Overview of yesterday's market and trading tips

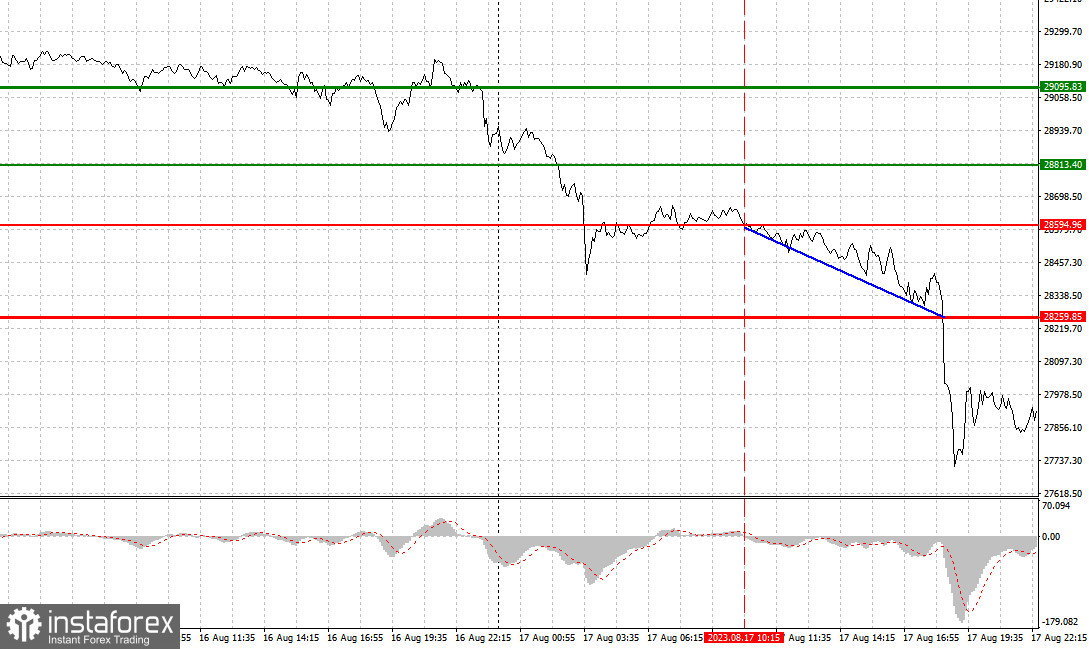

The price test of 28,594 came at a time when the MACD was in the negative zone at the beginning of the indicator's downward movement, which confirmed the correct signal to sell Bitcoin, especially on the back of sluggish buying activity lately. As a result, the price fell to 28,259, where I advised taking profits.

After breaking through some important support levels early in the week, Bitcoin has been hit by its biggest sell-off recently. There are rumors that Elon Musk sold SpaceX's corporate Bitcoin holdings worth $373 million, purchased in 2021-2022. It was the catalyst for the sell-off. As a result, $1 billion worth of traders' positions have been terminated over the past 24 hours, affecting 175,000 traders. Apparently, the current bear market is not over yet, since it is too premature to expect robust BTC buying until the news that the Fed is ready to complete its aggressive rate hike campaign. I bet on a further fall of the trading instrument. I would follow scenario No. 1.

Buy signal

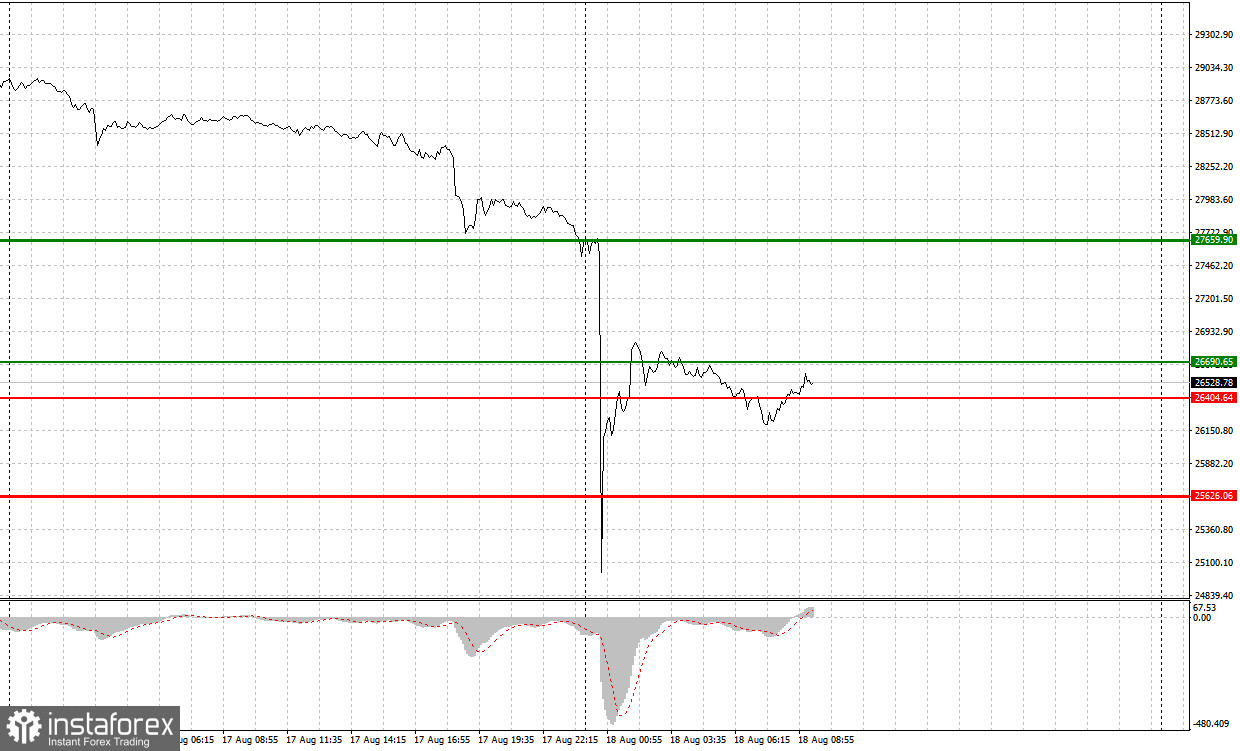

Scenario #1: You can buy Bitcoin today when the price reaches the entry point around 26,690 (green line on the chart) with the aim of rising to the level of 27,650 (thicker green line on the chart). In the area of 27,650, I recommend exiting buy positions and opening sell positions in the opposite direction. Traders could hardly count on the strong growth of Bitcoin today. So, it is better to trade on the decline after the price updates new lows. Important! Before buying, make sure that the MACD indicator is above zero.

Scenario #2: You can also buy Bitcoin today in case the price of 26,404 is tested two times in a row. This will limit the downward potential of the instrument and encourage an upward reversal of the market. We can expect growth to opposite levels 26,690 and 27,695.

Sell signal

Scenario #1: Selling Bitcoin today is possible only after the level of 26,404 is updated (red line on the chart). Once a new low is printed, this will lead to a rapid decline in the trading instrument. The key target of the sellers will be the level of 25,626, where I recommend exiting short positions, as well as opening long positions immediately in the opposite direction. Bitcoin will remain under selling presure. Important! Before selling, make sure that the MACD indicator is below zero.

Scenario #2: Another option is to sell Bitcoin today in case of two consecutive tests of the price of 26,690. This will limit the upward potential of the trading instrument and lead to a downward reversal of the market. We can expect a decline to the opposite levels of 26,404 and 25,626.

What's on the chart:

The thin green line is the entry price at which you can buy the trading instrument.

The thick green line is the price where you can set Take-Profit (TP) or manually fix profits, as further growth above this level is unlikely.

The thin red line is the entry price at which you can sell the trading instrument.

The thick red line is the price where you can set Take-Profit (TP) or manually fix profits, as further decline below this level is unlikely.

MACD line: it is important to be guided by overbought and oversold areas when entering the market

Important: Novice traders in the cryptocurrency market need to be very cautious when making decisions to enter the market. It is best to stay out of the market before important fundamental reports are released to avoid getting caught in sharp price fluctuations. If you decide to trade during news releases, always place stop orders to minimize losses. Without setting stop orders, you can quickly lose your entire deposit, especially if you don't use money management and trade with large volumes.

Remember, for successful trading, it is necessary to have a clear trading plan, similar to the one I presented above. Spontaneously making trading decisions based on the current market situation is inherently a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română