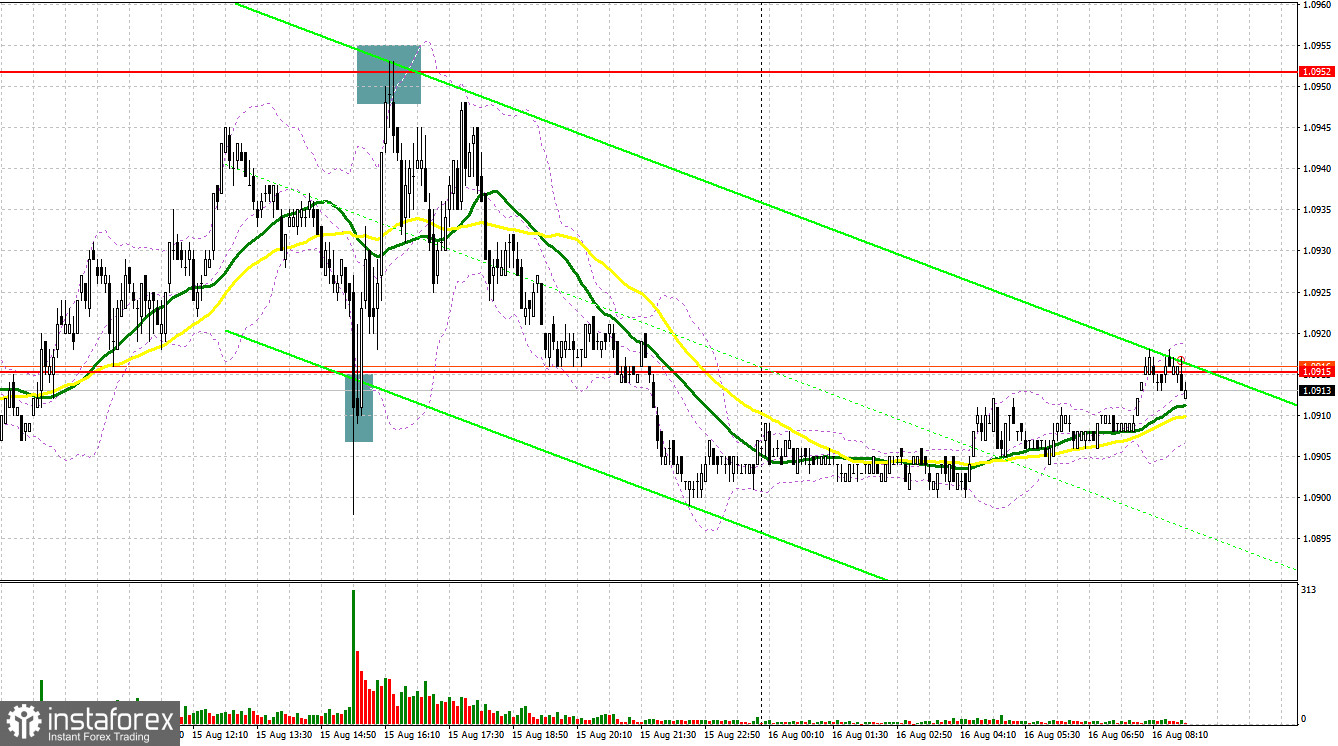

Yesterday, the pair formed several good signals to enter the market. Let's analyze what happened on the 5-minute chart. In my morning review, I mentioned the level of 1.0935 as a possible entry point. A rise to this level and its false breakout generated an excellent sell signal. However, the pair failed to develop a strong downward movement as the economic data from the eurozone and Germany in particular was quite positive. In the second half of the day, a false breakout of the 1.0915 level formed a signal to buy the pair and pushed the price all the way up to 1.0952 As bears showed their presence at this level, the euro eased and declined by more than 30 pips.

For long positions on EUR/USD

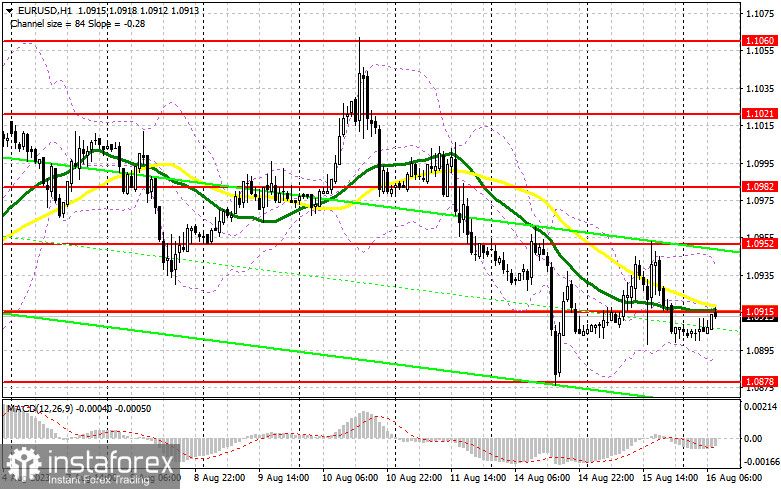

Yesterday's US retail sales data came in better than economists' forecasts, leading to a decline in the pair. However, the pressure on the euro was short-lived. In the first half of the day on Wednesday, we have crucial reports coming out regarding the eurozone's GDP change for the second quarter of this year, as well as the data on the eurozone's industrial production volume. It is most likely that the GDP estimate won't be revised, so I am anticipating a market reaction mainly to the industrial production numbers. A decrease in these indicators will lead to a decline in the euro, so I won't rush to buy it. Only the formation of a false breakout around the weekly low of 1.0878 can form a good entry point to buy the euro, with a prospect to retest the resistance level at 1.0915, where the moving averages support the bears. A breakout and a downward retest of this range will boost the demand for the euro, giving it a chance to continue the upward trend and retest the upper boundary of the sideways channel at 1.0952 that was formed yesterday. The ultimate target remains the area of 1.0982 where I will be locking in profits.

If EUR/USD declines and there is no buying activity at 1.0878, things will turn bad for buyers. In this case, only the formation of a false breakout around the next support level at 1.0836 will present an opportunity to buy the euro. I will open long positions immediately on a rebound from the low of 1.0808, considering an upward correction of 30-35 pips within the day.

For short positions on EUR/USD

For today, sellers have the opportunity to maintain pressure on the pair, but they need to make sure that the price does not go above the new resistance level of 1.0915, which currently serves as the midpoint of the sideways channel. I will open positions there only after the formation of a false breakout. Coupled with weak data from the eurozone, this will give a sell signal, leading to another drop to the support at 1.0878. A breakthrough and subsequent consolidation below this range, followed by an upward retest, can signal a selling opportunity, paving the way to the low of 1.0836. A retest of this level would indicate the emergence of a bearish market. The ultimate target lies at 1.0808 where I will be looking to lock in profits.

If EUR/USD trends upward during the European session and if no selling activity is observed at 1.0915, which is possible, bulls will attempt to regain control of the market. In such a scenario, I would wait until the price hits the next resistance at 1.0952, the upper boundary of the sideways channel. I would also consider selling there, but only after a failed consolidation above this level. I will go short immediately on a pullback from the high of 1.0982, keeping in mind a downward correction of 30-35 pips.

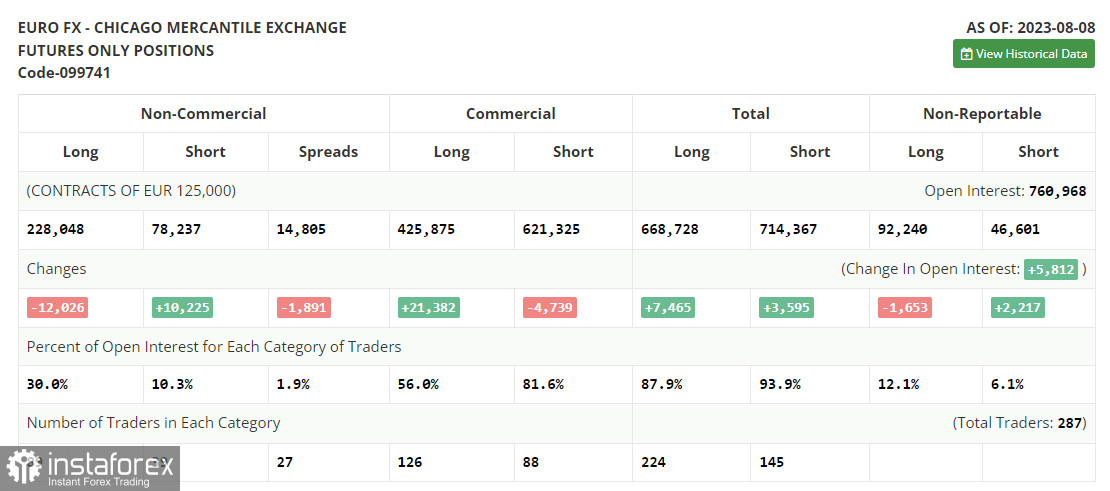

COT report

The Commitments of Traders report for August 8 indicated a decrease in long positions and a rise in short ones. This shift occurred prior to the release of crucial inflation data from the US. In theory, this data should have provided clarity regarding the forthcoming policies of the Federal Reserve. However, it didn't play out that way. Prices in the US rose again in July, laying the groundwork for potential further rate hikes by the regulator. Despite this, the decline in the euro presents an appealing opportunity. Regardless of the mentioned data, the optimal medium-term strategy in the current conditions remains buying risk assets on dips. The COT report highlighted that non-commercial long positions decreased by 12,026 to 228,048, while non-commercial short positions increased by 10,225, reaching 78,237. As a result, the spread between long and short positions narrowed by 1,891. The closing price dropped to 1.0981 from 1.0999 recorded in the previous week.

Indicator signals:

Moving Averages

Trading below the 30- and 50-day moving averages indicates a further decline in the pair.

Please note that the time period and levels of the moving averages are analyzed only for the H1 chart, which differs from the general definition of the classic daily moving averages on the D1 chart.

Bollinger Bands

In case of a decline, the lower band of the indicator at 1.0940 will act as support.

Description of indicators:

• A moving average of a 50-day period determines the current trend by smoothing volatility and noise; marked in yellow on the chart;

• A moving average of a 30-day period determines the current trend by smoothing volatility and noise; marked in green on the chart;

• MACD Indicator (Moving Average Convergence/Divergence) Fast EMA with a 12-day period; Slow EMA with a 26-day period. SMA with a 9-day period;

• Bollinger Bands: 20-day period;

• Non-commercial traders are speculators such as individual traders, hedge funds, and large institutions who use the futures market for speculative purposes and meet certain requirements;

• Long non-commercial positions represent the total number of long positions opened by non-commercial traders;

• Short non-commercial positions represent the total number of short positions opened by non-commercial traders;

• The non-commercial net position is the difference between short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română