight months! There have been plenty of such crosses of the Kijun-sen line, and the upward trend resumed each time. However, the price has never settled below the Senkou Span B line. Therefore, we should now proceed from the Senkou Span B line.

An important point – the Ichimoku cloud rose last week, so as the value of the line, we suggest using the level of 1.2567, not 1.2720. There were plenty of macroeconomic statistics in the UK this week. Early in the week, it became known that the unemployment rate rose to 4.2%, the number of claims for unemployment benefits increased, not decreased (as the market expected), and wages grew much stronger than forecasted, which could cause a new spike in inflation. The market "saw" only the wage report, which increases the likelihood of a more significant rate hike by the Bank of England in the future, and considered unemployment secondary news, which, in our opinion, is wrong. The market again worked off the positive factor for the pound and disregarded the negatives.

Also, this week, reports on inflation in the UK were released, which announced a decrease in the main indicator to 6.8%, fully in line with forecasts. The pound could continue to fall as inflation is also falling. Still, the core inflation indicator did not decrease in July (although traders expected it to fall by 0.1%) and now exceeds the value of the main inflation - 6.9%. Perhaps the pound continues to hold so high precisely because the market expects new "hawkish" measures from the British regulator.

COT Analysis.

According to the latest report on the British pound, the "Non-commercial" group opened 7.3 thousand buy contracts and 3.3 thousand sell contracts. As a result, the net position of non-commercial traders increased by 4 thousand contracts for the week. The net position indicator has steadily increased for the past 11 months, and the British pound has risen. We are approaching the point where the net position has grown too much to expect further growth of the pair. A protracted decline of the pound should begin. COT reports allow for some slight strengthening of the British currency, but it is becoming harder and harder to believe in it daily. It's difficult to say on what basis the market can continue buying. Slowly, sell signals are appearing on 4-hour and 24-hour timeframes.

The British currency has risen 2800 points from its absolute lows reached last year, which is a lot. With a strong downward correction, continuing growth would be logical. However, the pair has not been following logic for a long time. The market unilaterally perceives the fundamental background: many data in favor of the dollar are ignored. The "Non-commercial" group currently has 90.5 thousand contracts open for purchase and 39.5 thousand contracts for sale. We are still skeptical about the long-term growth of the British currency, and the market has recently started to pay little attention to sales.

Trading plan for the week of August 21 – 25:

- The pound/dollar pair is trying to form a new correction. Each new attempt at correction looked pitiful, but this time we will see a move below the Ichimoku cloud. The price is above all lines of the Ichimoku indicator (except the critical one). Securing the price above the Kijun-sen line will indicate a possible resumption of the upward trend. The growth may be chaotic, weak, inertial, or illogical. The target is the 76.4% Fibonacci level of 1.3330.

- As for sales, there currently needs to be technical grounds for them. The price settled below the Kijun-sen line, but the Senkou Span B line is nearby. Selling on such a strong upward trend is dangerous, but buying without understanding why the pound is growing and when its "fairytale" will end is also questionable. The situation is unusual and frankly deadlocked. It is best to wait for the price to settle below 1.2567. Then we can talk about breaking the upward trend.

Explanations for the illustrations:

Price support and resistance levels, Fibonacci levels – levels that are targets when opening purchases or sales. Take Profit levels can be placed near them.

Indicators: Ichimoku (standard settings), Bollinger Bands (standard settings), MACD (5, 34, 5).

Indicator 1 on COT charts – net position size for each trader category.

Indicator 2 on COT charts – net position size for the "Non-commercial" group

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română