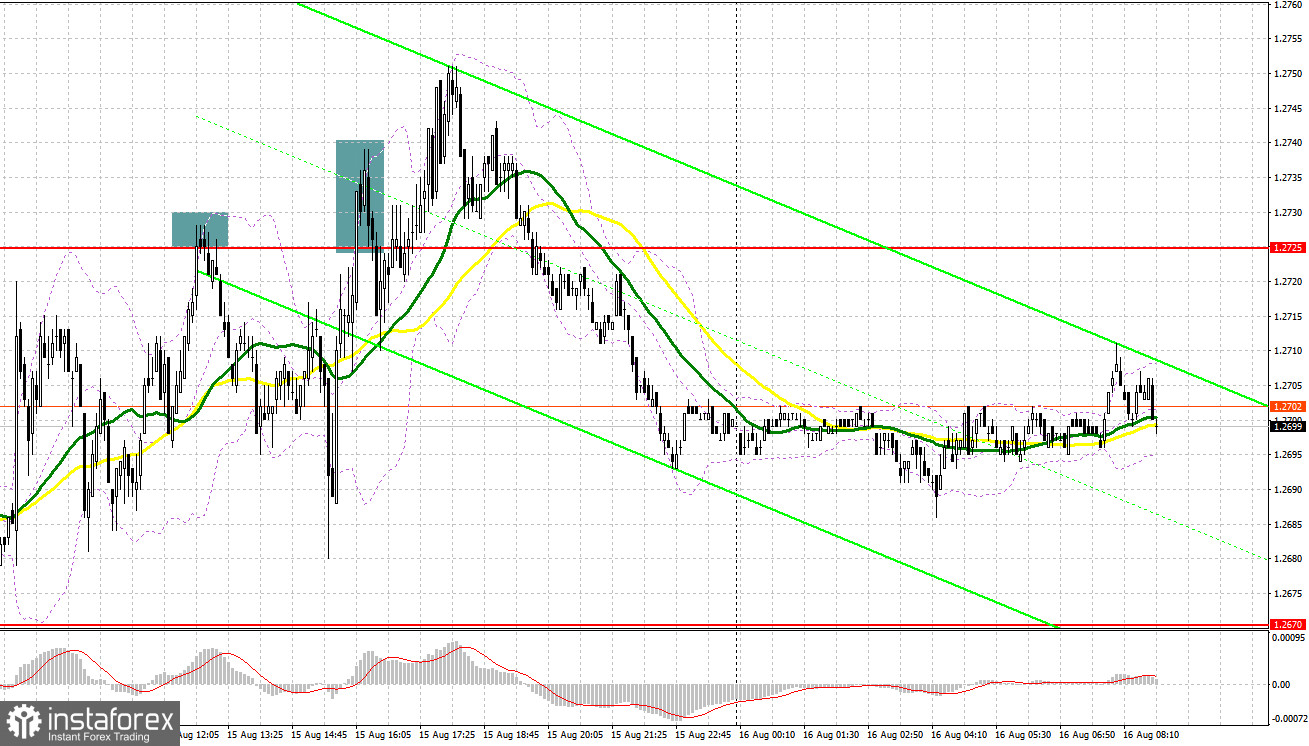

Yesterday, the pound/dollar pair formed several entry signals. Let's look at the 5-minute chart and figure out what actually happened. In my morning forecast, I turned your attention to the level of 1.2725 and recommended making decisions with this level in focus. Growth and a false breakout at this mark produced a sell signal. As a result, the pair fell by more than 40 pips. In the afternoon, a false breakout at 1.2725 did not provide a good result.

For long positions on GBP/USD:

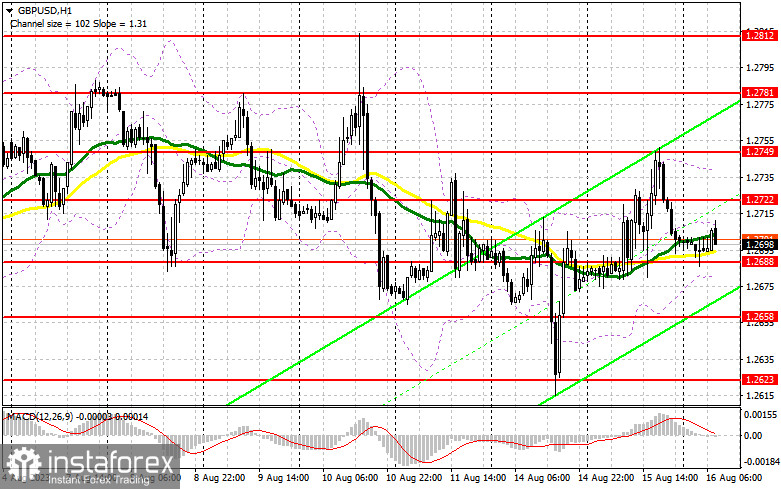

Yesterday's data on the sharp rise in average earnings in the UK only provided temporary support for the pound, afterwards, the pair was under pressure again. Today's UK inflation report turned out to be worse than economists' forecasts, which, as you can see on the chart, is already limiting the GBP/USD decline prospects as high price pressure, especially in the core index, persists. For this reason, long positions will be interesting today, but it is best to act on the downside all the way from the same support level at 1.2688, which is in line with the bullish moving averages. A false breakout on this mark will confirm the presence of big players in the market, which will produce a good buy signal and will lead to a breakout to the resistance at 1.2722. A breakout and consolidation above this range will give the bulls a boost, preserving the chances of building a correction with the next target at 1.2749 - yesterday's high. A more distant target will be 1.2781 where I will be taking profits.

If GBP/USD falls and there are no bulls at 1.2688, the pound will be under pressure. In this case, only the protection of 1.2658, as well as a false breakout on this mark, will create new entry points into long positions. You could buy GBP/USD at a bounce from 1.2623, keeping in mind an upward intraday correction of 30-35 pips.

For short positions on GBP/USD:

The pair is trading within the sideways channel, so bears will become more active, especially at its upper boundaries. An unsuccessful consolidation above 1.2722, the new intermediate resistance level, will produce a sell signal with a prospect of falling to 1.2688. A breakout of this level and its upward retest would significantly dent the bulls' positions, offering a chance for a more substantial decline towards the low of 1.2658. A more distant target will be the month's low at 1.2623 - the bulls' last hope.

If GBP/USD grows and there is no activity at 1.2722, which can happen given the inflation report, bulls will not regain full control of the pair, but they will get the chance to start an upward correction towards 1.2749. Only a false breakout at this mark would provide an entry point for going short. If there is no downward movement there, I would sell the pound right on a rebound from 1.2781, hoping for an intraday correction of 30-35 pips.

COT report:

The Commitments of Traders (COT) report for August 8th recorded a decline in both long and short positions. Traders have been closing their positions ahead of important UK GDP data, realizing that the Bank of England would continue to raise interest rates, no matter the cost. Good data on the British economy allowed the market to maintain balance, preventing a significant sell-off of the British pound last week, which was triggered by another increase in inflation in the US. However, the optimal strategy is to buy the pound on dips, as the difference in the policies of the central banks will affect the prospects of the US dollar, putting pressure on it. The latest COT report indicates that long positions of the non-commercial group of traders have decreased by 8,936 to 93,239, while short positions fell by 6,394 to 36,219. As a result, the spread between long and short positions increased by 185. The weekly closing price dropped to 1.2749 compared to the prior value of 1.2775.

Indicator signals:

Moving Averages

Trading is taking place around the 30-day and 50-day moving averages, indicating a sideways market trend.

Note: The period and prices of moving averages are considered by the author on the one-hour chart that differs from the general definition of the classic daily moving averages on the daily chart.

Bollinger Bands

If GBP/USD falls, the indicator's lower border near 1.2680 will serve as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română