The July budget deficit came in at $220.78 billion. The deficit amounted to $1.613 billion in the first 10 months of the 2023 fiscal year, more than doubling the previous year's figure.

Against this background, the Treasury will be forced to issue more interest-bearing debt securities. This increase in the supply of government bonds in the market will occur at a time when the Federal Reserve keeps tightening monetary policy, leading to an oversupply, which in turn will result in higher yields.

If the US is able to avoid a recession, which is the most likely scenario, risk-on sentiment will improve, thus triggering a sell-off in short-term government bonds. Everything goes to the fact that US Treasury yields will rise, contributing to stronger demand for the dollar.

Of course, with higher yields and a simultaneous increase in the budget deficit, servicing debt will become more burdensome. However, it is not yet clear when problems arise, but yields are already rising. Therefore, demand for the greenback is likely to increase in the short term.

USD/CAD

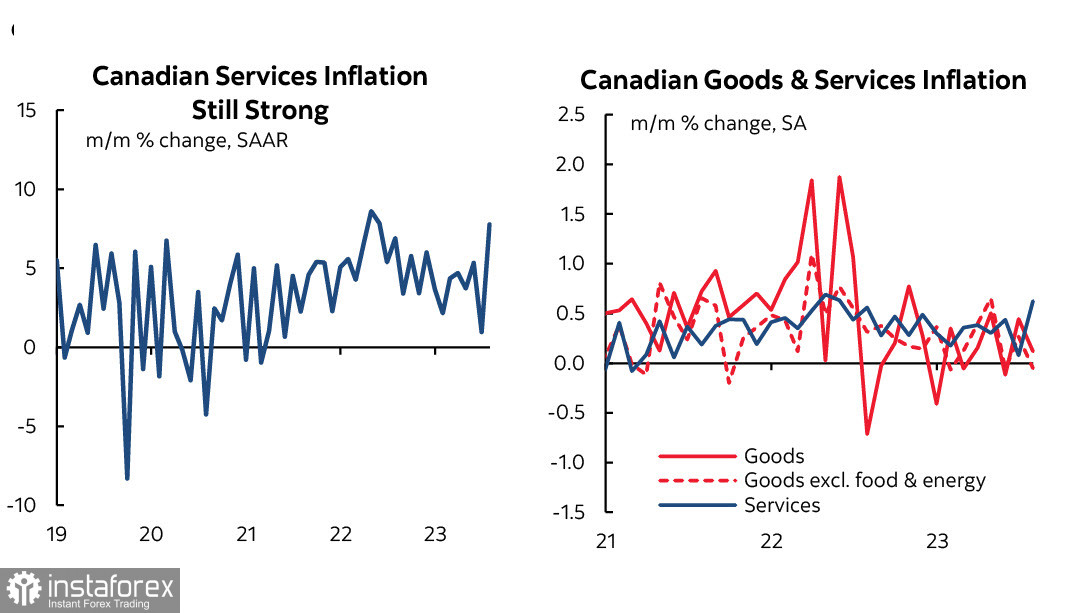

Canada's inflation in July exceeded estimates across all metrics. The core consumer price index remained unchanged at 3.2% year-over-year, while economists expected a decline to 2.8%. The overall index rose to 3.3% from 2.8%. Combined with strong wage data and falling productivity, this means that inflation risks remain extremely high. What is particularly alarming is a sharp rise in consumer prices in the services sector.

The yield of 10-year Canadian bonds exceeded 3.8%, setting another record. Moreover, there is every reason to assume that it will continue to grow. Now markets are betting on a rate hike at the meeting on September 6 and another increase by the end of the year. The Bank of Canada seems to be losing the battle against inflation. A wait-and-see approach may cause another surge in inflation, and the lagging impact of previous rate hikes may be weaker than that of forecasts. If the Bank of Canada waits for lagging effects, it may face wages and expectations getting out of control.

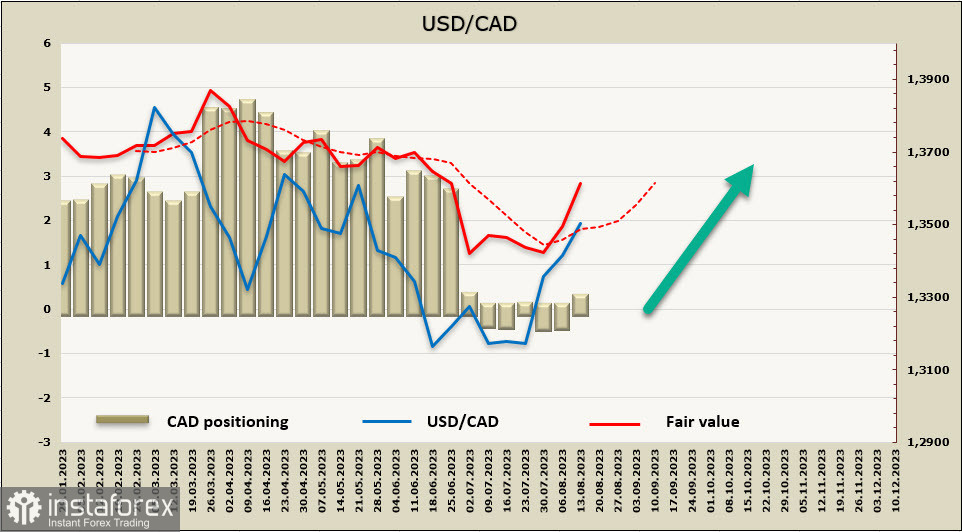

The weekly change for the Canadian dollar is -526 million. The accumulated advantage of long positions has been offset. By the end of the reporting period, the net short position stood at -46 million. market positioning is neutral, but the price continues to post sharp gains.

The USD/CAD pair has hit a 2.5-month high and is likely to extend gains. The upper boundary of the corrective bearish channel at 1.3690/3720 can be seen as a target.

USD/JPY

Exiting a negative rate policy is the next step for the Bank of Japan. At its July meeting, the regulator announced "greater flexibility" in its Yield Curve Control (YCC) program. However, it consistently avoided describing this shift either as a revision of QQE or as part of a process ultimately leading to an exit. The decision is aimed at "patiently continuing with monetary easing while nimbly responding to both upside and downside risks," BOJ Deputy Governor Uchida stated on August 2. In his speech, Uchida publicly outlined the next two steps: a formal abandonment of YCC and an end to the bank's negative interest rate policy.

At the moment, the Bank of Japan is far from achieving its 2 percent inflation target, so it will most likely maintain its current monetary policy.

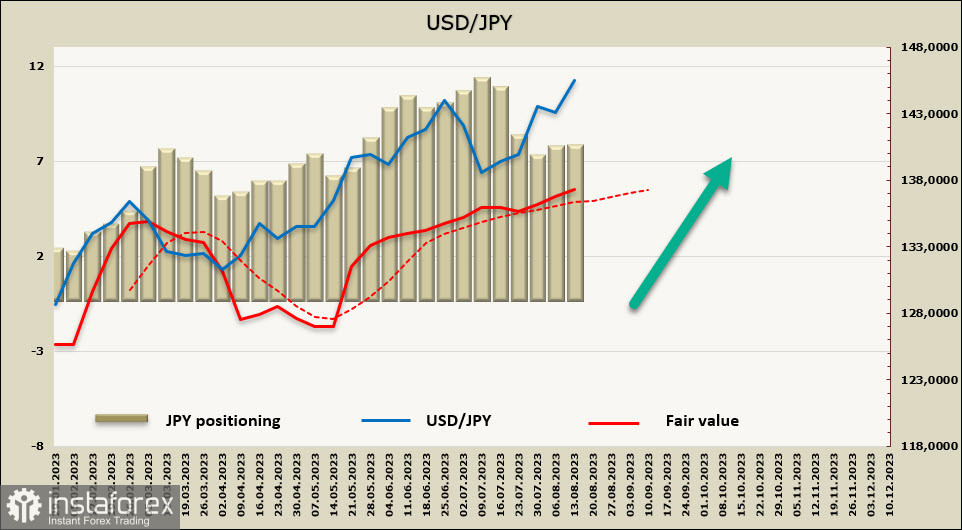

Stocks and bonds are falling amid rising US bond yields. As the yield gap increases, the yen loses value. The first interest rate cut by the Federal Reserve is still beyond confident forecasts. This means that the yield spread factor will continue to put pressure on the yen for a long time to come.

The net short position on the Japanese yen increased by 344 million over the reporting week, reaching a volume of 7.252 billion. At the same time, the price continues to move up.

The USD/JPY pair has hit a 9-month high. And there are no signs of a bearish reversal. The pair is expected to extend gains, heading for the channel boundary of 147.50/80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română