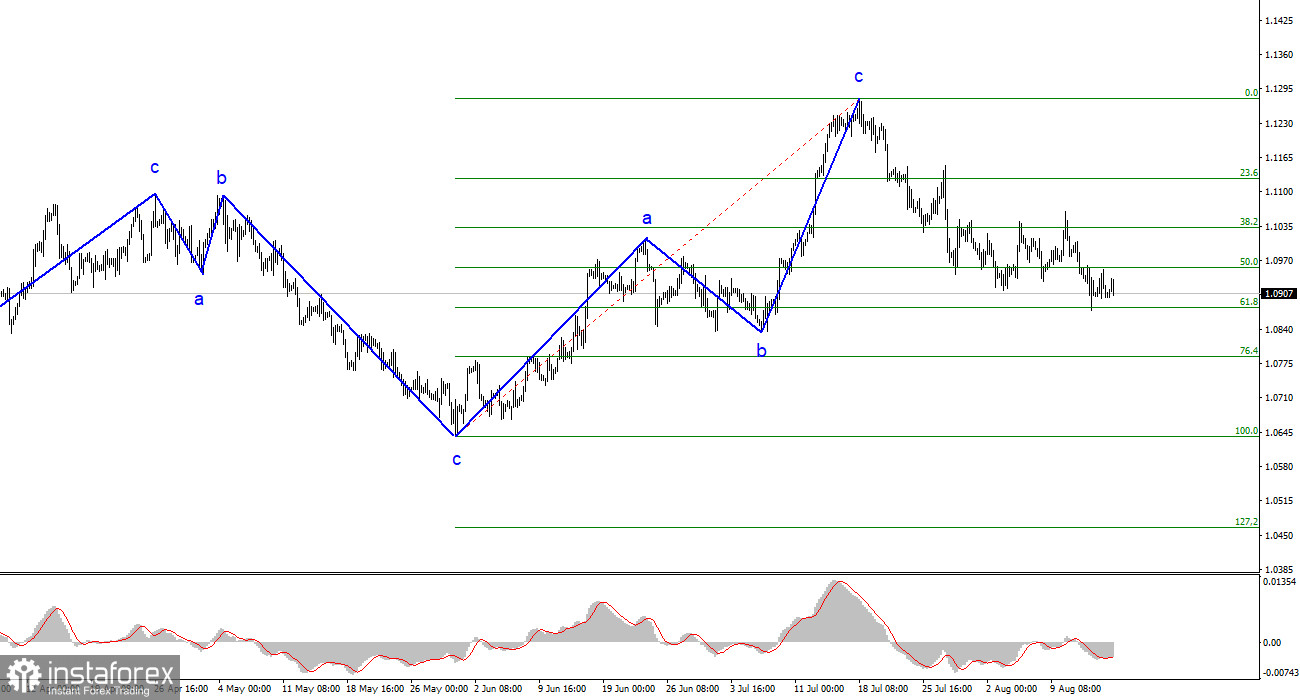

The wave analysis of the 4-hour chart for the EUR/USD pair remains quite clear. The entire ascending portion of the trend, which began construction last year, has taken on a complex structure, and over the past six months, we have only seen three-wave structures that alternate with each other. I have regularly mentioned that I expect the pair to approach the 5-figure mark, from which the construction of the last upward three-wave began. I stand by my words. The next upward three-wave structure has been completed, so the market is starting to build a downward trend segment.

Theoretically, the trend segment that began on May 31 could take on a five-wave appearance with the structure a-b-c-d-e, but the chances of this are getting slimmer each day. We will likely see another descending wave set, with a minimum of three waves. The news background is not strong enough for the euro currency (sometimes it is frankly weak), so demand for it remains consistently high. The unsuccessful attempt to break through the 1.1032 mark, corresponding to 38.2% according to Fibonacci, indicates the market's readiness to sell again.

There are no buyers on the market.

The EUR/USD exchange rate on Wednesday remained unchanged. However, underneath this "unchanged" situation, some rather interesting movements can be observed. It started with increased demand for the euro currency in the morning. This was supported by reports from the European Union on GDP and industrial production. GDP in the second quarter is growing by 0.3% (exactly in this formulation, because there will be three assessments of the indicator, and today the second one was released), and industrial production increased by 0.5% m/m in June. The forecast value for GDP was met, and industrial production exceeded it. Therefore, the production report could have triggered increased demand for the euro, adding about 30 basis points to the price.

In the second half of the day, the euro currency declined, unrelated to the news background. US reports began to be released later, and not all of them were published at this time. Therefore, the market began to increase demand for the dollar simply because it considered it necessary. Based on all the above, demand for the dollar continues to increase, which is fully consistent with my expectations as I forecast the construction of a downward trend segment. The pair are returning to the 1.0880 mark and will make another attempt to break through, which may be more successful. In this case, the decline of the pair will continue. At least three downward waves should be built, so I consider only the scenario with a decrease for the coming months.

General Conclusions

Based on the analysis, the construction of the upward wave set has been completed. I still consider targets in the range of 1.0500–1.0600 to be quite realistic, and with these targets, I advise selling the pair. The a-b-c structure looks complete and convincing. Therefore it is finished. Consequently, I advise selling the pair with targets around the 1.0836 mark and below. I believe the construction of the downward trend segment will continue, and a successful attempt at 1.0880 will indicate the market's readiness for new sales.

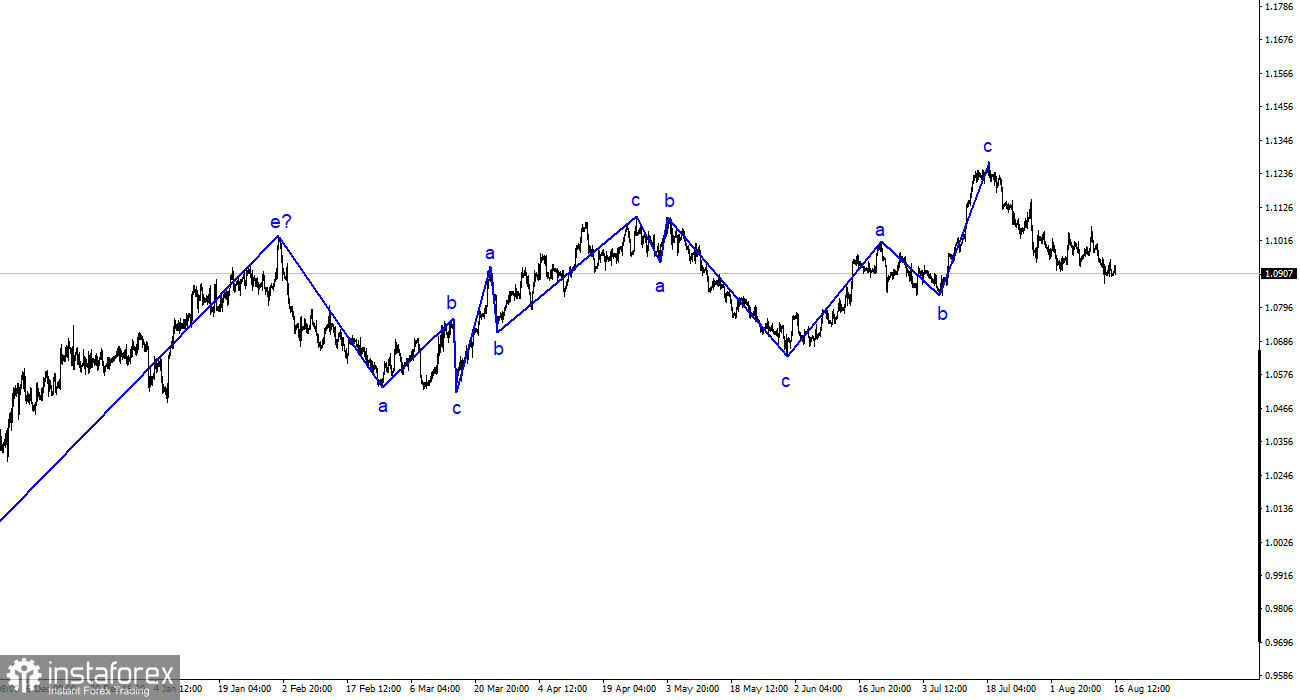

On the older wave scale, the wave marking of the ascending trend segment has taken on an extended form, but it is likely completed. We saw five waves upward, which most likely constitute an a-b-c-d-e structure. Subsequently, the pair built four three-wave structures: two down and two up. It has likely moved into the phase of building another downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română