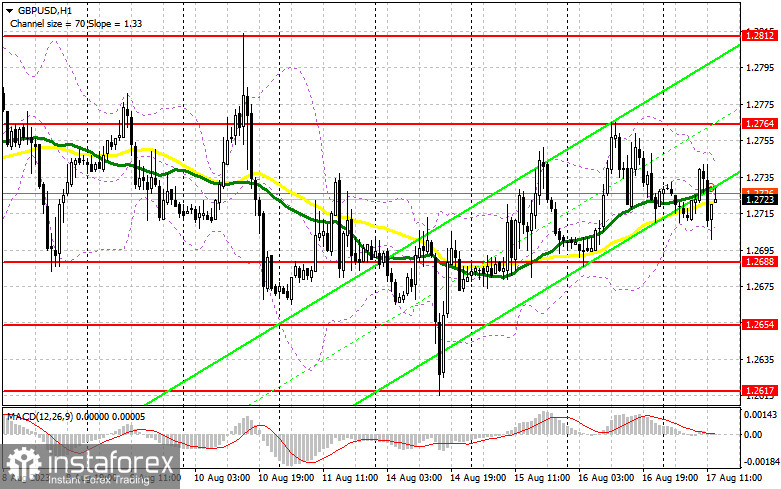

In my morning forecast, I drew attention to the 1.2723 level and recommended making market entry decisions based on it. Let's take a look at the 5-minute chart and see what happened. Trading around this level did not provide suitable entry points, so the technical picture for the second half of the day was completely revised.

Requirements for opening long positions in GBP/USD:

Due to low volatility and volume, it has become increasingly difficult to trade the pound recently. Amid expectations of weak market statistics and initial US unemployment benefit claims, demand for the pound may return, leading to a renewal of yesterday's high. If the data shows a decrease in claims and the Philadelphia Fed's manufacturing index rises, the GBP/USD will likely drop. In that case, I will only act around the nearest support of 1.2688. Forming a false breakout at this level will provide an excellent entry point with a growth target to resistance at 1.2764, formed based on yesterday's results. A breakthrough and a top-down test of this range against the backdrop of weak US data will create an additional buying signal, strengthening the pound and allowing it to reach a new high of 1.2812. In case of a move above this range, we can discuss a surge to 1.2847, where I will fix profits.

In the event of a GBP/USD decline and a lack of buyers at 1.2688 in the second half of the day, especially if there are strong US labor market data, pressure on the pair will only increase, leading to a more significant sell-off. If this happens, I will postpone long positions to 1.2654. There will be purchases only on a false breakout. Immediate rebounds for opening long positions on GBP/USD can occur from 1.2617, with a correction target of 30-35 points within the day.

Requirements for opening short positions in GBP/USD:

The bears could not do anything in the first half of the day, keeping trade within a sideways channel. Only a false breakout around 1.2764 after the release of the US labor market reports will create a sell signal, aiming to decrease to the nearest support at 1.2688, formed based on yesterday's results. A breakthrough and a bottom-up test of this range will provide an entry point for sale, targeting a renewal of 1.2654. A further target will be the 1.2617 area, where I will fix profits. In the event of GBP/USD growth and a lack of bears at 1.2764 in the second half of the day, bulls will regain market control, leading to an ascending correction. In this case, only a false breakout in the area of the next resistance at 1.2812 will form an entry point for short positions. In the absence of activity there, I also advise selling GBP/USD from 1.2847, aiming for a pair rebound down 30-35 points within the day.

Indicator Signals:

Moving Averages

Trading occurs around the 30 and 50-day moving averages, indicating a sideways market.

Note: The author considers the period and prices of the moving averages on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decrease, the lower boundary of the indicator at around 1.2710 will act as support.

Indicator Descriptions

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

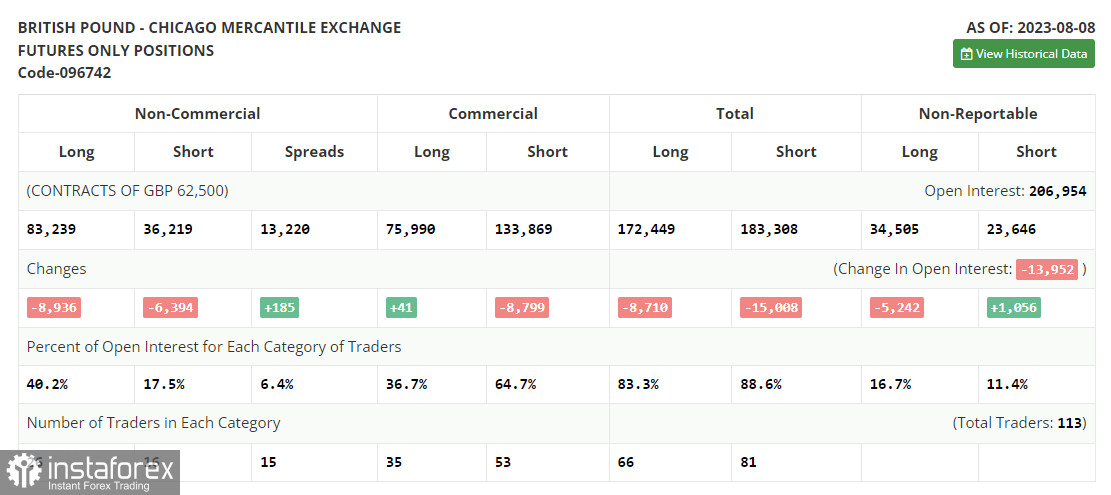

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions that use the futures market for speculative purposes and meet certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between non-commercial traders' short and long positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română