EUR/USD

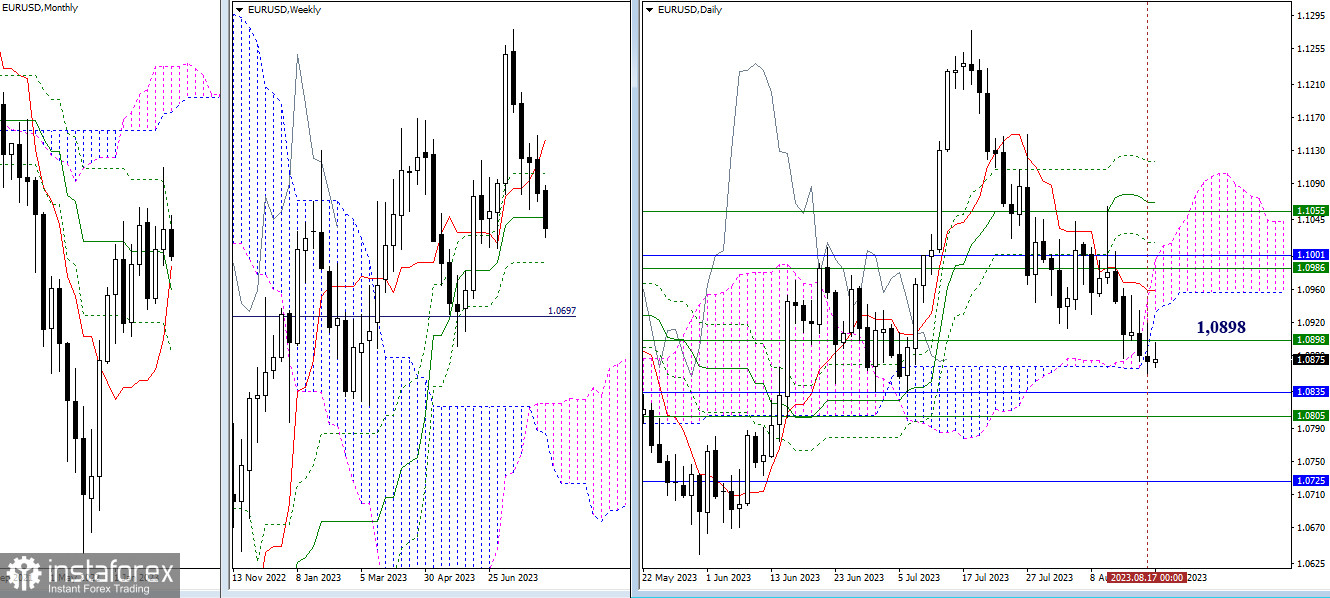

Higher Timeframes

Over the past 24 hours, the pair closed below the daily cloud and the weekly medium-term trend (1.0898). Consolidation at these positions will allow us to outline new opportunities to strengthen bearish sentiments. Meanwhile, the current downward tasks include the liquidation of the weekly golden cross in the Ichimoku cloud (1.0805) and testing the monthly support levels (1.0835 - 1.0725). A change in sentiment and a show of activity by bullish players can quickly lead to a loss of 1.0898, after which the result will be of interest when testing the daily short-term trend (1.0960) and returning to the daily cloud.

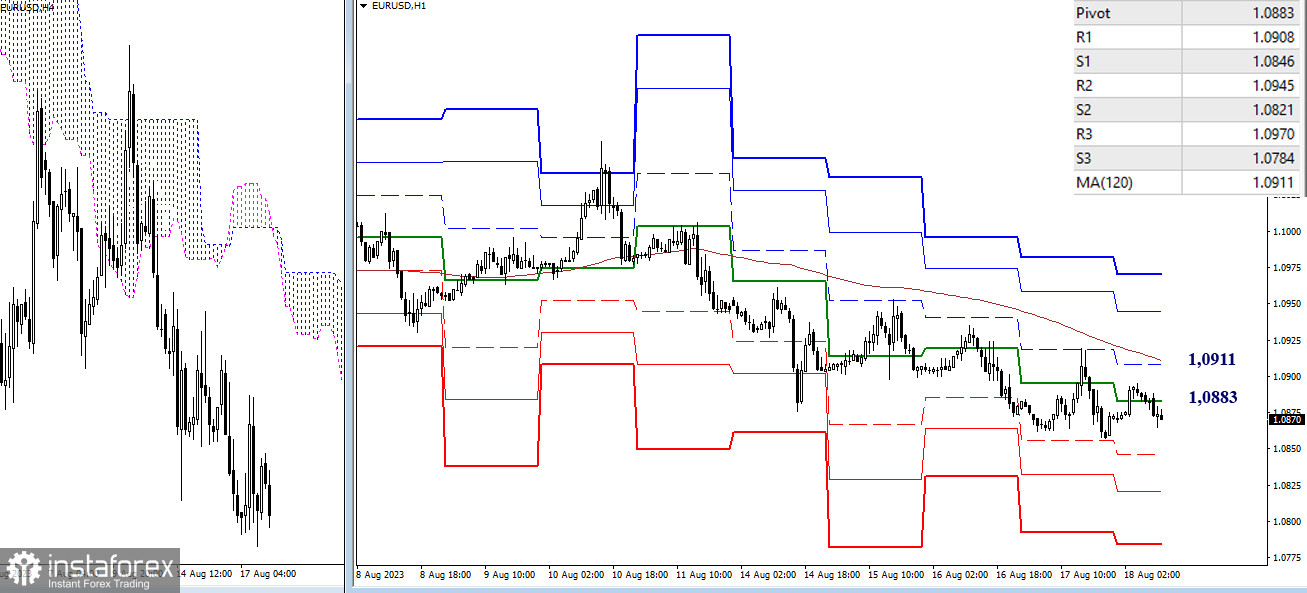

H4 - H1

Currently, the main advantage on the lower timeframes belongs to the bears. The benchmarks for the development of today's decline are at 1.0846 - 1.0821 - 1.0784 (support levels of classic pivot points). The key levels at this time are in the range of 1.0883 - 1.0911 (central pivot point + weekly long-term trend). A break and consolidation above the key levels will change the current balance of power, with potential bullish targets at 1.0945 (R2) and 1.0970 (R3).

***

GBP/USD

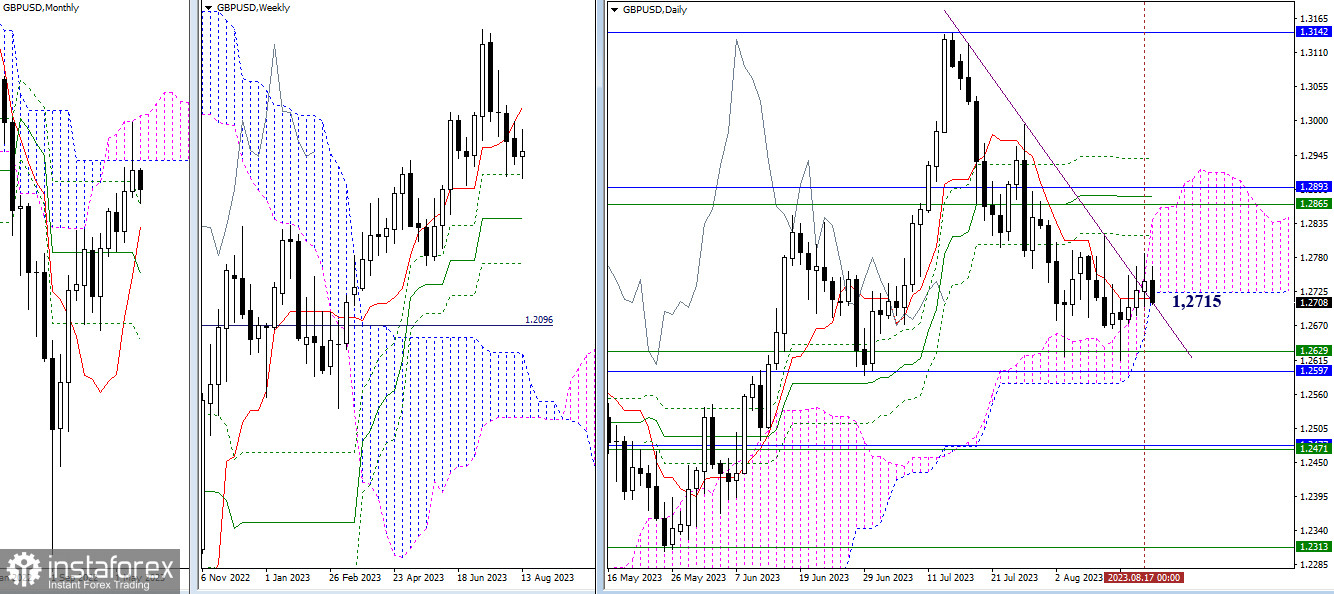

Higher Timeframes

The daily cloud and the short-term trend support the pair. The situation does not receive large-scale development, although there is a slight corrective rise. Levels 1.2597 - 1.2629 of the weekly and monthly timeframes currently serve as benchmarks for bearish players. While bullish targets today remain unchanged at 1.2816 - 1.2865 - 1.2893 - 1.2940 (levels of the daily Ichimoku cross + weekly short-term trend + lower boundary of the monthly cloud).

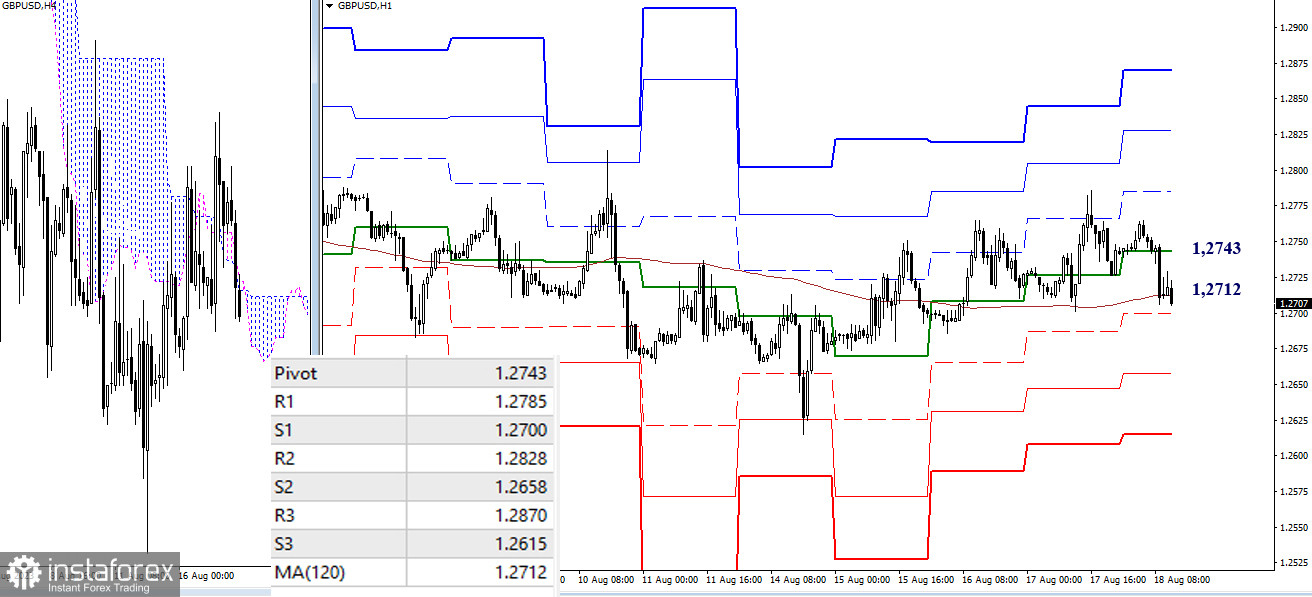

H4 - H1

On the lower timeframes, the weekly long-term trend (1.2712) is being tested again. The level determines the distribution of the balance of power. Working above it gives an advantage to bullish players. A decline and work below the weekly long-term trend will give an advantage to bearish players. The supports (1.2700 - 1.2658 - 1.2615) and resistances (1.2785 - 1.2828 - 1.2870) of classic pivot points serve as targets for intraday movement.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibo Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română