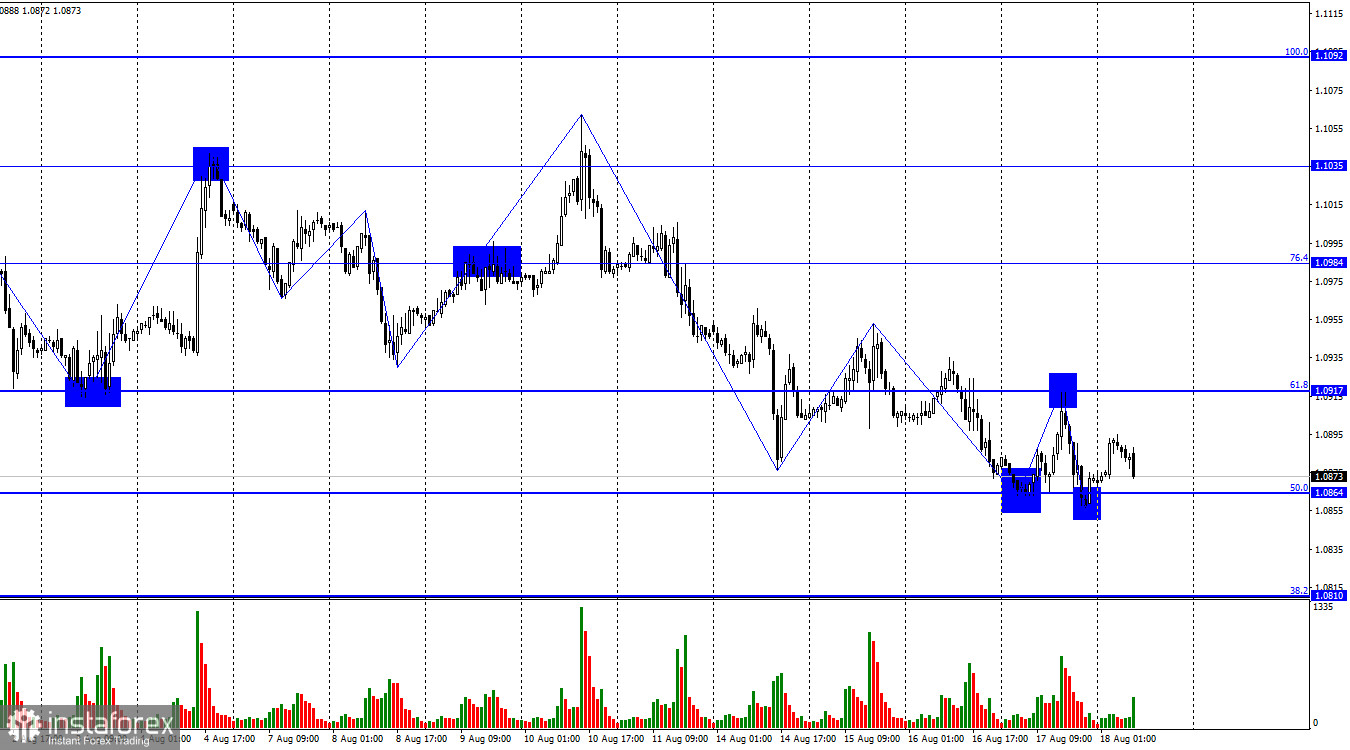

On Thursday, the EUR/USD pair rebounded from the corrective level of 50.0% (1.0864), reversed in favor of the European currency, rose to the Fibonacci level of 61.8% (1.0917), rebounded from it, and returned to the 1.0864 level. A new rebound from this level once again worked in favor of the EU currency, but this time the rise may be very weak, as the pair have already started to return to the rebound point. Fixing the pair's rate below the 50.0% level will favor continuing the quote decline toward the next corrective level of 38.2% (1.0810).

The waves continue to tell us only one thing: the trend is bearish. Yesterday's wave up did not break the last peak; the next wave down broke the last low. Thus, there are no signs of the end of the bearish trend. Such signs will appear if the 1.0864 level does not let the pair fall below it, or the quotes are fixed above the 1.0917 level.

What does the news background tell us? Yesterday's reports on unemployment benefit claims almost entirely coincided with traders' expectations. They cannot be called either strong or weak. Thus, the euro's rise in the first half of the day and the dollar's rise after lunch are unrelated to the news background. Today, the EU will release the inflation report for July, but traders have already been familiar with its value since two weeks ago, and today the final assessment will come out. I am not expecting a strong rise in the pair today, I am not expecting strong movements, and I am not expecting a change in traders' sentiment. The most likely event of the day is a fix below the 1.0864 level.

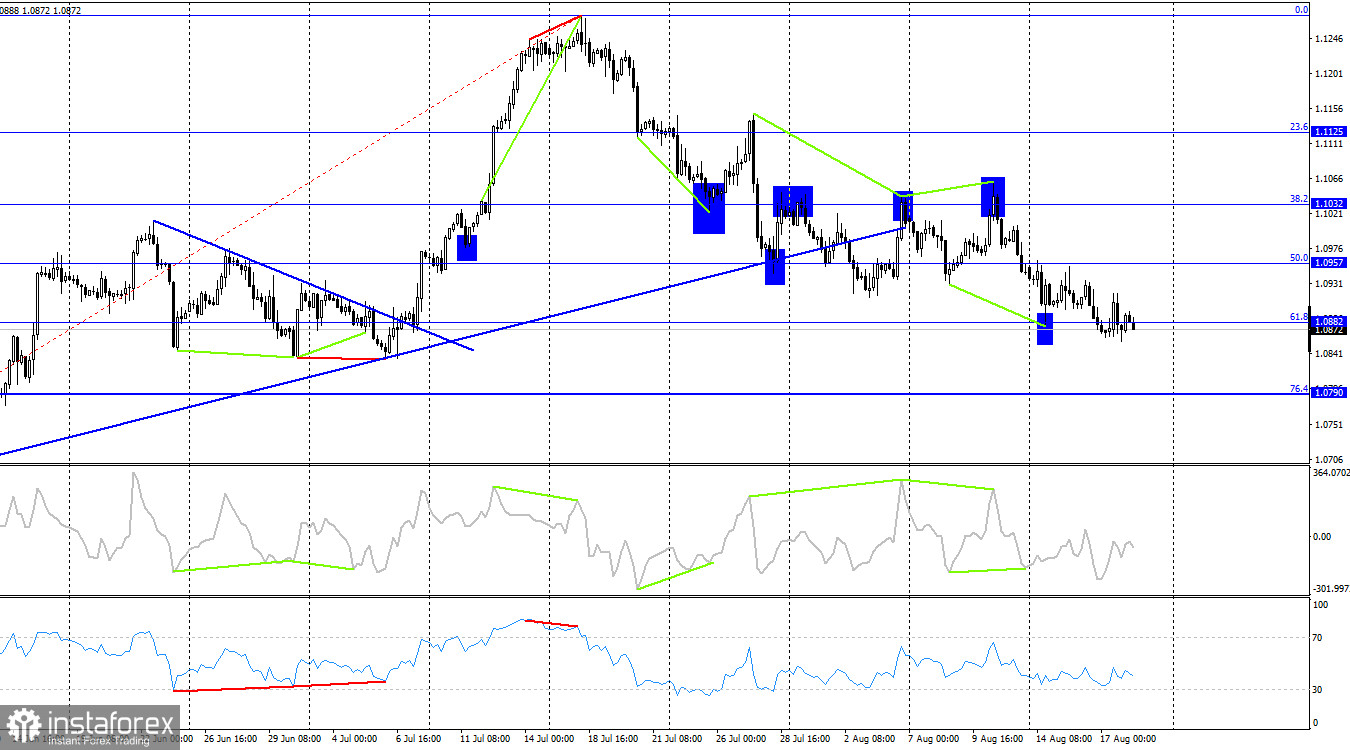

On the 4-hour chart, the pair consolidated below the ascending trendline and two rebounds from the Fibo level of 38.2% (1.1032). Thus, I expected a fall in the European currency to the corrective level of 61.8% (1.0882), and it happened. At the moment, quotes have already closed below this level, but on the hourly chart, they found support at the 1.0864 level. It is better to focus on the 1.0864 level today. No emerging divergences are observed at this time.

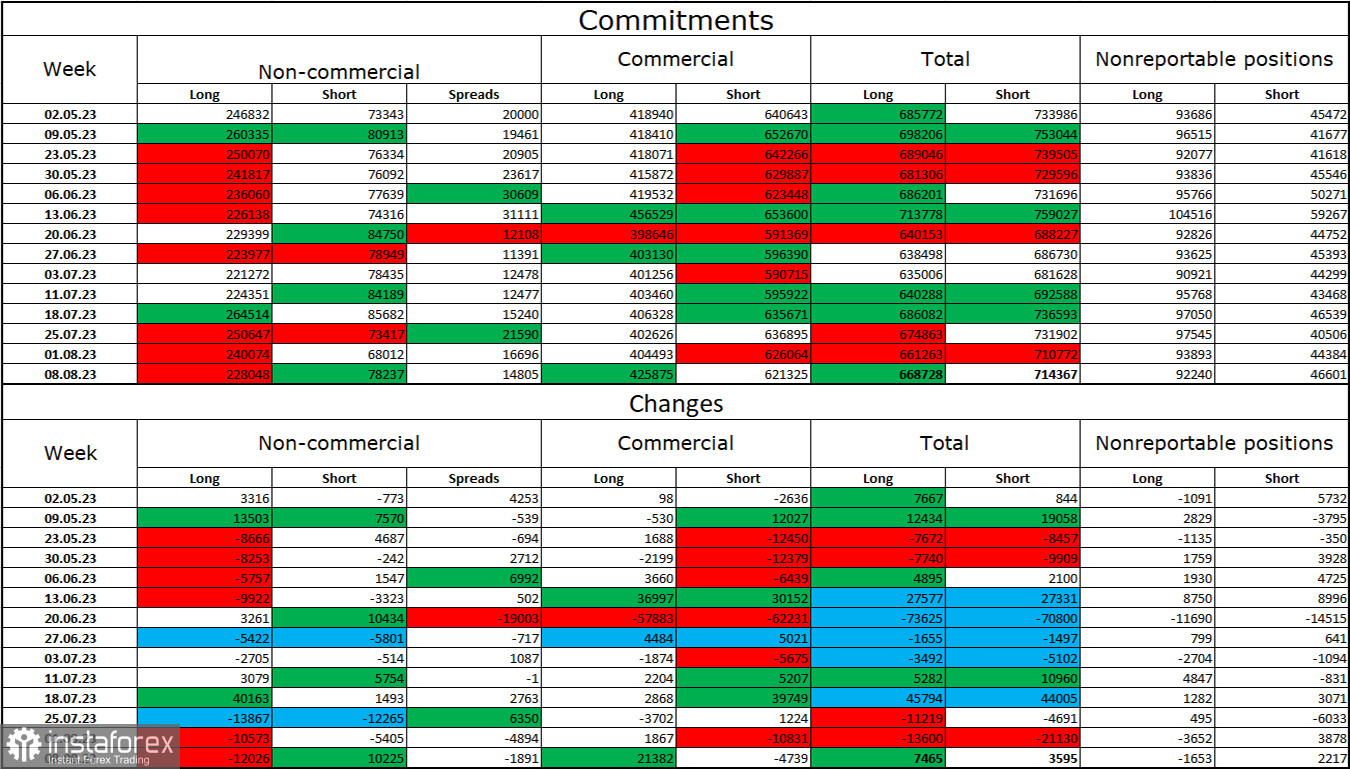

Commitments of Traders (COT) Report:

During the last reporting week, speculators closed 12,026 long contracts and opened 10,225 short contracts. The sentiment among large traders remains bullish but has weakened significantly over the past week. The total number of long contracts speculators hold now is 228,000, while short contracts are 78,000. The bullish sentiment persists, but the situation will change in the opposite direction soon. The high number of open long contracts suggests that buyers may continue to close them in the coming days – there is currently a strong bias towards bulls. The current figures allow for a continued decline in the euro in the coming weeks. The ECB is increasingly signalling the end of the quantitative easing tapering process.

News Calendar for the US and the European Union:

European Union – Consumer Price Index (CPI) (09:00 UTC).

On August 18th, the economic events calendar contains only one entry that could be more important. The impact of the information background on traders' sentiment throughout the day will be very weak or nonexistent.

Forecast for EUR/USD and advice for traders:

New sales can be recommended upon a rebound from the 1.0917 level on the hourly chart or a close below the 1.0864 level on the same chart. In the first case, the target will be 1.0864; in the second case, it will be 1.0810. Purchases are possible on a rebound from 1.0864, with a target of 1.0917.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română