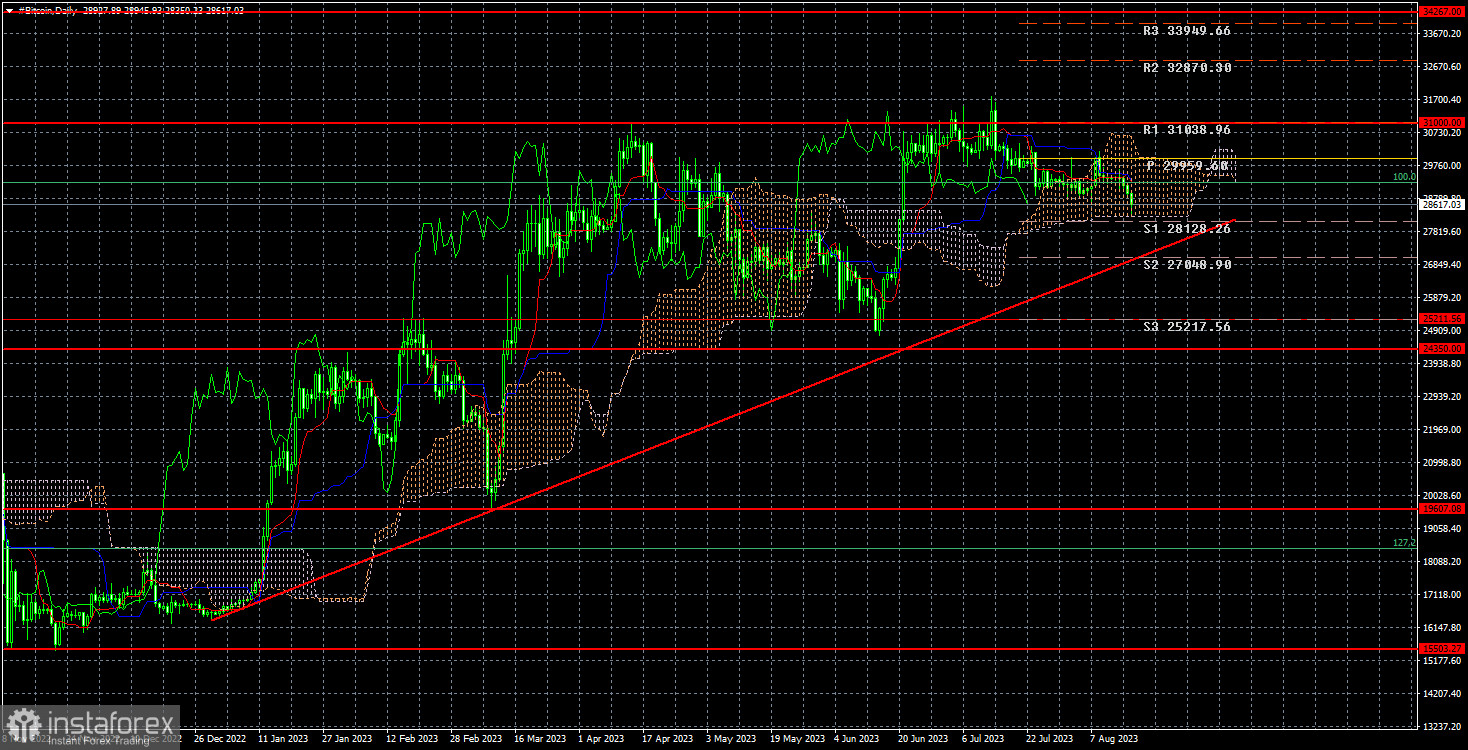

As anticipated, Bitcoin resumed its downward movement in the past day. After reaching the $31,000 level, we have observed a sideways movement for several months. First, the flat was seen below the $31,000 level, then a couple thousand dollars lower, and now the price has gone even lower. The second sideways channel in the 4-hour timeframe has also been abandoned, increasing the chances of a further drop. On the daily timeframe, the cryptocurrency has already touched the Senkou Span B line, which could become an insurmountable barrier. Still, we don't see any factors that could halt Bitcoin's decline. However, as always, we should be prepared for any developments. A strong rebound from the lower edge of the Ichimoku cloud could signal a buying opportunity. But it would be preferable for this signal to be confirmed within the 4-hour timeframe.

As Bitcoin continues to correct, Mark Yusko, the CEO of Morgan Creek Capital, has stated that Bitcoin will be worth $150,000 per coin next year. As justification for his opinion, Yusko cited the upcoming halving and SEC approval of a Bitcoin ETF, which have yet to occur. According to Yusko, SEC approval of a Bitcoin ETF alone could drive Bitcoin to $100,000. The fact that a similar instrument has already been launched in Europe and that Bitcoin is falling needs to be considered. Yusko also noted that the fair value of Bitcoin at the moment is $55,000 without explaining why. In his opinion, each new halving should result in a tenfold increase in Bitcoin's value.

Our opinion is as follows. Bitcoin may resume forming a "bullish" trend because the trend line on the 24-hour timeframe is still relevant. The price may rebound from it or the Senkou Span B line, leading to new growth. However, halving is not necessarily a driver for even a twofold increase, and the expected easing of the Fed's monetary policy has already been priced. The global financial crisis predicted by Robert Kiyosaki is mere coffee-ground fortune-telling. You can claim it is about to happen, and you might guess right. So far, we don't see strong fundamental factors supporting Bitcoin. The SEC has already indicated that a decision on the Bitcoin ETF will be postponed to next year.

In the 24-hour timeframe, Bitcoin has rebounded again from the $31,000 level and begun a stronger downturn. As we mentioned earlier, the minimum target for the fall is the ascending trend line, which currently lies around the $27,000 level. This should be the target for selling the cryptocurrency until strong buy signals are received. The Senkou Span B line is strong, and a rebound may follow.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română